No references are needed, you can answer the problem with all the information in the picture! thank you

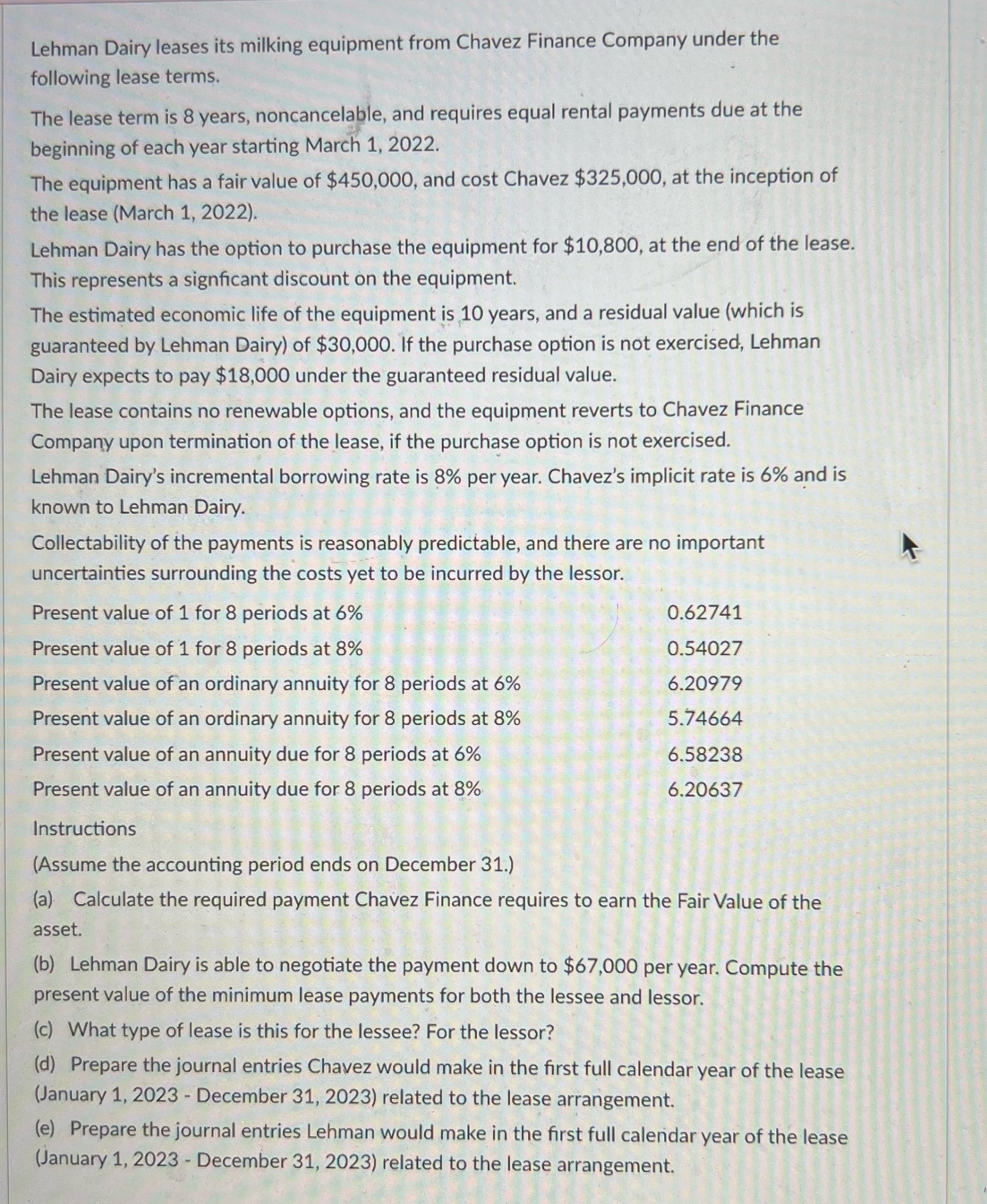

_. Lehman Dairy leases its milking equipment from Chavez Finance Company under the following lease terms. The lease term is 8 years, noncancelable, and requires equal rental payments due at the beginning of each year starting March 1, 2022. The equipment has a fair value of $450,000, and cost Chavez $325,000, at the inception of the. lease (March 1, 2022). Lehman Dairy has the option to purchase the equipment for $10,800, at the end of the lease. This represents a signicant discount on the equipment. The estimated economic life of the equipment is,10 years, and a residual value (which is guaranteed by Lehman Dairy) of $30,000. If the purchase option is not exercised, Lehman Dairy expects to pay $18,000 under the guaranteed residual value. The lease contains no renewable options, and the equipment reverts to Chavez Finance Company upon termination of the lease, if the purchase option is not exercised. Lehman Dairy's incremental borrowing rate is 8% per year. Chavez's implicit rate is 6% and is known to Lehman Dairy. Collectability of the payments is reasonably predictable, and there are no important uncertainties surrounding the costs yet to be incurred by the lessor. Present value of 1 for 8 periods at 6% . 0.62741 Present value of 1 for 8 periods at 8% 0.54027 Present value of" an ordinary annuity for 8 periods at 6% 6.20979 Present value of an ordinary annuity for 8 periods at 8% 5.74664 Present value of an annuity due for 8 periods at 6% 6.58238 Present value of an annuity due for 8 periods at 8% 6.20637 Instructions (Assume the accounting period ends on December 31.) (a) Calculate the required payment Chairez Finance requires to earn the Fair Value- ot the asset. (b) Lehman Dairy is able to negotiate the payment down to $67,000 per year. Compute the present value of the minimum lease payments for both the lessee and lessor. ' (c) What type of lease is this for the lessee? For the lessor? (d) Prepare the journal entries Chavez would make in the rst full calendar year of the lease (January 1., 2023 - December 31, 2023) related to the lease arrangement. (e) Prepare the journal entries Lehman Would make in the first full calendar year of the lease (January 1. 2023 December 31, 2023) related to the lease arrangement