Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no salvage value Question 3 (25 Marks) hciconsidering an investment which will require three $50,000 payments at the beginning of the first year, end of

no salvage value

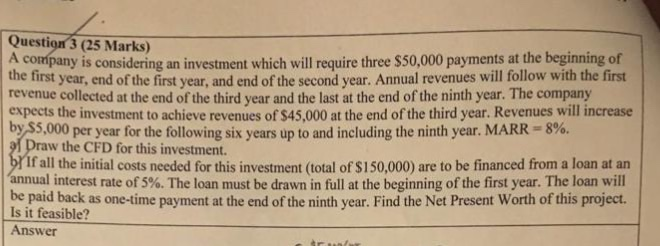

Question 3 (25 Marks) hciconsidering an investment which will require three $50,000 payments at the beginning of the first year, end of the first year, and end of the second year. Annual revenues will follow with the first revenue collected at the end of the third year and the last at the end of the ninth year. The company expects the investment to achieve revenues of $45,000 at the end of the third year. Revenues will increase byS5 ,000 per year for the following six years up to and including the ninth year. MARR-8%. raw the CFD for this investment. If all the initial costs needed for this investment (total of $150,000) are to be financed from a loan at an annual interest rate of 5%. The loan must be drawn in full at the beginning of the first year. The loan will be paid back as one-time payment at the end of the ninth year. Find the Net Present Worth of this project. Is it feasible Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started