no

no this is all information in the Q

this is all information in the Q

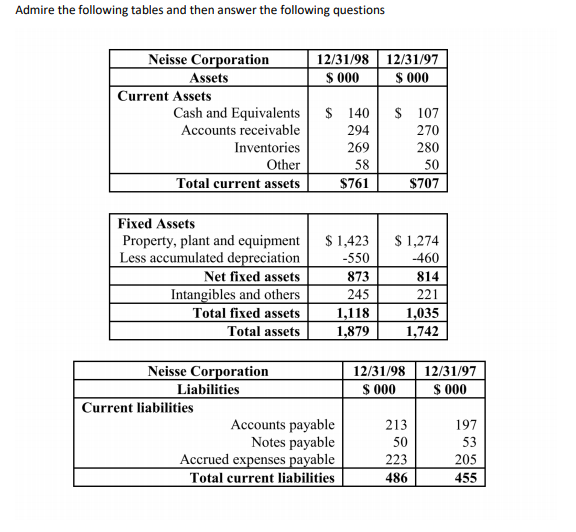

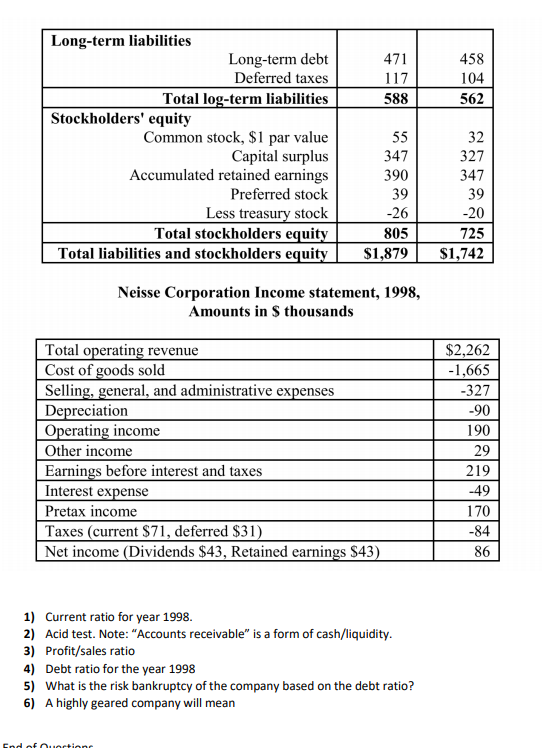

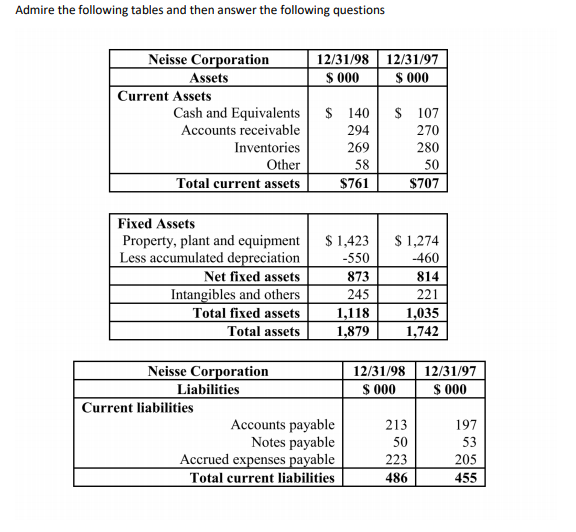

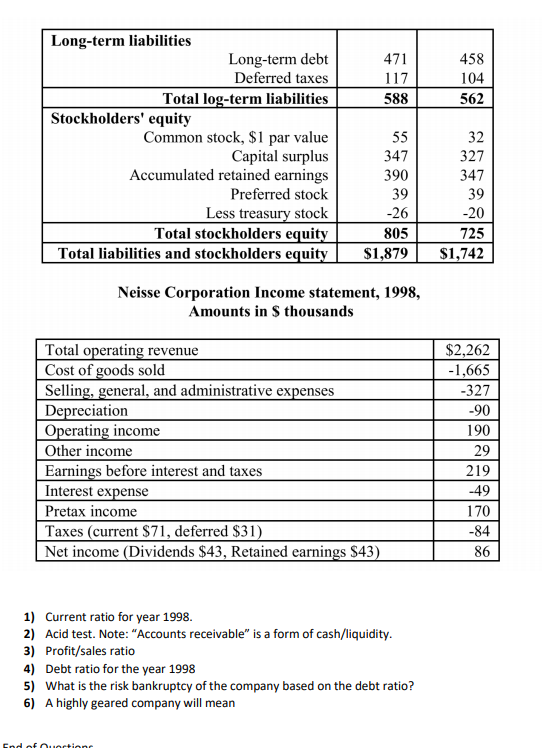

Admire the following tables and then answer the following questions 12/31/98 12/31/97 $ 000 $ 000 Neisse Corporation Assets Current Assets Cash and Equivalents Accounts receivable Inventories Other Total current assets $ 140 294 269 58 $ 107 270 280 50 $761 $707 $ 1,423 -550 $ 1,274 -460 Fixed Assets Property, plant and equipment Less accumulated depreciation Net fixed assets Intangibles and others Total fixed assets Total assets 814 873 245 221 1,035 1,118 1,879 1,742 12/31/98 $ 000 12/31/97 $ 000 Neisse Corporation Liabilities Current liabilities Accounts payable Notes payable Accrued expenses payable Total current liabilities 213 50 223 197 53 205 486 455 471 458 104 117 588 562 Long-term liabilities Long-term debt Deferred taxes Total log-term liabilities Stockholders' equity Common stock, $1 par value Capital surplus Accumulated retained earnings Preferred stock Less treasury stock Total stockholders equity Total liabilities and stockholders equity 55 347 390 39 -26 32 327 347 39 -20 805 725 $1,879 $1,742 Neisse Corporation Income statement, 1998, Amounts in thousands Total operating revenue Cost of goods sold Selling, general, and administrative expenses Depreciation Operating income $2,262 -1,665 -327 -90 190 Other income 29 219 -49 Earnings before interest and taxes Interest expense Pretax income Taxes (current $71, deferred $31) Net income (Dividends $43, Retained earnings $43) 170 -84 86 1) Current ratio for year 1998. 2) Acid test. Note: "Accounts receivable" is a form of cash/liquidity. 3) Profit/sales ratio 4) Debt ratio for the year 1998 5) What is the risk bankruptcy of the company based on the debt ratio? 6) A highly geared company will mean God of Ounction Admire the following tables and then answer the following questions 12/31/98 12/31/97 $ 000 $ 000 Neisse Corporation Assets Current Assets Cash and Equivalents Accounts receivable Inventories Other Total current assets $ 140 294 269 58 $ 107 270 280 50 $761 $707 $ 1,423 -550 $ 1,274 -460 Fixed Assets Property, plant and equipment Less accumulated depreciation Net fixed assets Intangibles and others Total fixed assets Total assets 814 873 245 221 1,035 1,118 1,879 1,742 12/31/98 $ 000 12/31/97 $ 000 Neisse Corporation Liabilities Current liabilities Accounts payable Notes payable Accrued expenses payable Total current liabilities 213 50 223 197 53 205 486 455 471 458 104 117 588 562 Long-term liabilities Long-term debt Deferred taxes Total log-term liabilities Stockholders' equity Common stock, $1 par value Capital surplus Accumulated retained earnings Preferred stock Less treasury stock Total stockholders equity Total liabilities and stockholders equity 55 347 390 39 -26 32 327 347 39 -20 805 725 $1,879 $1,742 Neisse Corporation Income statement, 1998, Amounts in thousands Total operating revenue Cost of goods sold Selling, general, and administrative expenses Depreciation Operating income $2,262 -1,665 -327 -90 190 Other income 29 219 -49 Earnings before interest and taxes Interest expense Pretax income Taxes (current $71, deferred $31) Net income (Dividends $43, Retained earnings $43) 170 -84 86 1) Current ratio for year 1998. 2) Acid test. Note: "Accounts receivable" is a form of cash/liquidity. 3) Profit/sales ratio 4) Debt ratio for the year 1998 5) What is the risk bankruptcy of the company based on the debt ratio? 6) A highly geared company will mean God of Ounction

no

no this is all information in the Q

this is all information in the Q