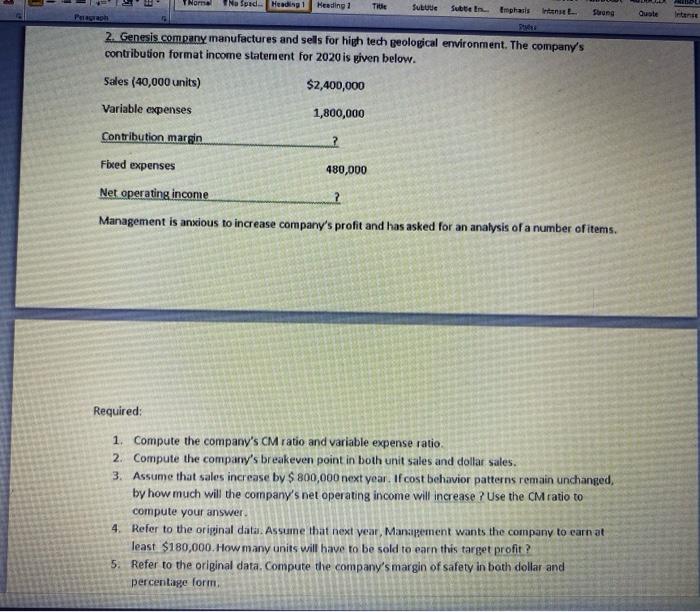

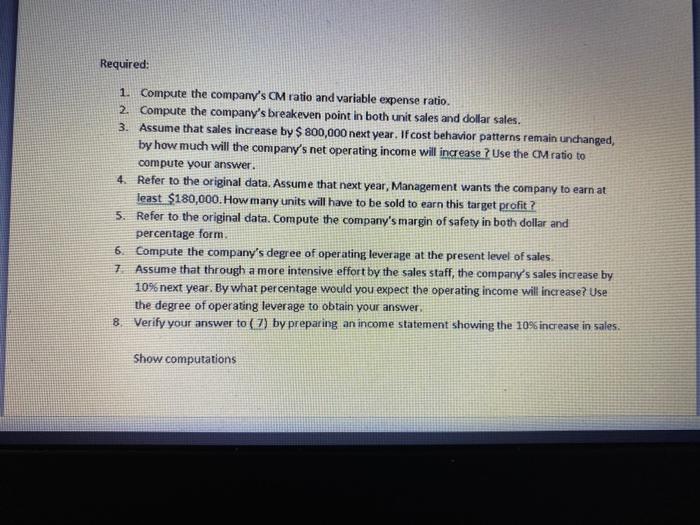

Nome Quote Na Surd. Heading 1 Heading 1 Title futute Subien. Emphasis Paragraph 2. Genesis company manufactures and sells for high tech geological environment. The company's contribution format income statement for 2020 is given below. Sales (40,000 units) $2,400,000 Variable expenses 1,800,000 Contribution margin ? Fbed expenses 480,000 Net operating income Management is anxious to increase company's profit and has asked for an analysis of a number of items. Required: 1. Compute the company's CM ratio and variable expense ratio 2. Compute the company's breakeven point in both unit sales and dollar sales. 3. Assume that sales increase by $ 800,000 next year. If cost behavior patterns remain unchanged, by how much will the company's net operating income will increase ? Use the CM ratio to compute your answer. 4. Refer to the original data. Assume that next year, Manipement wants the company to earn at least $180,000. How many units will have to be sold to earn this target profit? 5. Refer to the original data. Compute the company's margin of safety in both dollar and percentage form. Required: 1. Compute the company's CM ratio and variable expense ratio. 2. Compute the company's breakeven point in both unit sales and dollar sales. 3. Assume that sales increase by $ 800,000 next year. If cost behavior patterns remain unchanged, by how much will the company's net operating income will increase? Use the ratio to compute your answer. 4. Refer to the original data. Assume that next year, Management wants the company to earn at least $180,000. How many units will have to be sold to earn this target profit? 5. Refer to the original data. Compute the company's margin of safety in both dollar and percentage form. 6. Compute the company's degree of operating leverage at the present level of sales 1. Assume that through a more intensive effort by the sales staff, the company's sales increase by 10% next year. By what percentage would you expect the operating income will increase? Use the degree of operating leverage to obtain your answer, 8 Verify your answer to ( 7) by preparing an income statement showing the 10% increase in sales. Show computations