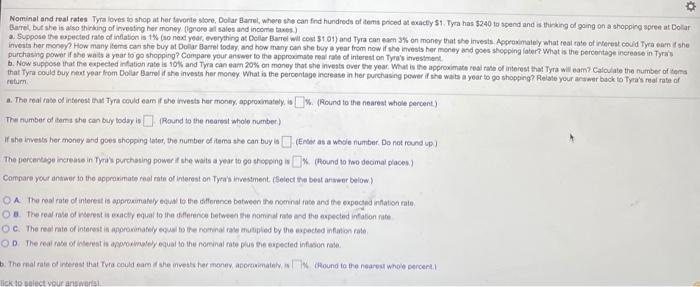

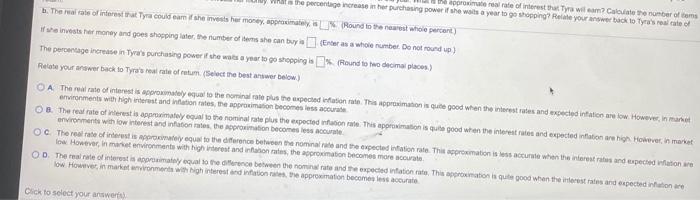

Nominal and real rates Tyra loves to shop at her favorite store, Dolar Barrel, where she can find hundreds of tems priced at exactly 51 Tyra has $240 to spend and thinking of going on a shopping spree at Dolar Barrel, but she is also thinking of investing her money increases and income taxes) Suppose the spected rate of inflation is 1% (so next you, everything at Dollar Barrel Wilco 101) and Tyra can com 3% on money that the invests. Approximately what real rate of interest could Tyra cat she invest her money? How many items can she buy at Dollar Barrel today, and how many can she buy a year from now if the invests her money and shopping faberWhat is the percentage increase in Tyra purchasing power if she was a year to go shopping? Compare your answer to the approximate real role of interest on Tyna's investment b. Now suppose that the expected inflation rate is 10% and Tyra can cam 20% on money that the invests over the year Wat the approximate real rate of interest that Tyra wilcom Calo to the number of roma that Tyra could buy next year from Dollar Barrel she invests her money What is the percentage increase in her purchasing power she was a year to go shopping? Relate your answer back to Tyra's real rate of return A. The real te of interest that Tyrn could com ho vests harmony, approximately. (Round to the nearest whole percent) The number of fame she can buy today (Round to the nearest whole number ) If she invests her money and goes shopping toder, the number of tome she can buy or as a whole number. Do not found up) The percentage incronia in ne purchasing power if she was a year to go shopping (Round to wo decimal placea) Compare your answer to the approximate rool rate of interest on Tya's investment (Select the best onweer below) On the real rate of interest is approvately own to the difference between the nominal rate and the expected inflation rato, OB The role of rest is exacty equal to the difference between the nominal role and the expected nation note OC. The real rate of interest is normally relamutiplied by the expected inftantion vote OD The real tale of West is avaly equal to the nominalnate plus the expected infor b. The mal rate of interest that Tracould eam she invecermone primately Round to the nearest whole percent lick to select your answers proximal rate of that Tyra wilam Calientes Was the percentage increase the purchasing power he was a year to go shopping? Relate your answer back to Ty's related b. The real the interest y could eam nee money, Round while percent) We invested money and goes shopping at the rooms she can buy as a whole number. Do not round up) The percentage increase in Tyas purchasing powerheats you to go shopping a Round to ho decimal places) Relate your answer back to TyasoftumSelect the best below) OA The rate of approximately to the nominale plus the expected to the premis quite good when the interest rates and expected inflation are ow. However, in maniet environments with high interest and Wation rates, er becomes les ac OB The real rate of West is approximately to the role plus he expected to his primaton sot good when the interest rates and expected inflation are high However, in market environments with low terest and inflation at the promotion becomes OC The relate of interests y equal to the below the nominal and the expected to this primation is accurate when the interest rates and expected to wa low However, in mare environment with highest and for the cromation becomes more wou OD. The real rate of interest is my colore e mandatorate Theron is quite good when the interest rates and expected inflation low However, in market moments with high stand interation becomes Click to select your