Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Non provided Marius Hardware and Building Supply is a local company. It is seeking to expand its operation and has approached your credit institution for

Non provided

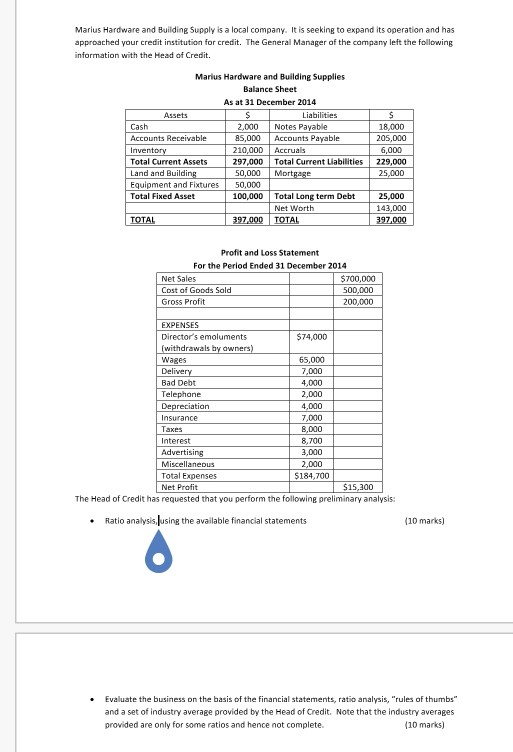

Marius Hardware and Building Supply is a local company. It is seeking to expand its operation and has approached your credit institution for credit. The General Manager of the company left the follwing information with the Head of Credit. Marius Hardware and Building Supplies Balance Sheet As at 31 December 2014 Assets Liabilities Cash Accounts Receivable Inven Total Cuent Assets Land and Buildin Equipment and Fixtures Total Fixed Asset 2,000 Notes Payable 85,000Accounts Payable 210,000Accruals 297,000Total Current Liabilities 229,000 50,000 18,000 205,000 6,000 50,000 100,000 Total Long term Debt 25,000 143,000 397,000 Net Worth TOTAL 97,000TOTAL Profit and Loss Statement For the Period Ended 31 December 2014 Net Sales Cost af Goods Sald Gross Profit 700,000 500,000 200,000 EXPENSES 74,000 Wages Deli Bad Debt Telephane 65,000 7,000 4,000 2,000 4,000 ,000 Insurance Interest Advertising Miscellaneous Total Expenses Net Profit 8,700 3,000 2,000 5184,700 The Head of Credit has requested that you perform the following preliminary analysis: Ratio analysis, using the available financial statements (10 marks Evaluate the business on the basis of the financial statements, ratio analysis, "rules of thumbs" and a set of industry average provided by the Head of Credit. Note that the industry averages provided are only for some ratios and hence not complete. (10 marks Marius Hardware and Building Supply is a local company. It is seeking to expand its operation and has approached your credit institution for credit. The General Manager of the company left the follwing information with the Head of Credit. Marius Hardware and Building Supplies Balance Sheet As at 31 December 2014 Assets Liabilities Cash Accounts Receivable Inven Total Cuent Assets Land and Buildin Equipment and Fixtures Total Fixed Asset 2,000 Notes Payable 85,000Accounts Payable 210,000Accruals 297,000Total Current Liabilities 229,000 50,000 18,000 205,000 6,000 50,000 100,000 Total Long term Debt 25,000 143,000 397,000 Net Worth TOTAL 97,000TOTAL Profit and Loss Statement For the Period Ended 31 December 2014 Net Sales Cost af Goods Sald Gross Profit 700,000 500,000 200,000 EXPENSES 74,000 Wages Deli Bad Debt Telephane 65,000 7,000 4,000 2,000 4,000 ,000 Insurance Interest Advertising Miscellaneous Total Expenses Net Profit 8,700 3,000 2,000 5184,700 The Head of Credit has requested that you perform the following preliminary analysis: Ratio analysis, using the available financial statements (10 marks Evaluate the business on the basis of the financial statements, ratio analysis, "rules of thumbs" and a set of industry average provided by the Head of Credit. Note that the industry averages provided are only for some ratios and hence not complete. (10 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started