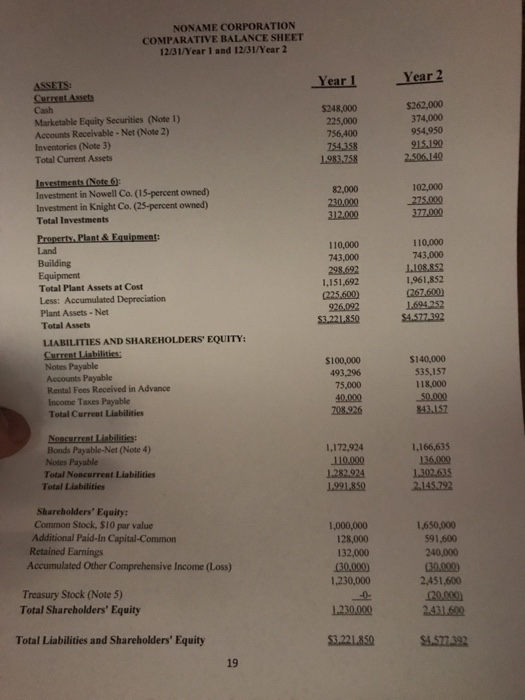

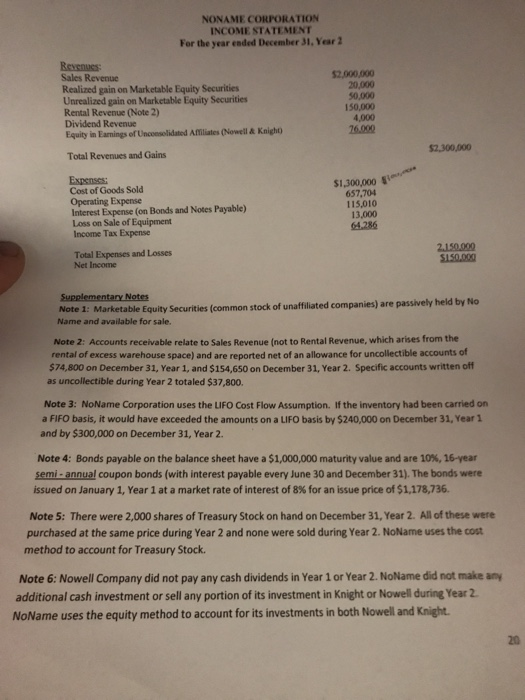

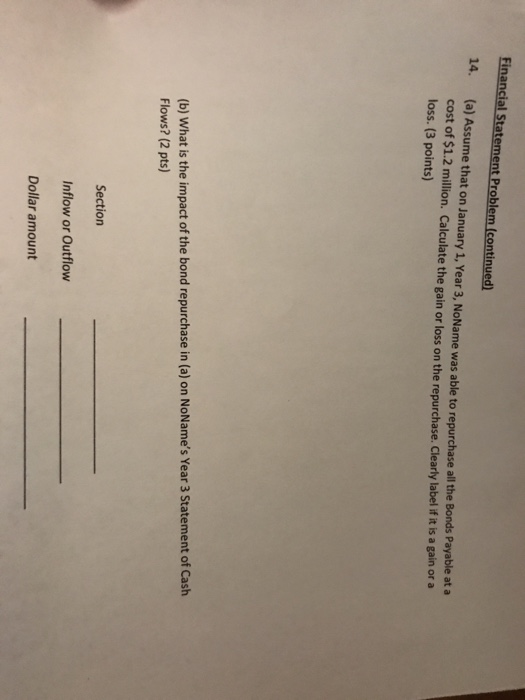

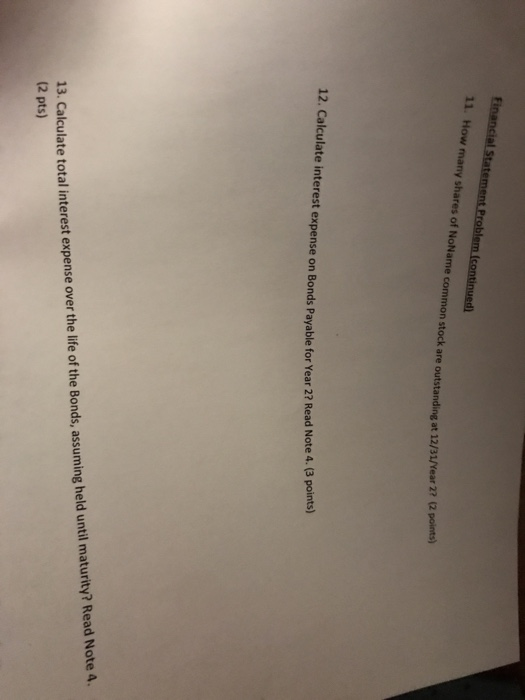

NONAME CORPORATION COMPARATIVE BALANCE SHEET 12/31/Year 1 and 12/31/Year 2 Year 1Year2 $248,000 225,000 756,400 754.358 Marketable Equity Securities (Note 1) Accounts Receivable-Net (Note 2) Inventories (Note 3) Total Current Assets 374,000 954,950 Investment in Nowell Co. (15-percent owned) Investment in Knight Co. (25-percent owned) Total Investments 82,000 230,000 102,000 Plant & Fasipment 110,000 743,000 110,000 743,000 Building Equipment Total Plant Assets at Cost Less: Accumulated Depreciation Plant Assets-Net Total Assets 1,151,692 1,961,852 LIABILITIES AND SHAREHOLDERS EQUITY $100,000 493,296 75,000 $140,000 535,157 118,000 Notes Payable Accounts Payable Rental Fees Received in Advance Income Taxes Payable Total Current Liabilities 843.152 Bonds Payable-Net (Note 4) Notes Payable Total Noncurrent Liabilities Total Liabilities 1,172,924 1,166,635 136009 Shareholders' Equity: Common Stock, $10 par value Additional Paid-In Capital-Common Retained Earnings Accumulated Other Comprehensive Income (Loss) 1,000,000 128,000 132,000 (30,000) 1,230,000 1,650,000 591,600 240,000 2,451,600 Treasury Stock (Note 5) Total Shareholders' Equity Total Liabilities and Shareholders' Equity 3.221.850 $4.577.392 3.221850 19 NONAME CORPORATION INCOME STATEMENT For the year eaded December 31. Year Revenues Sales Revenue Realized gain on Marketable Equity Securities Unrealized gain on Marketable Equity Securities Rental Revenue (Note 2) Dividend Revenue $2,000,000 20,000 50,000 150,000 4,000 76000 Equity in Earnings of Unconselidated Affliates (Nowell & Knight $2,300,000 Total Revenues and Gains $1,300,000 657,704 115,010 13,000 64.286 Cost of Goods Sold Operating Expense Interest Expense (on Bonds and Notes Payable) Loss on Sale of Equipment Income Tax Expense 2.150.000 150.000 Total Expenses and Losses Net Income 1: Marketable Equity Securities (common stock of unaffilated companies) are passively held by No Name and available for sale. Note 2: Accounts receivable relate to Sales Revenue (not to Rental Revenue, which arises from the rental of excess warehouse space) and are reported net of an allowance for uncollectible accounts of $74,800 on December 31, Year 1, and $154,650 on December 31, Year 2. Specific accounts written off as uncollectible during Year 2 totaled $37,800. Note 3: NoName Corporation uses the LIFO Cost Flow Assumption. If the inventory had been carried on a FIFO basis, it would have exceeded the amounts on a LIFO basis by $240,000 on December 31, Year 1 and by $300,000 on December 31, Year 2. Note 4: Bonds payable on the balance sheet have a S 1,000,000 maturity value and are 10%, 16-year semi- annual coupon bonds (with interest payable every June 30 and December 31). The bonds were issued on January 1, Year 1 at a market rate of interest of 8% for an issue price of $1,178,736. Note 5: There were 2,000 shares of Treasury Stock on hand on December 31, Year 2. All of these were method to account for Treasury Stock. purchased at the same price during Year 2 and none were sold during Year 2. NoName uses the cost Note 6: Nowell Company did not pay any cash dividends in Year 1 or Year 2. NoName did not make any additional cash investment or sell any portion of its investment in Knight or Nowell during Year2 NoName uses the equity method to account for its investments in both Nowell and Knight 20 Financial Statement Problem (continued) 14. (a) Assume that on January 1, Year 3, NoName was able to repurchase all the Bonds Payable at a cost of $1.2 million. Calculate the gain or loss on the repurchase. Clearly label if it is a gain or a loss. (3 points) (b) What is the impact of the bond repurchase in (a) on NoName's Year 3 Statement of Cash Flows? (2 pts) Section Inflow or Outflow Dollar amount 11. How many shares of NoName common stock are outstanding at 12/31/Year 2? (2 points) 12. Calculate interest expense on Bonds Payable for Vear 22 Read Note 4.(3 points) 13. Calculate total interest expense over the life of the Bonds, assuming held until maturity? Read Note 4. (2 pts) NONAME CORPORATION COMPARATIVE BALANCE SHEET 12/31/Year 1 and 12/31/Year 2 Year 1Year2 $248,000 225,000 756,400 754.358 Marketable Equity Securities (Note 1) Accounts Receivable-Net (Note 2) Inventories (Note 3) Total Current Assets 374,000 954,950 Investment in Nowell Co. (15-percent owned) Investment in Knight Co. (25-percent owned) Total Investments 82,000 230,000 102,000 Plant & Fasipment 110,000 743,000 110,000 743,000 Building Equipment Total Plant Assets at Cost Less: Accumulated Depreciation Plant Assets-Net Total Assets 1,151,692 1,961,852 LIABILITIES AND SHAREHOLDERS EQUITY $100,000 493,296 75,000 $140,000 535,157 118,000 Notes Payable Accounts Payable Rental Fees Received in Advance Income Taxes Payable Total Current Liabilities 843.152 Bonds Payable-Net (Note 4) Notes Payable Total Noncurrent Liabilities Total Liabilities 1,172,924 1,166,635 136009 Shareholders' Equity: Common Stock, $10 par value Additional Paid-In Capital-Common Retained Earnings Accumulated Other Comprehensive Income (Loss) 1,000,000 128,000 132,000 (30,000) 1,230,000 1,650,000 591,600 240,000 2,451,600 Treasury Stock (Note 5) Total Shareholders' Equity Total Liabilities and Shareholders' Equity 3.221.850 $4.577.392 3.221850 19 NONAME CORPORATION INCOME STATEMENT For the year eaded December 31. Year Revenues Sales Revenue Realized gain on Marketable Equity Securities Unrealized gain on Marketable Equity Securities Rental Revenue (Note 2) Dividend Revenue $2,000,000 20,000 50,000 150,000 4,000 76000 Equity in Earnings of Unconselidated Affliates (Nowell & Knight $2,300,000 Total Revenues and Gains $1,300,000 657,704 115,010 13,000 64.286 Cost of Goods Sold Operating Expense Interest Expense (on Bonds and Notes Payable) Loss on Sale of Equipment Income Tax Expense 2.150.000 150.000 Total Expenses and Losses Net Income 1: Marketable Equity Securities (common stock of unaffilated companies) are passively held by No Name and available for sale. Note 2: Accounts receivable relate to Sales Revenue (not to Rental Revenue, which arises from the rental of excess warehouse space) and are reported net of an allowance for uncollectible accounts of $74,800 on December 31, Year 1, and $154,650 on December 31, Year 2. Specific accounts written off as uncollectible during Year 2 totaled $37,800. Note 3: NoName Corporation uses the LIFO Cost Flow Assumption. If the inventory had been carried on a FIFO basis, it would have exceeded the amounts on a LIFO basis by $240,000 on December 31, Year 1 and by $300,000 on December 31, Year 2. Note 4: Bonds payable on the balance sheet have a S 1,000,000 maturity value and are 10%, 16-year semi- annual coupon bonds (with interest payable every June 30 and December 31). The bonds were issued on January 1, Year 1 at a market rate of interest of 8% for an issue price of $1,178,736. Note 5: There were 2,000 shares of Treasury Stock on hand on December 31, Year 2. All of these were method to account for Treasury Stock. purchased at the same price during Year 2 and none were sold during Year 2. NoName uses the cost Note 6: Nowell Company did not pay any cash dividends in Year 1 or Year 2. NoName did not make any additional cash investment or sell any portion of its investment in Knight or Nowell during Year2 NoName uses the equity method to account for its investments in both Nowell and Knight 20 Financial Statement Problem (continued) 14. (a) Assume that on January 1, Year 3, NoName was able to repurchase all the Bonds Payable at a cost of $1.2 million. Calculate the gain or loss on the repurchase. Clearly label if it is a gain or a loss. (3 points) (b) What is the impact of the bond repurchase in (a) on NoName's Year 3 Statement of Cash Flows? (2 pts) Section Inflow or Outflow Dollar amount 11. How many shares of NoName common stock are outstanding at 12/31/Year 2? (2 points) 12. Calculate interest expense on Bonds Payable for Vear 22 Read Note 4.(3 points) 13. Calculate total interest expense over the life of the Bonds, assuming held until maturity? Read Note 4. (2 pts)