Answered step by step

Verified Expert Solution

Question

1 Approved Answer

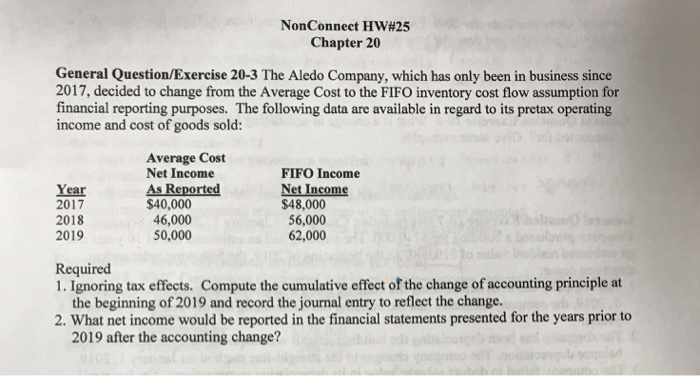

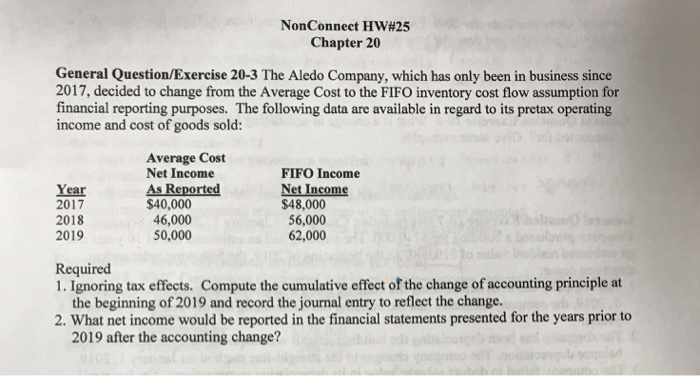

NonConnect Hw#25 Chapter 20 General Question/Exercise 20-3 The Aledo Company, which has only been in business since 2017, decided to change from the Average Cost

NonConnect Hw#25 Chapter 20 General Question/Exercise 20-3 The Aledo Company, which has only been in business since 2017, decided to change from the Average Cost to the FIFO inventory cost flow assumption for financial reporting purposes. The following data are available in regard to its pretax operating income and cost of goods sold: Average Cost Net Income FIFO Income Year 2017 2018 2019 Net Income $48,000 $40,000 46,000 50,000 56,000 62,000 Required 1. Ignoring tax effects. Compute the cumulative effect of the change of accounting principle at the beginning of 2019 and record the journal entry to reflect the change 2. What net income would be reported in the financial statements presented for the years prior to 2019 after the accounting change

NonConnect Hw#25 Chapter 20 General Question/Exercise 20-3 The Aledo Company, which has only been in business since 2017, decided to change from the Average Cost to the FIFO inventory cost flow assumption for financial reporting purposes. The following data are available in regard to its pretax operating income and cost of goods sold: Average Cost Net Income FIFO Income Year 2017 2018 2019 Net Income $48,000 $40,000 46,000 50,000 56,000 62,000 Required 1. Ignoring tax effects. Compute the cumulative effect of the change of accounting principle at the beginning of 2019 and record the journal entry to reflect the change 2. What net income would be reported in the financial statements presented for the years prior to 2019 after the accounting change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started