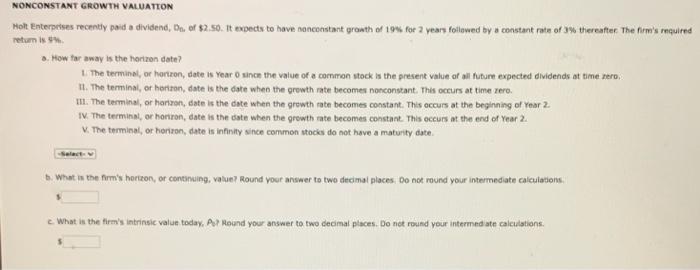

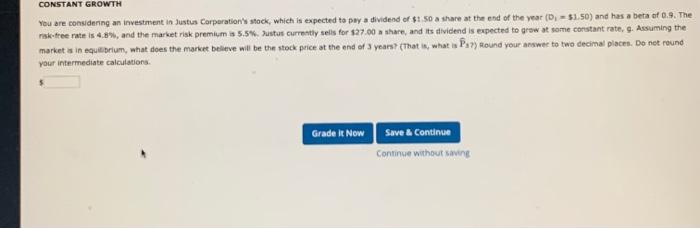

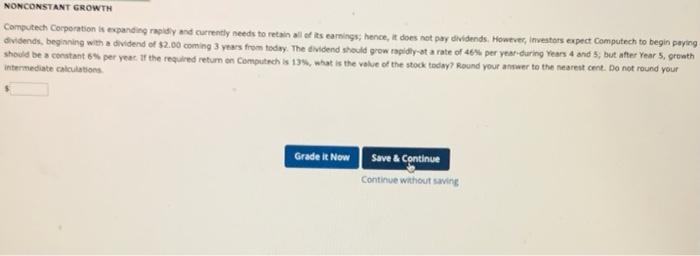

NONCONSTANT GROWTH VALUATION Holt Enterpeises recently paid a dividend, D. or $2.50. It expects to have nonconstant growth of 19% for 2 years followed by a constant rate of thereafter the firm's required retum is How far away is the horizon date? 1. The terminal, or hortron, date is Year since the value of a common stock is the present value of all fourt expected dividends at time nero 11. The terminal, or hormon date is the date when the growth rate becomes no constant. This occurs at time rero. III. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the beginning of Year 2 1. The terminal, or horon, date is the cate when the growth rate becomes constant. This occurs at the end of Year 2. The terminal, or horizon, date is infinity since common stocks do not have a maturity date What is the firm's hortton, or continuing, value7 Round your answer to two decimal places. Do not round your intermediate calculations What is the firm's intrinsic value today. Por Round your answer to two decimal places. Do not round your intermediate calculations CONSTANT GROWTH You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend or $1.50 a share at the end of the year (0, - $1.50) and has a beta of 0.9. The risk-free rate is 4.8%, and the market risk premium 5.5%. Sustus currently sells for $27.00 share, and its dividend is expected to grow at some constant rate, 9. Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (that is, what a Ps) Round your answer to two decimal place. Do not round your intermediate calculations. Grade It Now Save & Continue Continue without saving NONCONSTANT GROWTH Computech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect computech to begin pering dividends, beginning with a dividend of $2.00 coming 3 years from today. The dividend should grow rapidly-at a rate of 46% per year-during Years 4 and 5; but after Year 5 growth should be a constant 8% per year. If the required retum en Computach is 139, what is the value of the stock taday? Round your answer to the nearest cert. Do not round your intermediate cons Grade It Now Save & Continue Continue wthout saying