Question

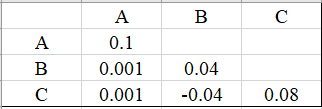

Non-linear and Non-smoothing Optimization: Stocks A, B, and C have expected returns of 7%, 6%, and 10%, respectively and the following variance-covariance matrix:- (a) Determine

Non-linear and Non-smoothing Optimization:

Stocks A, B, and C have expected returns of 7%, 6%, and 10%, respectively and the following variance-covariance matrix:-

(a) Determine the fraction of portfolio to hold in each stock so as to minimize the variance of the portfolio subject to a minimum expected return of the portfolio of 8%.

(b) Can the variance of the portfolio be smaller than the variance of any individual stock? Explain.

(c) Find the optimal portfolio if the minimum expected returns for 7% and 9%. Also, plot a curve to show the relationship between expected return and variance.

I would greatly appreciate it, if you could please explain the process so that I could better understand how to solve the problem and to also compare it with my current answer. Thank you!

B B 0.1 0.001 0.001 0.04 -0.04 0.08 B B 0.1 0.001 0.001 0.04 -0.04 0.08Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started