Answered step by step

Verified Expert Solution

Question

1 Approved Answer

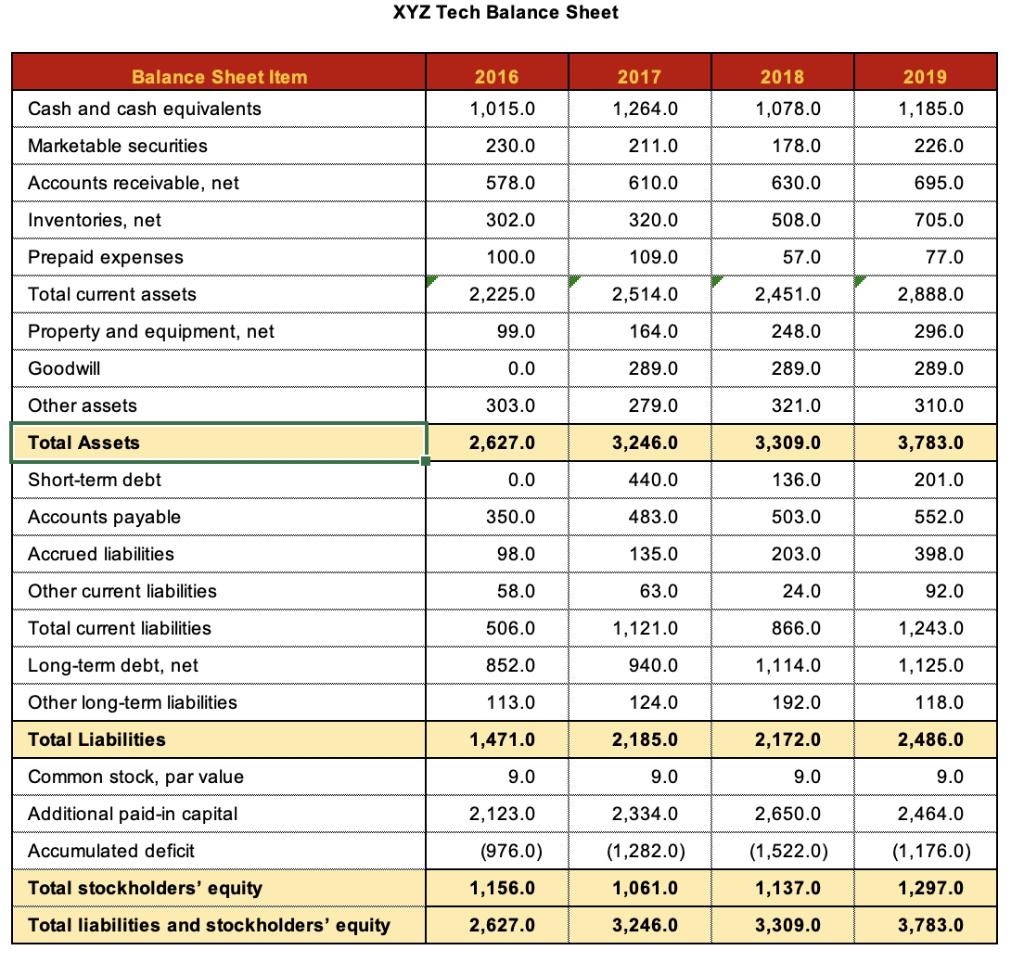

XYZ Tech Balance Sheet Balance Sheet Item 2016 2017 2018 2019 Cash and cash equivalents 1,015.0 1,264.0 1,078.0 1,185.0 Marketable securities 230.0 211.0 178.0

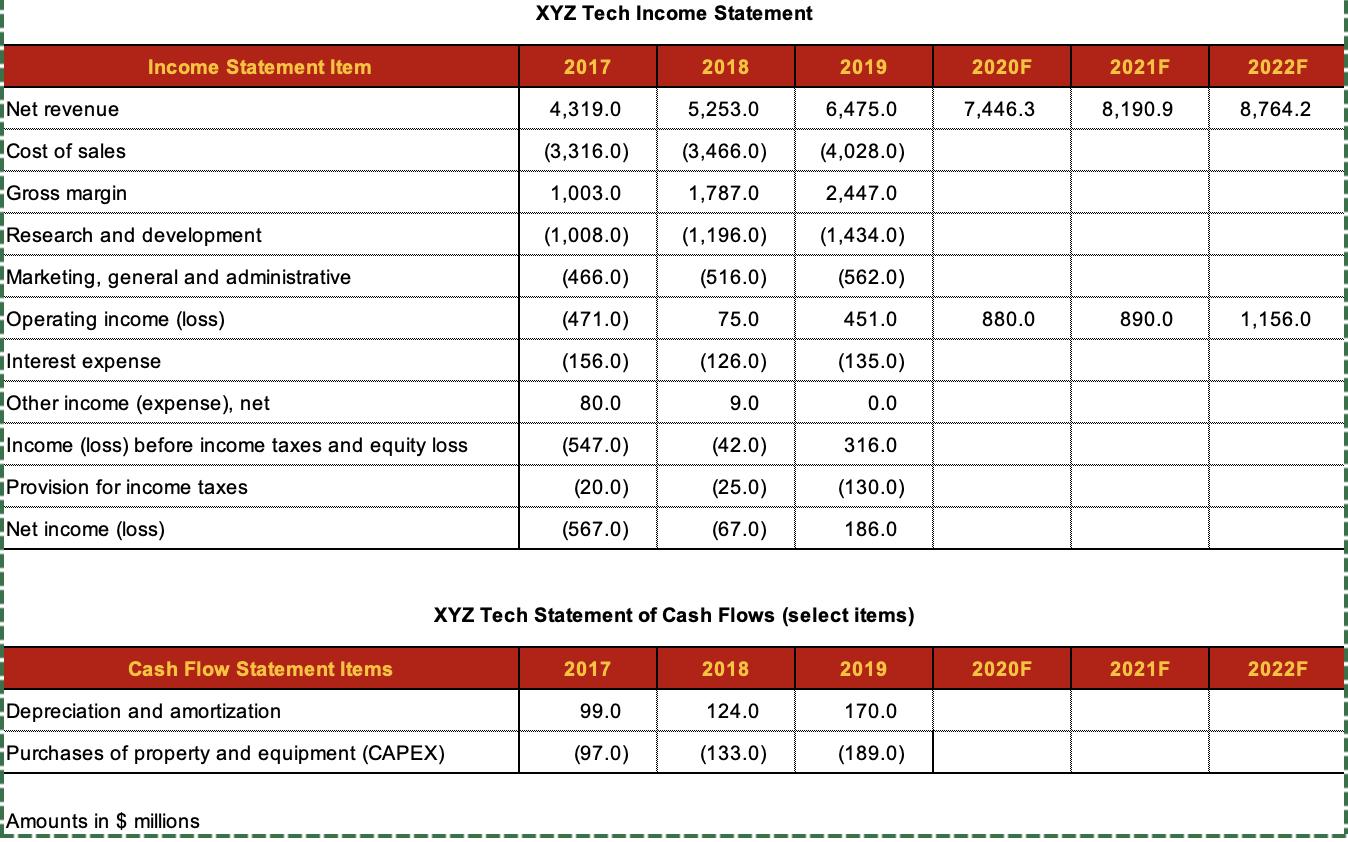

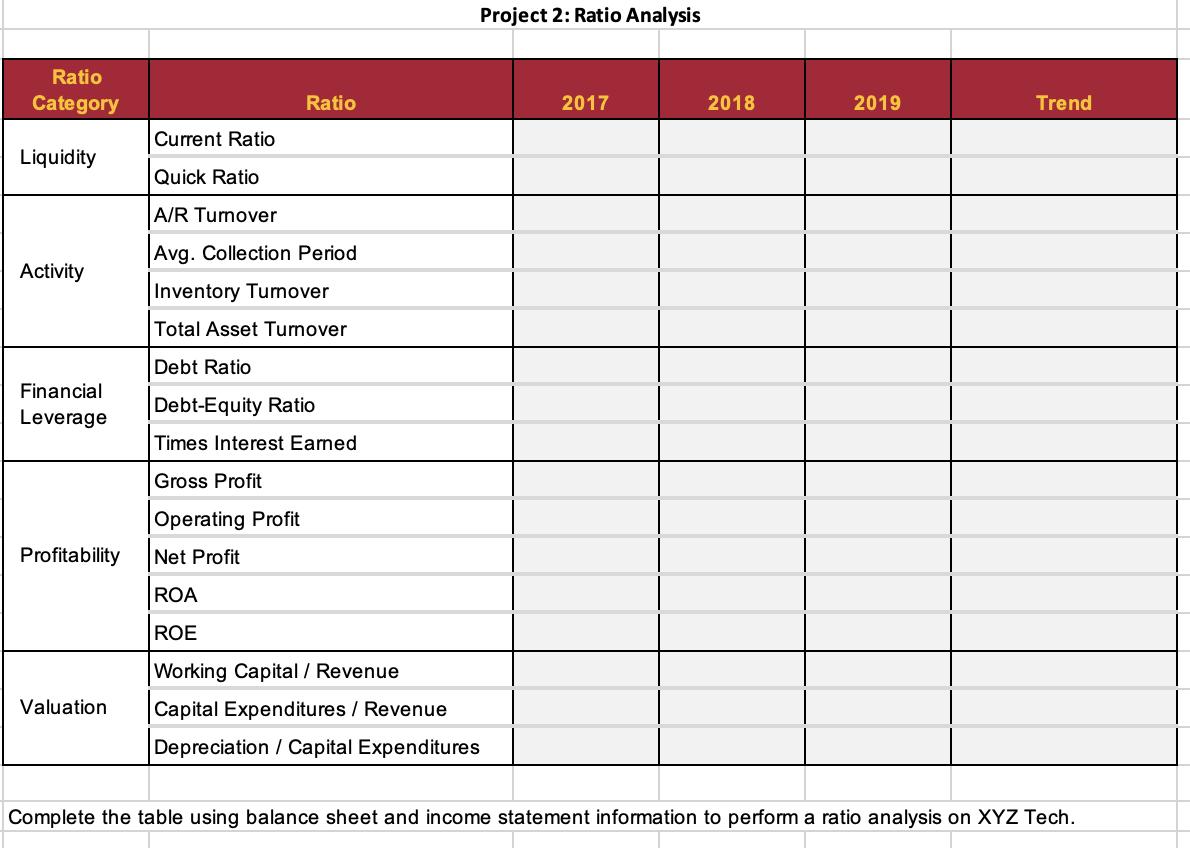

XYZ Tech Balance Sheet Balance Sheet Item 2016 2017 2018 2019 Cash and cash equivalents 1,015.0 1,264.0 1,078.0 1,185.0 Marketable securities 230.0 211.0 178.0 226.0 Accounts receivable, net 578.0 610.0 630.0 695.0 Inventories, net 302.0 320.0 508.0 705.0 Prepaid expenses 100.0 109.0 57.0 77.0 Total current assets 2,225.0 2,514.0 2,451.0 2,888.0 Property and equipment, net 99.0 164.0 248.0 296.0 Goodwill 0.0 289.0 289.0 289.0 Other assets 303.0 279.0 321.0 310.0 Total Assets 2,627.0 3,246.0 3,309.0 3,783.0 Short-term debt 0.0 440.0 136.0 201.0 Accounts payable 350.0 483.0 503.0 552.0 Accrued liabilities 98.0 135.0 203.0 398.0 Other current liabilities 58.0 63.0 24.0 92.0 Total current liabilities 506.0 1,121.0 866.0 1,243.0 Long-term debt, net 852.0 940.0 1,114.0 1,125.0 Other long-term liabilities 113.0 124.0 192.0 118.0 Total Liabilities 1,471.0 2,185.0 2,172.0 2,486.0 Common stock, par value 9.0 9.0 9.0 9.0 Additional paid-in capital 2,123.0 2,334.0 2,650.0 2,464.0 Accumulated deficit (976.0) (1,282.0) (1,522.0) (1,176.0) Total stockholders' equity 1,156.0 1,061.0 1,137.0 1,297.0 Total liabilities and stockholders' equity 2,627.0 3,246.0 3,309.0 3,783.0 XYZ Tech Income Statement Income Statement Item 2017 2018 2019 2020F 2021F 2022F Net revenue 4,319.0 5,253.0 6,475.0 7,446.3 8,190.9 8,764.2 Cost of sales (3,316.0) (3,466.0) (4,028.0) Gross margin 1,003.0 1,787.0 2,447.0 Research and development (1,008.0) (1,196.0) (1,434.0) Marketing, general and administrative (466.0) (516.0) (562.0) Operating income (loss) (471.0) 75.0 451.0 880.0 890.0 1,156.0 Interest expense (156.0) (126.0) (135.0) Other income (expense), net 80.0 9.0 0.0 Income (loss) before income taxes and equity loss (547.0) (42.0) 316.0 Provision for income taxes (20.0) (25.0) (130.0) Net income (loss) (567.0) (67.0) 186.0 Cash Flow Statement Items XYZ Tech Statement of Cash Flows (select items) Depreciation and amortization Purchases of property and equipment (CAPEX) Amounts in $ millions 2017 2018 2019 2020F 2021F 2022F 99.0 124.0 170.0 (97.0) (133.0) (189.0) Ratio Category Ratio Current Ratio Liquidity Quick Ratio A/R Turnover Activity Financial Leverage Avg. Collection Period Inventory Tumover Total Asset Tumover Debt Ratio Debt-Equity Ratio Times Interest Earned Gross Profit Operating Profit Profitability Net Profit ROA ROE Working Capital / Revenue Valuation Capital Expenditures / Revenue Project 2: Ratio Analysis 2017 2018 2019 Trend Depreciation/Capital Expenditures Complete the table using balance sheet and income statement information to perform a ratio analysis on XYZ Tech.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets fill out the table stepbystep NOPAT Component EBIT Year 0 4510 million from 2019 Income St...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started