Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nordia and Roper Ltd. operates a mini mart and had accounting profit for the year ended 2022 of $15,000,000. Notes: The following deductions were made

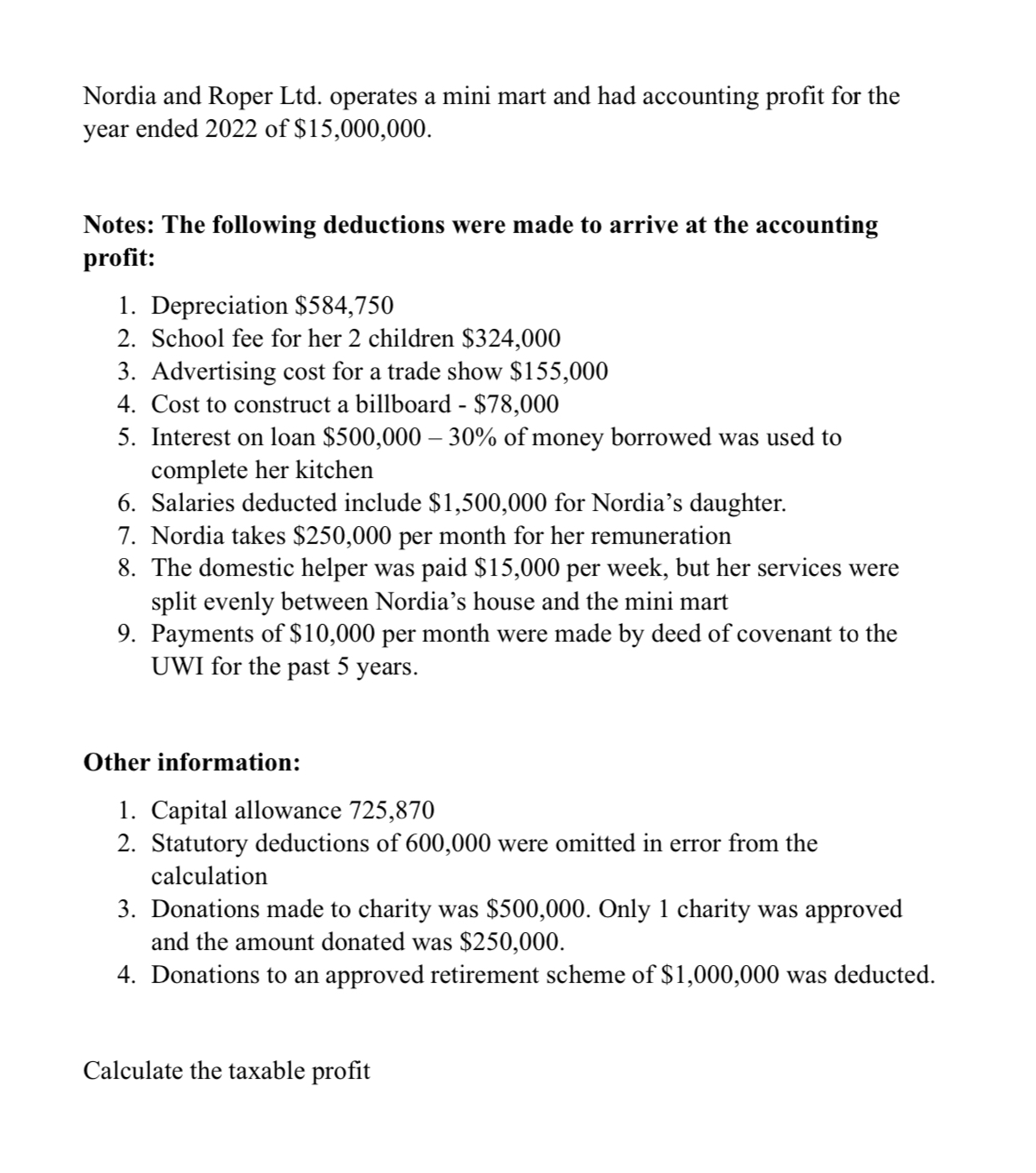

Nordia and Roper Ltd. operates a mini mart and had accounting profit for the year ended 2022 of $15,000,000. Notes: The following deductions were made to arrive at the accounting profit: 1. Depreciation $584,750 2. School fee for her 2 children $324,000 3. Advertising cost for a trade show $155,000 4. Cost to construct a billboard - $78,000 5. Interest on loan $500,00030% of money borrowed was used to complete her kitchen 6. Salaries deducted include $1,500,000 for Nordia's daughter. 7. Nordia takes $250,000 per month for her remuneration 8. The domestic helper was paid $15,000 per week, but her services were split evenly between Nordia's house and the mini mart 9. Payments of $10,000 per month were made by deed of covenant to the UWI for the past 5 years. Other information: 1. Capital allowance 725,870 2. Statutory deductions of 600,000 were omitted in error from the calculation 3. Donations made to charity was $500,000. Only 1 charity was approved and the amount donated was $250,000. 4. Donations to an approved retirement scheme of $1,000,000 was deducted

Nordia and Roper Ltd. operates a mini mart and had accounting profit for the year ended 2022 of $15,000,000. Notes: The following deductions were made to arrive at the accounting profit: 1. Depreciation $584,750 2. School fee for her 2 children $324,000 3. Advertising cost for a trade show $155,000 4. Cost to construct a billboard - $78,000 5. Interest on loan $500,00030% of money borrowed was used to complete her kitchen 6. Salaries deducted include $1,500,000 for Nordia's daughter. 7. Nordia takes $250,000 per month for her remuneration 8. The domestic helper was paid $15,000 per week, but her services were split evenly between Nordia's house and the mini mart 9. Payments of $10,000 per month were made by deed of covenant to the UWI for the past 5 years. Other information: 1. Capital allowance 725,870 2. Statutory deductions of 600,000 were omitted in error from the calculation 3. Donations made to charity was $500,000. Only 1 charity was approved and the amount donated was $250,000. 4. Donations to an approved retirement scheme of $1,000,000 was deducted Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started