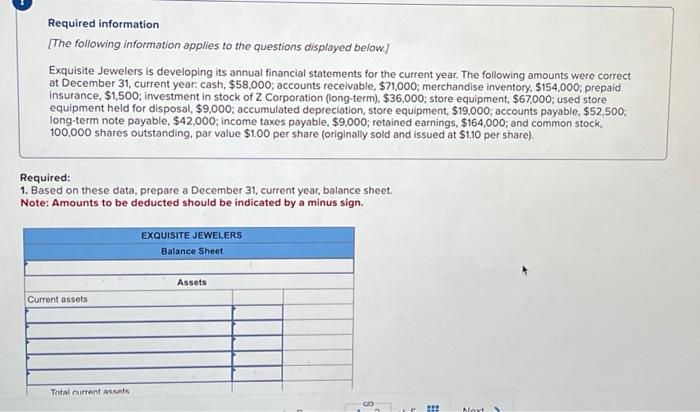

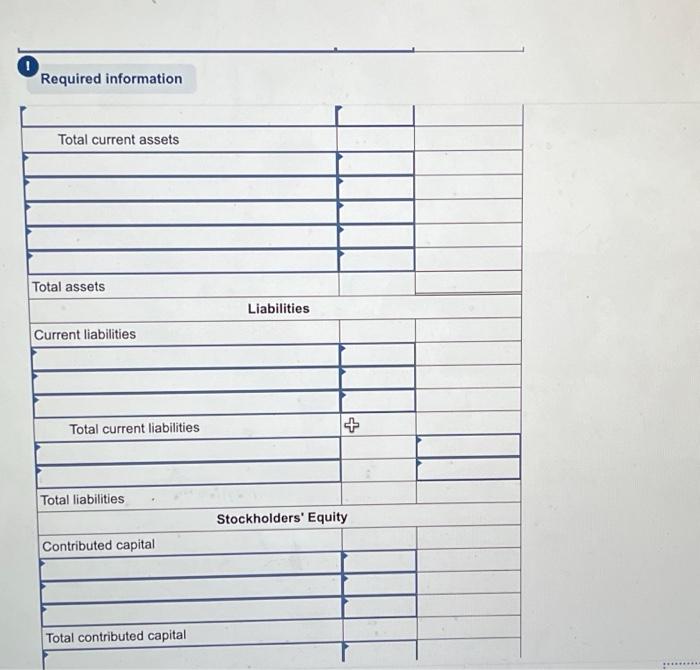

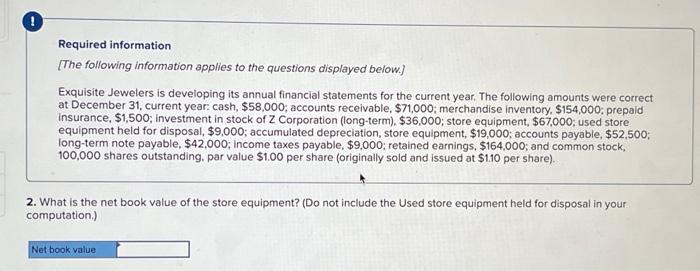

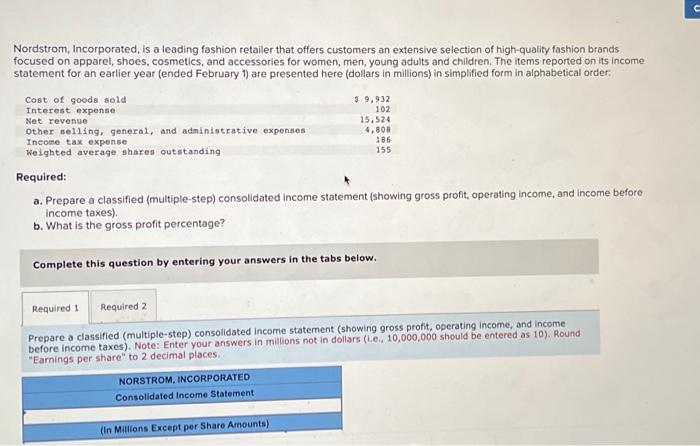

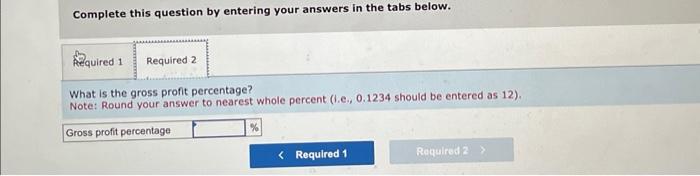

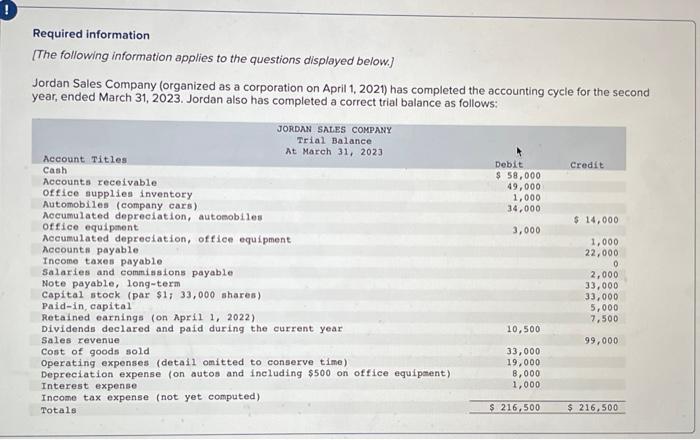

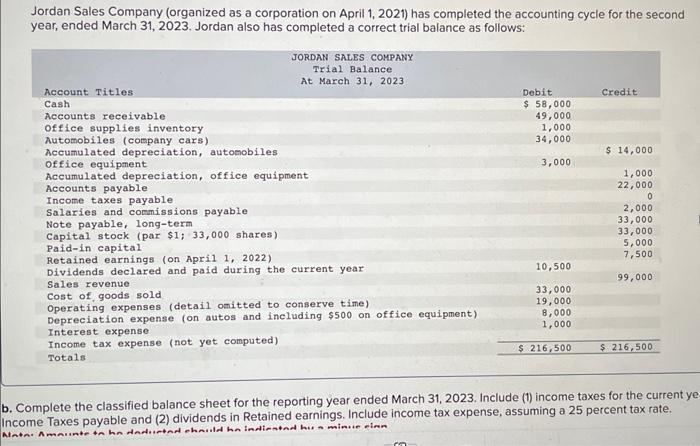

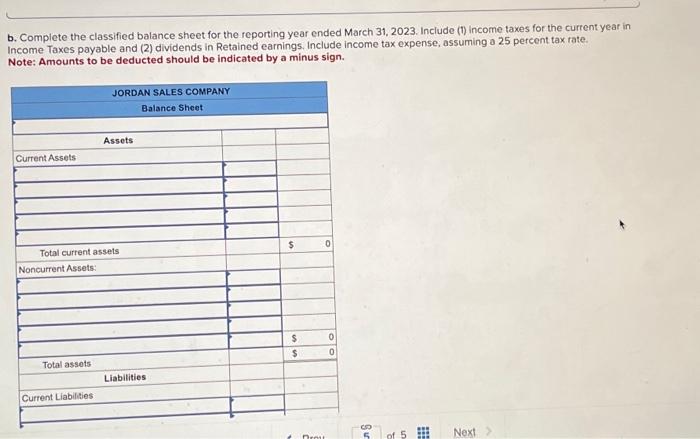

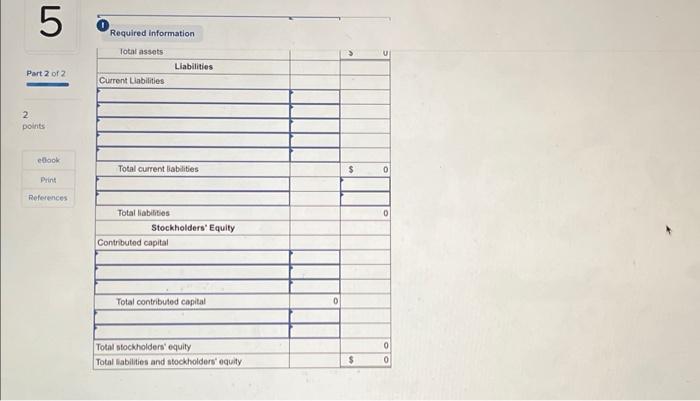

Nordstrom, Incorporated, is a leading fashion retailer that offers customers an extensive selection of high-quality fashion brands focused on apparel, shoes, cosmetics, and accessories for women, men, young adults and children. The items reported on its income statement for an earlier year (ended February 1) are presented here (dollars in millions) in simplified form in alphabetical order: Required: a. Prepare a classified (multiple-step) consolidated income statement (showing gross profit, operating income, and income before income taxes). b. What is the gross profit percentage? Complete this question by entering your answers in the tabs below. Prepare a classified (multiple-step) consolidated income statement (showing gross profit, operating income, and income before income taxes). Note: Enter your answers in millions not in dollars (1.e., 10,000,000 should be entered as 10 ). Round "Earnings per share" to 2 decimal places. Required information [The following information applies to the questions displayed below.] Jordan Sales Company (organized as a corporation on April 1, 2021) has completed the accounting cycle for the second year, ended March 31,2023 . Jordan also has completed a correct trial balance as follows: b. Complete the classified balance sheet for the reporting year ended March 31,2023 . Include (1) income taxes for the current year in Income Taxes payable and (2) dividends in Retained earnings. Include income tax expense, assuming a 25 percent tax rate. Note: Amounts to be deducted should be indicated by a minus sign. (1) Required information Part 2 of 2 2. \begin{tabular}{|c|c|} \hline Total assets: & 3 \\ \hline \multicolumn{2}{|l|}{ Liabilities } \\ \hline Current Liabilities : & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \multirow[t]{3}{*}{ Total current liabilities } & $ \\ \hline & \\ \hline & \\ \hline Total liabilitios & 0 \\ \hline \multicolumn{2}{|l|}{ Stockholders' Equity } \\ \hline \multicolumn{2}{|l|}{ Contributod capital } \\ \hline \\ \hline \\ \hline \\ \hline \multicolumn{2}{|l|}{ Total contributed copital } \\ \hline \multicolumn{2}{|l|}{+} \\ \hline \\ \hline Total stockholders' equity & 0 \\ \hline Total liabilities and stockholders' equity & $ \\ \hline \end{tabular} Complete this question by entering your answers in the tabs below. What is the gross profit percentage? Note: Round your answer to nearest whole percent (1.e., 0.1234 should be entered as 12), Required information [The following information applies to the questions displayed below.] Exquisite Jewelers is developing its annual financial statements for the current year. The following amounts were correct at December 31, current year: cash, $58,000; accounts receivable, $71,000; merchandise inventory, $154,000; prepaid insurance, $1,500; investment in stock of Z Corporation (long-term), $36,000; store equipment, $67,000; used store equipment held for disposal, $9,000; accumulated depreciation, store equipment, $19,000; accounts payable, $52,500; long-term note payable, $42,000; income taxes payable, $9,000; retained earnings, $164,000; and common stock, 100,000 shares outstanding, par value $1.00 per share (originally sold and issued at $1.10 per share). 2. What is the net book value of the store equipment? (Do not include the Used store equipment held for disposal in your computation.) Required information [The following information applies to the questions displayed below] Exquisite Jewelers is developing its annual financial statements for the current year. The following amounts were correct at December 31, current year: cash, $58,000; accounts receivable, $71,000; merchandise inventory, $154,000; prepaid insurance, $1,500; investment in stock of Z Corporation (long-term). $36,000; store equipment, $67,000; used store equipment held for disposal, $9,000; accumulated depreciation, store equipment, $19.000; accounts payable, $52,500; long-term note payable, $42,000; income taxes payable, $9,000; retained earnings, $164,000; and common stock, 100,000 shares outstanding. par value $1.00 per share (originally sold and issued at $1.10 per share). Required: 1. Based on these data, prepare a December 31, current year, balance sheet. Note: Amounts to be deducted should be indicated by a minus sign. Jordan Sales Company (organized as a corporation on April 1, 2021) has completed the accounting cycle for the second year, ended March 31, 2023. Jordan also has completed a correct trial balance as follows: b. Complete the classified balance sheet for the reporting year ended March 31, 2023. Include (1) income taxes for the current ye Income Taxes payable and (2) dividends in Retained earnings. Include income tax expense, assuming a 25 percent tax rate. Required information