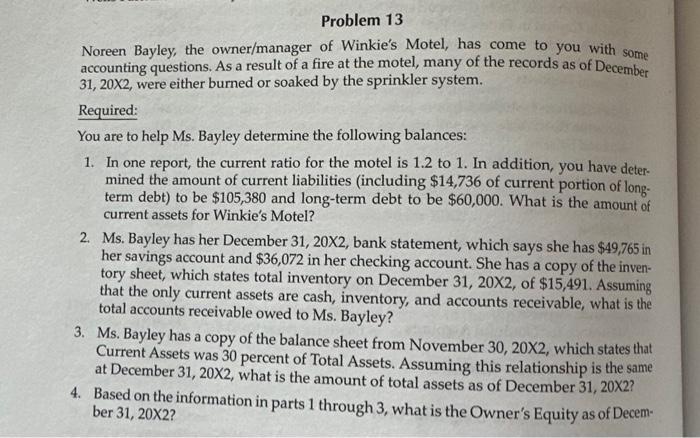

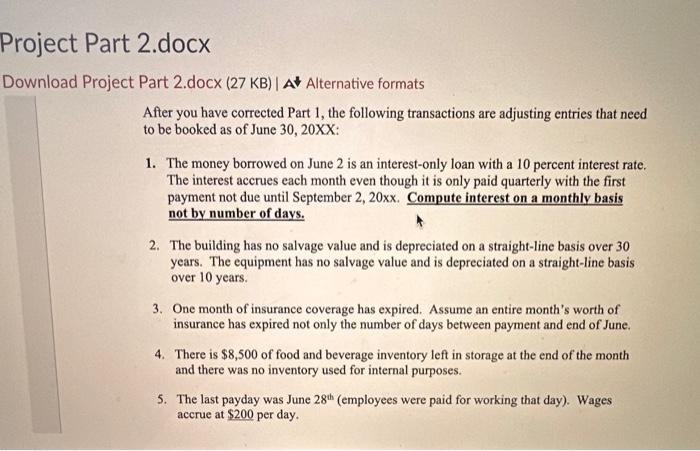

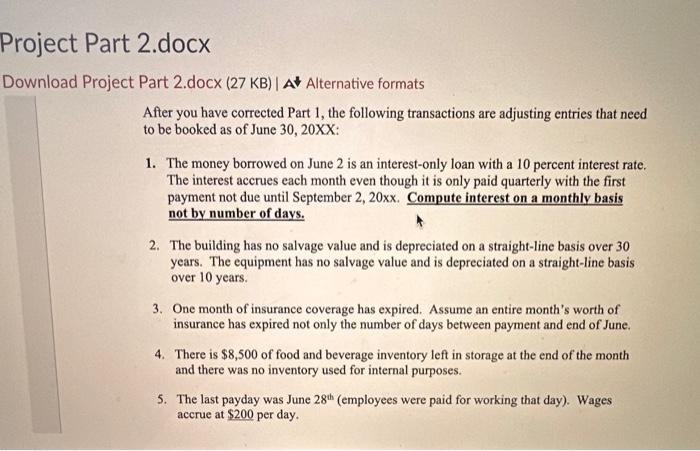

Noreen Bayley, the owner/manager of Winkie's Motel, has come to you with some accounting questions. As a result of a fire at the motel, many of the records as of December 31,20X2, were either burned or soaked by the sprinkler system. Required: You are to help Ms. Bayley determine the following balances: 1. In one report, the current ratio for the motel is 1.2 to 1 . In addition, you have determined the amount of current liabilities (including $14,736 of current portion of longterm debt) to be $105,380 and long-term debt to be $60,000. What is the amount of current assets for Winkie's Motel? 2. Ms. Bayley has her December 31,20X2, bank statement, which says she has $49,765 in her savings account and $36,072 in her checking account. She has a copy of the inventory sheet, which states total inventory on December 31,202, of $15,491. Assuming that the only current assets are cash, inventory, and accounts receivable, what is the total accounts receivable owed to Ms. Bayley? 3. Ms. Bayley has a copy of the balance sheet from November 30,202, which states that Current Assets was 30 percent of Total Assets. Assuming this relationship is the same at December 31,202, what is the amount of total assets as of December 31,202 ? 4. Based on the information in parts 1 through 3 , what is the Owner's Equity as of December 31,202 ? Part 2.docx (27KB)A Alternative formats After you have corrected Part 1, the following transactions are adjusting entries that need to be booked as of June 30,20XX : 1. The money borrowed on June 2 is an interest-only loan with a 10 percent interest rate. The interest accrues each month even though it is only paid quarterly with the first payment not due until September 2,20xx. Compute interest on a monthly basis not by number of days. 2. The building has no salvage value and is depreciated on a straight-line basis over 30 years. The equipment has no salvage value and is depreciated on a straight-line basis over 10 years. 3. One month of insurance coverage has expired. Assume an entire month's worth of insurance has expired not only the number of days between payment and end of June. 4. There is $8,500 of food and beverage inventory left in storage at the end of the month and there was no inventory used for internal purposes. 5. The last payday was June 28th (employees were paid for working that day). Wages accrue at $200 per day. Noreen Bayley, the owner/manager of Winkie's Motel, has come to you with some accounting questions. As a result of a fire at the motel, many of the records as of December 31,20X2, were either burned or soaked by the sprinkler system. Required: You are to help Ms. Bayley determine the following balances: 1. In one report, the current ratio for the motel is 1.2 to 1 . In addition, you have determined the amount of current liabilities (including $14,736 of current portion of longterm debt) to be $105,380 and long-term debt to be $60,000. What is the amount of current assets for Winkie's Motel? 2. Ms. Bayley has her December 31,20X2, bank statement, which says she has $49,765 in her savings account and $36,072 in her checking account. She has a copy of the inventory sheet, which states total inventory on December 31,202, of $15,491. Assuming that the only current assets are cash, inventory, and accounts receivable, what is the total accounts receivable owed to Ms. Bayley? 3. Ms. Bayley has a copy of the balance sheet from November 30,202, which states that Current Assets was 30 percent of Total Assets. Assuming this relationship is the same at December 31,202, what is the amount of total assets as of December 31,202 ? 4. Based on the information in parts 1 through 3 , what is the Owner's Equity as of December 31,202 ? Part 2.docx (27KB)A Alternative formats After you have corrected Part 1, the following transactions are adjusting entries that need to be booked as of June 30,20XX : 1. The money borrowed on June 2 is an interest-only loan with a 10 percent interest rate. The interest accrues each month even though it is only paid quarterly with the first payment not due until September 2,20xx. Compute interest on a monthly basis not by number of days. 2. The building has no salvage value and is depreciated on a straight-line basis over 30 years. The equipment has no salvage value and is depreciated on a straight-line basis over 10 years. 3. One month of insurance coverage has expired. Assume an entire month's worth of insurance has expired not only the number of days between payment and end of June. 4. There is $8,500 of food and beverage inventory left in storage at the end of the month and there was no inventory used for internal purposes. 5. The last payday was June 28th (employees were paid for working that day). Wages accrue at $200 per day