Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NoRisk Insurance Co is trying to increase their business, so they've hired a new employee, Noelle, and they've launched a call-in web series called

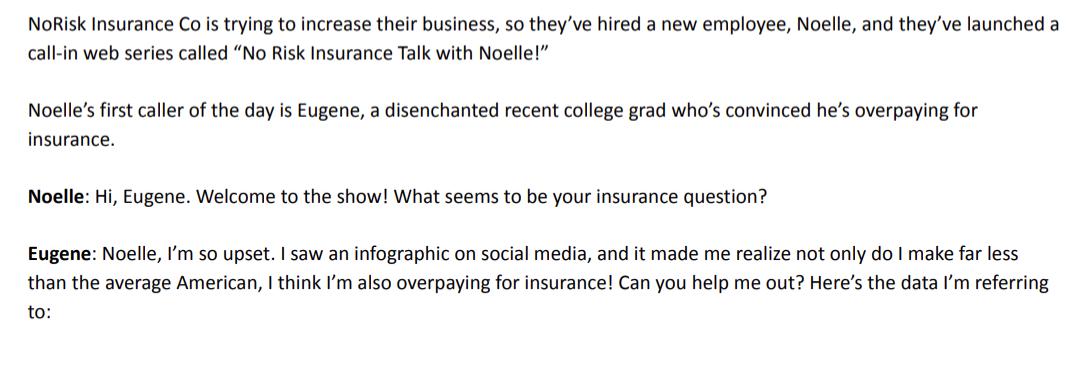

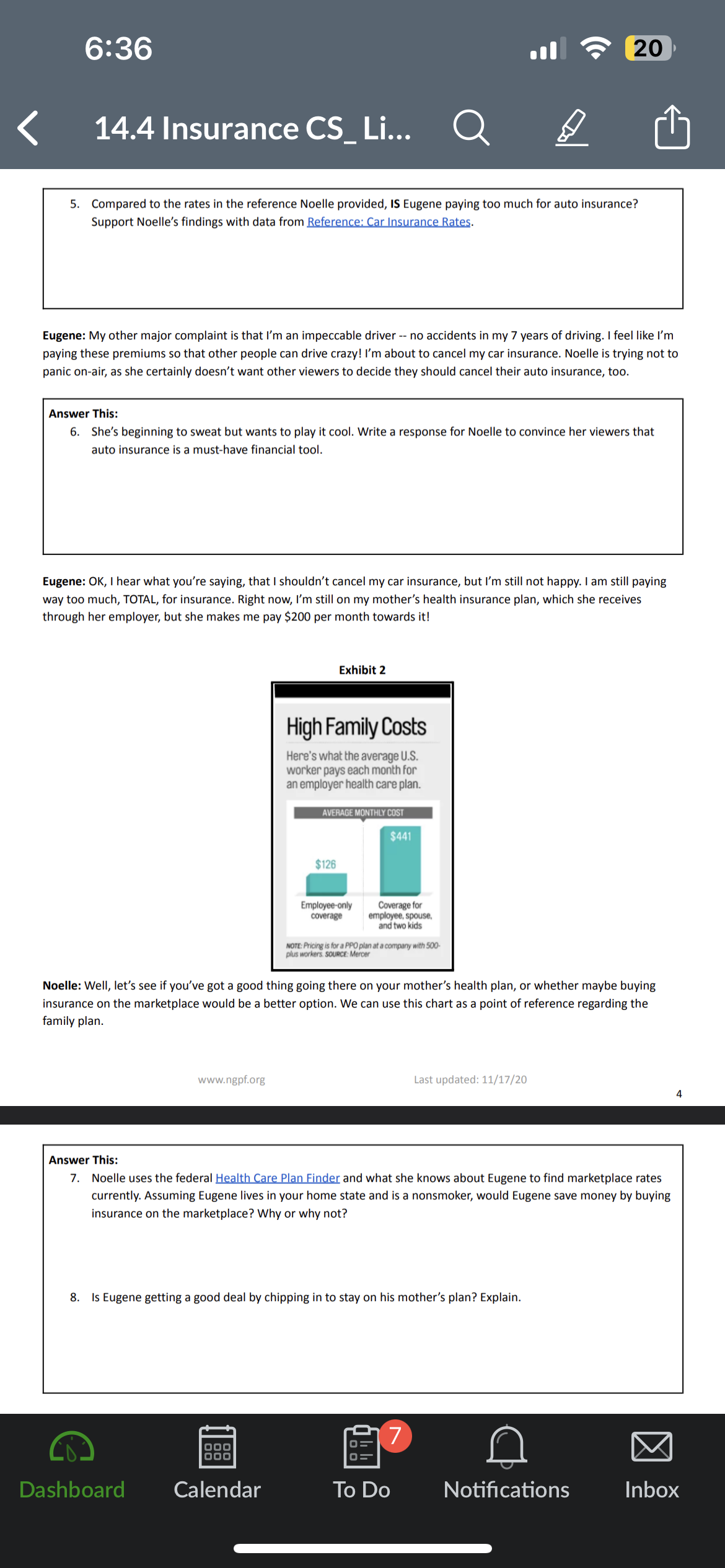

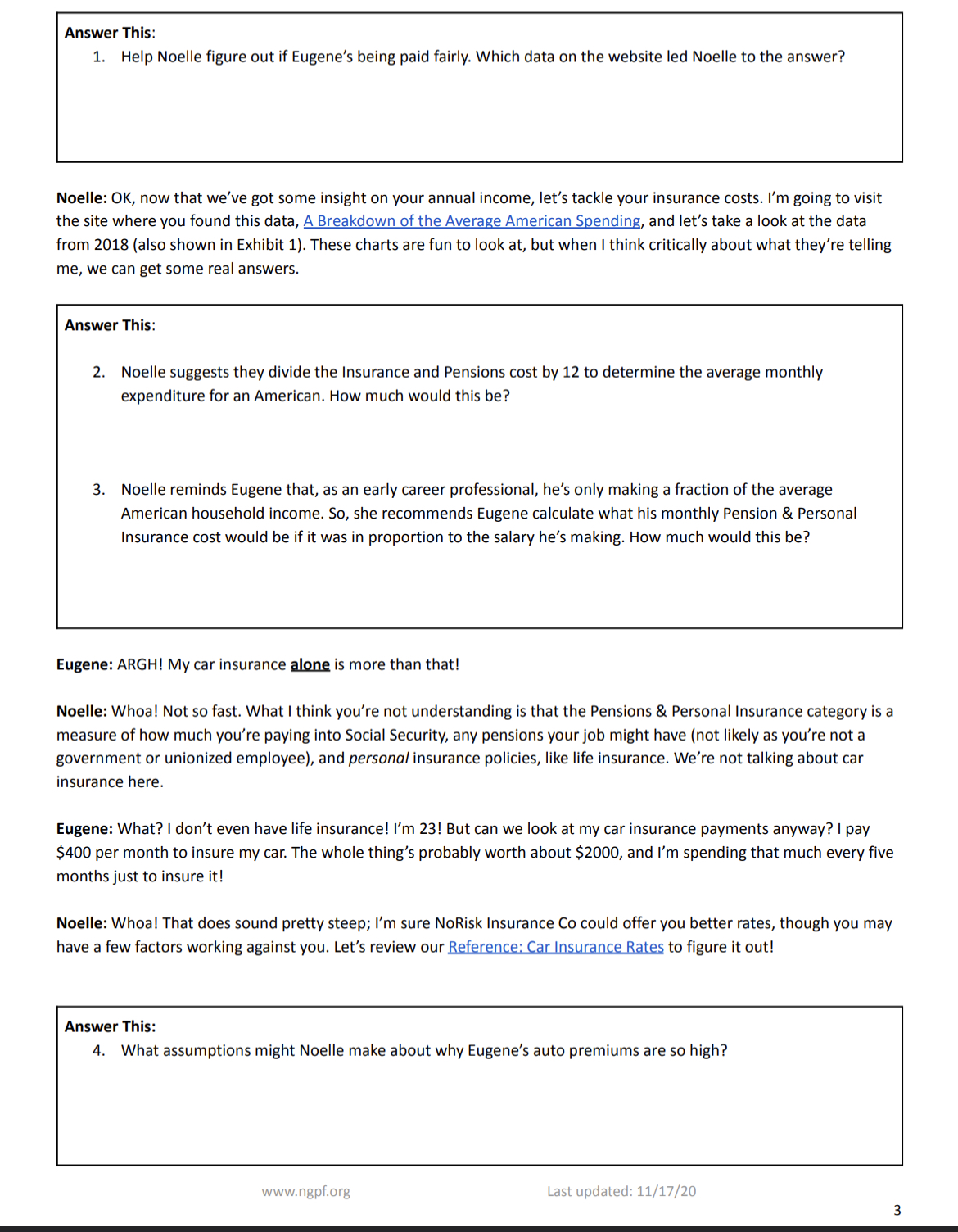

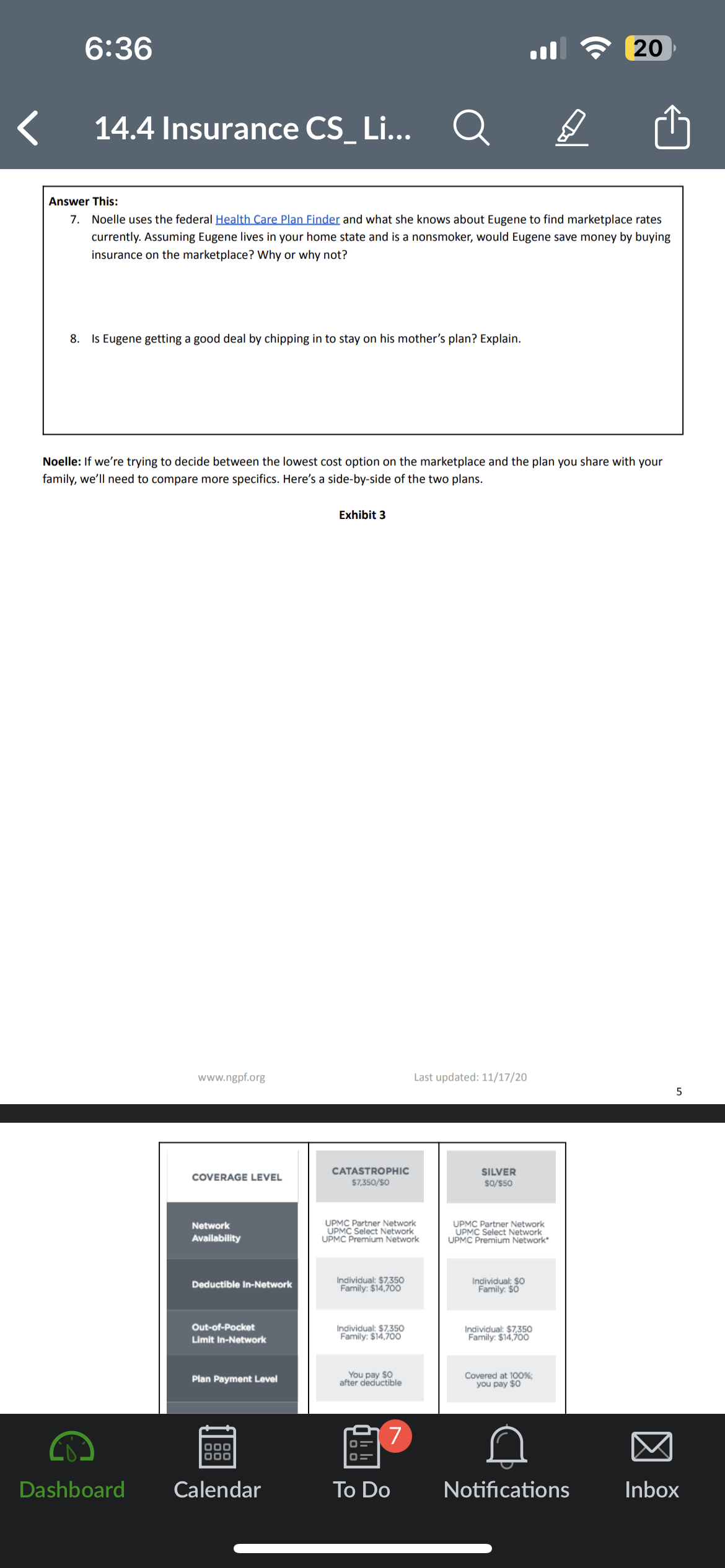

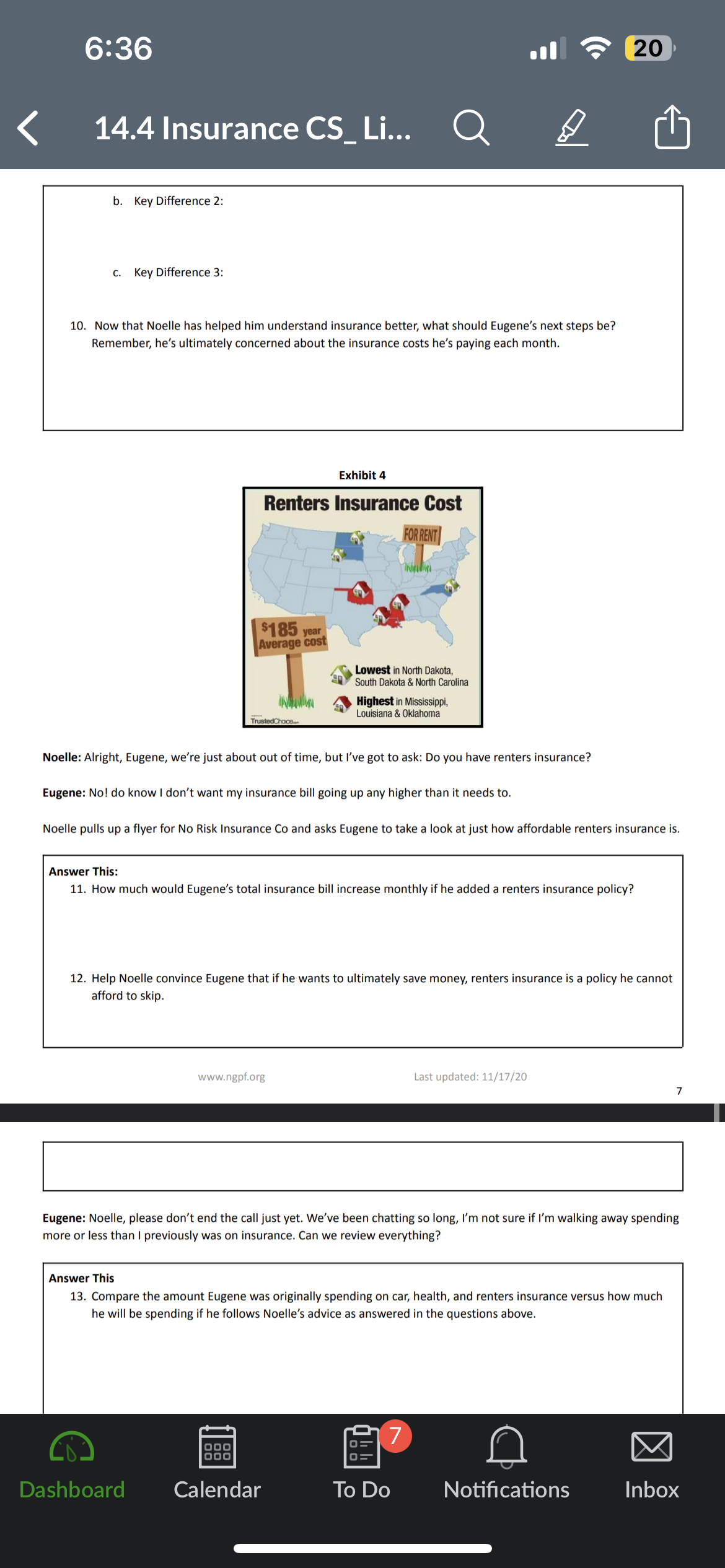

NoRisk Insurance Co is trying to increase their business, so they've hired a new employee, Noelle, and they've launched a call-in web series called "No Risk Insurance Talk with Noelle!" Noelle's first caller of the day is Eugene, a disenchanted recent college grad who's convinced he's overpaying for insurance. Noelle: Hi, Eugene. Welcome to the show! What seems to be your insurance question? Eugene: Noelle, I'm so upset. I saw an infographic on social media, and it made me realize not only do I make far less than the average American, I think I'm also overpaying for insurance! Can you help me out? Here's the data I'm referring to: 6:36 3 20 14.4 Insurance CS_Li... Q D 5. Compared to the rates in the reference Noelle provided, IS Eugene paying too much for auto insurance? Support Noelle's findings with data from Reference: Car Insurance Rates. Eugene: My other major complaint is that I'm an impeccable driver -- no accidents in my 7 years of driving. I feel like I'm paying these premiums so that other people can drive crazy! I'm about to cancel my car insurance. Noelle is trying not to panic on-air, as she certainly doesn't want other viewers to decide they should cancel their auto insurance, too. Answer This: 6. She's beginning to sweat but wants to play it cool. Write a response for Noelle to convince her viewers that auto insurance is a must-have financial tool. Eugene: OK, I hear what you're saying, that I shouldn't cancel my car insurance, but I'm still not happy. I am still paying way too much, TOTAL, for insurance. Right now, I'm still on my mother's health insurance plan, which she receives through her employer, but she makes me pay $200 per month towards it! Exhibit 2 High Family Costs Here's what the average U.S. worker pays each month for an employer health care plan. AVERAGE MONTHLY COST $441 $126 Employee-only coverage Coverage for employee, spouse. and two kids NOTE: Pricing is for a PPO plan at a company with 500- plus workers. SOURCE: Mercer Noelle: Well, let's see if you've got a good thing going there on your mother's health plan, or whether maybe buying insurance on the marketplace would be a better option. We can use this chart as a point of reference regarding the family plan. www.ngpf.org Last updated: 11/17/20 Answer This: 7. Noelle uses the federal Health Care Plan Finder and what she knows about Eugene to find marketplace rates currently. Assuming Eugene lives in your home state and is a nonsmoker, would Eugene save money by buying insurance on the marketplace? Why or why not? 8. Is Eugene getting a good deal by chipping in to stay on his mother's plan? Explain. 4 7 Dashboard Calendar To Do Notifications Inbox Answer This: 1. Help Noelle figure out if Eugene's being paid fairly. Which data on the website led Noelle to the answer? Noelle: OK, now that we've got some insight on your annual income, let's tackle your insurance costs. I'm going to visit the site where you found this data, A Breakdown of the Average American Spending, and let's take a look at the data from 2018 (also shown in Exhibit 1). These charts are fun to look at, but when I think critically about what they're telling me, we can get some real answers. Answer This: 2. Noelle suggests they divide the Insurance and Pensions cost by 12 to determine the average monthly expenditure for an American. How much would this be? 3. Noelle reminds Eugene that, as an early career professional, he's only making a fraction of the average American household income. So, she recommends Eugene calculate what his monthly Pension & Personal Insurance cost would be if it was in proportion to the salary he's making. How much would this be? Eugene: ARGH! My car insurance alone is more than that! Noelle: Whoa! Not so fast. What I think you're not understanding is that the Pensions & Personal Insurance category is a measure of how much you're paying into Social Security, any pensions your job might have (not likely as you're not a government or unionized employee), and personal insurance policies, like life insurance. We're not talking about car insurance here. Eugene: What? I don't even have life insurance! I'm 23! But can we look at my car insurance payments anyway? I pay $400 per month to insure my car. The whole thing's probably worth about $2000, and I'm spending that much every five months just to insure it! Noelle: Whoa! That does sound pretty steep; I'm sure NoRisk Insurance Co could offer you better rates, though you may have a few factors working against you. Let's review our Reference: Car Insurance Rates to figure it out! Answer This: 4. What assumptions might Noelle make about why Eugene's auto premiums are so high? www.ngpf.org Last updated: 11/17/20 3 6:36 14.4 Insurance CS_Li... Q D COVERAGE LEVEL Network Availability CATASTROPHIC $7,350/$0 SILVER $0/$50 UPMC Partner Network UPMC Select Network UPMC Premium Network UPMC Partner Network UPMC Select Network UPMC Premium Network Deductible In-Network Individual: $7,350 Family: $14,700 Out-of-Pocket Limit In-Network Individual: $0 Family: $0 Individual: $7,350 Family: $14,700 Individual: $7,350 Family: $14,700 Plan Payment Level Primary Care Provider Office Visit You pay $O after deductible You pay $0 after the deductible; first 3 PCP visits are $35 copayment per visit, NOT subject to deductible Covered at 100%; you pay $0 You pay $50 copayment per visit Specialist Office Visit You pay $O after deductible You pay $100 copayment per visit Emergency Care You pay $O after deductible You pay $1,000 copayment per visit; copayment waived if you are admitted to hospital Urgent Care You pay $O after deductible You pay $100 copayment per visit Inpatient Hospital (Semiprivate Room) You pay $0 after deductible You pay $3,500 copayment per day Pharmacy Deductible N/A $75 Pharmacy Summary $0/50/50/$0 after medical deductible $25/$50/$100/50% after pharmacy deductible 20 Answer This: 9. Eugene has never looked in depth at a health insurance policy before. Noelle doesn't want to overwhelm him, so she wants to point out three key differences Eugene should care about when comparing catastrophic coverage to what his mother's silver plan provides. a. Key Difference 1: www.ngpf.org Last updated: 11/17/20 6 b. Key Difference 2: c. Key Difference 3: 10. Now that Noelle has helped him understand insurance better, what should Eugene's next steps be? Remember, he's ultimately concerned about the insurance costs he's paying each month. 7 Dashboard Calendar To Do Notifications Inbox 6:36 14.4 Insurance CS_Li... 3 20 Q Answer This: 7. Noelle uses the federal Health Care Plan Finder and what she knows about Eugene to find marketplace rates currently. Assuming Eugene lives in your home state and is a nonsmoker, would Eugene save money by buying insurance on the marketplace? Why or why not? 8. Is Eugene getting a good deal by chipping in to stay on his mother's plan? Explain. Noelle: If we're trying to decide between the lowest cost option on the marketplace and the plan you share with your family, we'll need to compare more specifics. Here's a side-by-side of the two plans. Exhibit 3 www.ngpf.org Last updated: 11/17/20 5 COVERAGE LEVEL Network Availability CATASTROPHIC $7,350/$0 SILVER $0/$50 UPMC Partner Network UPMC Select Network UPMC Premium Network UPMC Partner Network UPMC Select Network UPMC Premium Network Deductible In-Network Individual: $7,350 Family: $14,700 Out-of-Pocket Limit In-Network Individual: $0 Family: $0 Individual: $7,350 Family: $14,700 Individual: $7,350 Family: $14,700 Plan Payment Level You pay $0 after deductible Covered at 100%; you pay $0 7 Dashboard Calendar To Do Notifications Inbox 6:36 14.4 Insurance CS_Li... Q b. Key Difference 2: c. Key Difference 3: D 10. Now that Noelle has helped him understand insurance better, what should Eugene's next steps be? Remember, he's ultimately concerned about the insurance costs he's paying each month. Exhibit 4 Renters Insurance Cost FOR RENT $185 year Average cost Lowest in North Dakota, South Dakota & North Carolina Highest in Mississippi, Louisiana & Oklahoma TrustedChoice. 20 Noelle: Alright, Eugene, we're just about out of time, but I've got to ask: Do you have renters insurance? Eugene: No! do know I don't want my insurance bill going up any higher than it needs to. Noelle pulls up a flyer for No Risk Insurance Co and asks Eugene to take a look at just how affordable renters insurance is. Answer This: 11. How much would Eugene's total insurance bill increase monthly if he added a renters insurance policy? 12. Help Noelle convince Eugene that if he wants to ultimately save money, renters insurance is a policy he cannot afford to skip. www.ngpf.org Last updated: 11/17/20 7 Eugene: Noelle, please don't end the call just yet. We've been chatting so long, I'm not sure if I'm walking away spending more or less than I previously was on insurance. Can we review everything? Answer This 13. Compare the amount Eugene was originally spending on car, health, and renters insurance versus how much he will be spending if he follows Noelle's advice as answered in the questions above. 7 Dashboard Calendar To Do Notifications Inbox 6:36 14.4 Insurance CS_Li... 3 20 Noelle pulls up a flyer for No Risk Insurance Co and asks Eugene to take a look at just how affordable renters insurance is. Answer This: 11. How much would Eugene's total insurance bill increase monthly if he added a renters insurance policy? 12. Help Noelle convince Eugene that if he wants to ultimately save money, renters insurance is a policy he cannot afford to skip. www.ngpf.org Last updated: 11/17/20 7 Eugene: Noelle, please don't end the call just yet. We've been chatting so long, I'm not sure if I'm walking away spending more or less than I previously was on insurance. Can we review everything? Answer This 13. Compare the amount Eugene was originally spending on car, health, and renters insurance versus how much he will be spending if he follows Noelle's advice as answered in the questions above. 14. Noelle needs to wrap up this episode of "Insurance Talk with Noelle." Summarize what Eugene and the viewers at home learned today about insurance. www.ngpf.org 7 Last updated: 11/17/20 8 Dashboard Calendar To Do Notifications Inbox

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started