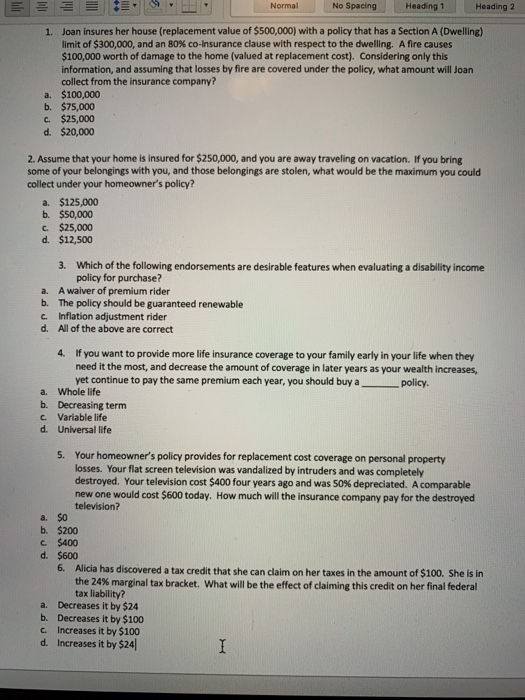

Normal No Spacing Heading 1 Heading 2 1. Joan insures her house (replacement value of $500,000) with a policy that has a Section A (Dwelling) limit of $300,000, and an 80% co-Insurance clause with respect to the dwelling. A fire causes $100,000 worth of damage to the home (valued at replacement cost). Considering only this Information, and assuming that losses by fire are covered under the policy, what amount will loan collect from the insurance company? a $100,000 b. $75,000 c. $25,000 d. $20,000 2. Assume that your home is insured for $250,000, and you are away traveling on vacation. If you bring some of your belongings with you, and those belongings are stolen, what would be the maximum you could collect under your homeowner's policy? a $125.000 b. $50,000 c $25,000 d. $12,500 3. Which of the following endorsements are desirable features when evaluating a disability income policy for purchase? a. A waiver of premium rider b. The policy should be guaranteed renewable c Inflation adjustment rider d. All of the above are correct 4. If you want to provide more life insurance coverage to your family early in your life when they need it the most, and decrease the amount of coverage in later years as your wealth increases, yet continue to pay the same premium each year, you should buy a policy. a. Whole life b. Decreasing term c Variable life d. Universal life 5. Your homeowner's policy provides for replacement cost coverage on personal property losses. Your flat screen television was vandalized by intruders and was completely destroyed. Your television cost $400 four years ago and was 50% depreciated. A comparable new one would cost $600 today. How much will the insurance company pay for the destroyed television? a SO b. $200 c $400 d. $600 6. Alicia has discovered a tax credit that she can claim on her taxes in the amount of $100. She is in the 24% marginal tax bracket. What will be the effect of claiming this credit on her final federal tax liability? a. Decreases it by $24 b. Decreases it by $100 c. Increases it by $100 d. Increases it by $24