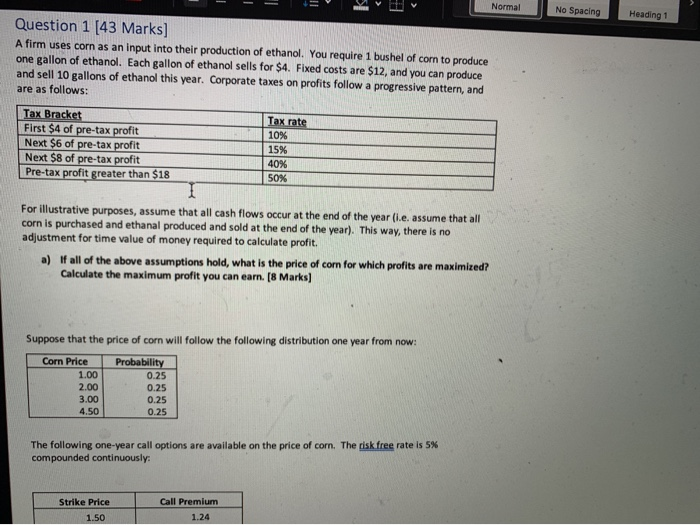

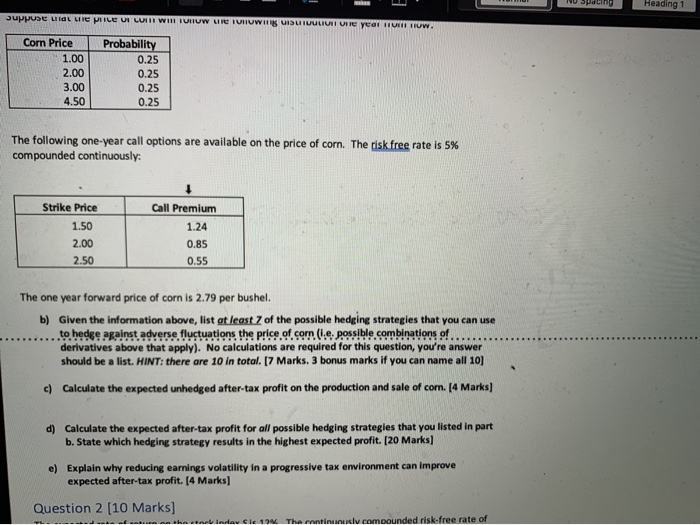

Normal No Spacing Heading 1 Question 1 [43 Marks) Afirm uses corn as an input into their production of ethanol. You require 1 bushel of corn to produce one gallon of ethanol. Each gallon of ethanol sells for $4. Fixed costs are $12, and you can produce and sell 10 gallons of ethanol this year. Corporate taxes on profits follow a progressive pattern, and are as follows: Tax Bracket Tax rate First $4 of pre-tax profit 10% Next $6 of pre-tax profit 15% Next $8 of pre-tax profit 40% Pre-tax profit greater than $18 50% For illustrative purposes, assume that all cash flows occur at the end of the year (ie, assume that all corn is purchased and ethanal produced and sold at the end of the year). This way, there is no adjustment for time value of money required to calculate profit. a) If all of the above assumptions hold, what is the price of corn for which profits are maximized? Calculate the maximum profit you can earn. (8 Marks) Suppose that the price of corn will follow the following distribution one year from now: Corn Price Probability 0.25 2.00 0.25 0.25 1.00 0.25 The following one-year call options are available on the price of corn, The risk free rate is 5% compounded continuously Call Premium Strike Price 1 1.24 NU Spaling Heading 1 supuse ulaL LITE PILE UI LUIT WIR TURIUWIE TUITUWIEK UISUTUULIUTI VIIE CAT TUNTI TUW Corn Price 1.00 2.00 3.00 4.50 Probability 0.25 0.25 0.25 0.25 The following one-year call options are available on the price of corn. The risk free rate is 5% compounded continuously: Strike Price 1.50 2.00 2.50 Call Premium 1.24 0.85 0.55 The one year forward price of corn is 2.79 per bushel. b) Given the information above, list at least 7 of the possible hedging strategies that you can use to bedes against adverse fluctuations the price of corn. (.e. possible combinations of... derivatives above that apply). No calculations are required for this question, you're answer should be a list. HINT: there are 10 in total. [7 Marks. 3 bonus marks if you can name all 101 c) Calculate the expected unhedged after-tax profit on the production and sale of com. [4 Marks d) Calculate the expected after-tax profit for all possible hedging strategies that you listed in part b. State which hedging strategy results in the highest expected profit. [20 Marks] e) Explain why reducing earnings volatility in a progressive tax erwironment can improve expected after-tax profit. [4 Marks] Question 2 10 Marks] innusly compounded risk-free rate of Normal No Spacing Heading 1 Question 1 [43 Marks) Afirm uses corn as an input into their production of ethanol. You require 1 bushel of corn to produce one gallon of ethanol. Each gallon of ethanol sells for $4. Fixed costs are $12, and you can produce and sell 10 gallons of ethanol this year. Corporate taxes on profits follow a progressive pattern, and are as follows: Tax Bracket Tax rate First $4 of pre-tax profit 10% Next $6 of pre-tax profit 15% Next $8 of pre-tax profit 40% Pre-tax profit greater than $18 50% For illustrative purposes, assume that all cash flows occur at the end of the year (ie, assume that all corn is purchased and ethanal produced and sold at the end of the year). This way, there is no adjustment for time value of money required to calculate profit. a) If all of the above assumptions hold, what is the price of corn for which profits are maximized? Calculate the maximum profit you can earn. (8 Marks) Suppose that the price of corn will follow the following distribution one year from now: Corn Price Probability 0.25 2.00 0.25 0.25 1.00 0.25 The following one-year call options are available on the price of corn, The risk free rate is 5% compounded continuously Call Premium Strike Price 1 1.24 NU Spaling Heading 1 supuse ulaL LITE PILE UI LUIT WIR TURIUWIE TUITUWIEK UISUTUULIUTI VIIE CAT TUNTI TUW Corn Price 1.00 2.00 3.00 4.50 Probability 0.25 0.25 0.25 0.25 The following one-year call options are available on the price of corn. The risk free rate is 5% compounded continuously: Strike Price 1.50 2.00 2.50 Call Premium 1.24 0.85 0.55 The one year forward price of corn is 2.79 per bushel. b) Given the information above, list at least 7 of the possible hedging strategies that you can use to bedes against adverse fluctuations the price of corn. (.e. possible combinations of... derivatives above that apply). No calculations are required for this question, you're answer should be a list. HINT: there are 10 in total. [7 Marks. 3 bonus marks if you can name all 101 c) Calculate the expected unhedged after-tax profit on the production and sale of com. [4 Marks d) Calculate the expected after-tax profit for all possible hedging strategies that you listed in part b. State which hedging strategy results in the highest expected profit. [20 Marks] e) Explain why reducing earnings volatility in a progressive tax erwironment can improve expected after-tax profit. [4 Marks] Question 2 10 Marks] innusly compounded risk-free rate of