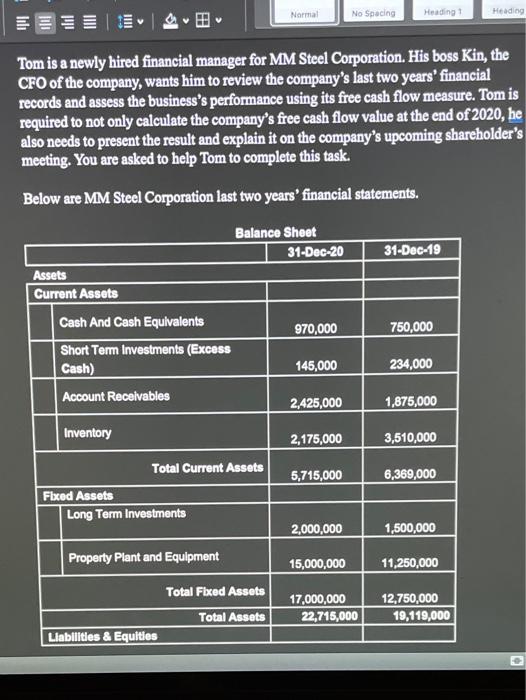

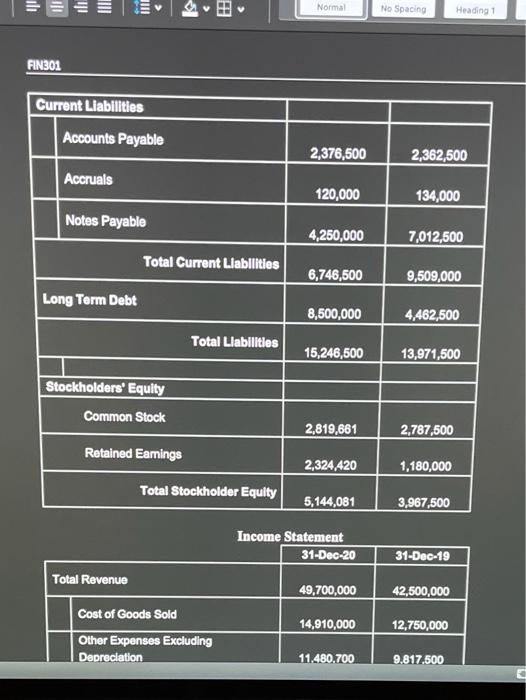

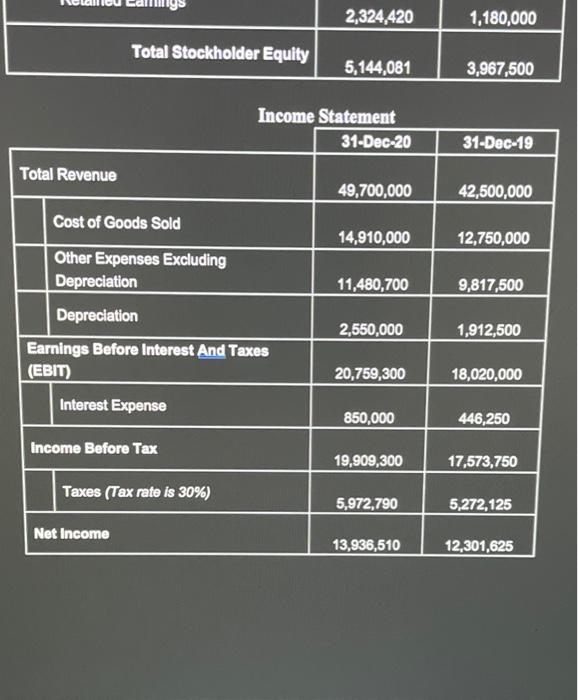

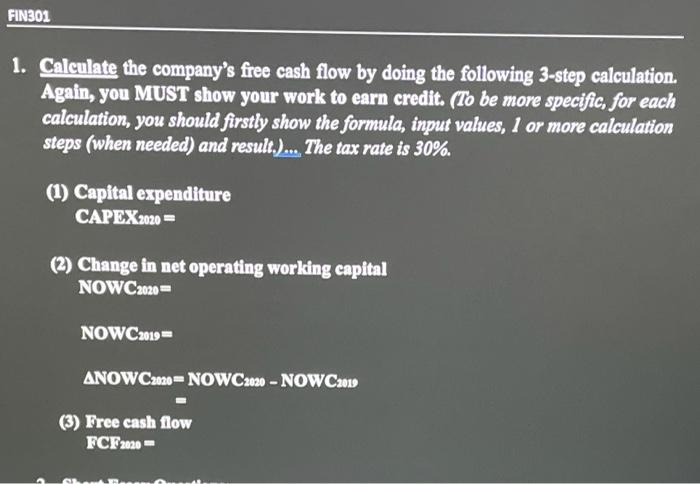

Normal No Spacing Heading Heading 1111 Tom is a newly hired financial manager for MM Steel Corporation. His boss Kin, the CFO of the company, wants him to review the company's last two years' financial records and assess the business's performance using its free cash flow measure. Tom is required to not only calculate the company's free cash flow value at the end of 2020, he also needs to present the result and explain it on the company's upcoming shareholder's meeting. You are asked to help Tom to complete this task. Below are MM Steel Corporation last two years' financial statements. 31-Dec-19 Balance Sheet 31-Dec-20 Assets Current Assets Cash And Cash Equivalents 970,000 Short Term Investments (Excess Cash) 145,000 Account Receivables 2,425,000 750,000 234,000 1,875,000 Inventory 2,175,000 3,510,000 5,715,000 6,369,000 Total Current Assets Fixed Assets Long Term Investments 2,000,000 1,500,000 Property Plant and Equipment 15,000,000 11,250,000 Total Fixed Assets 17,000,000 22,715,000 12,750,000 19,119,000 Total Assets Liabilities & Equities JUNI Normal No Spacing Heading 1 FIN301 Current Liabilities Accounts Payable 2,376,500 2,362,500 Accruals 120,000 134,000 Notes Payable 4,250,000 7,012,500 Total Current Liabilities 6,746,500 9,509,000 Long Term Debt 8,500,000 4,462,500 Total Liabilities 15,246,500 13,971,500 Stockholders' Equity Common Stock 2,819,661 2,787,500 Retained Eamings 2,324,420 1,180,000 Total Stockholder Equity 5,144,081 3,967,500 Income Statement 31-Dec-20 31-Dec-19 Total Revenue 49,700,000 42,500,000 14,910,000 12,750,000 Cost of Goods Sold Other Expenses Excluding Depreciation 11.480.700 9.817.500 2,324,420 1,180,000 Total Stockholder Equity 5,144,081 3,967,500 Income Statement 31-Dec-20 31-Dec-19 Total Revenue 49,700,000 42,500,000 Cost of Goods Sold 14,910,000 12,750,000 11,480,700 9,817,500 Other Expenses Excluding Depreciation Depreciation Earnings Before Interest And Taxes (EBIT) Interest Expense 2,550,000 1,912,500 20,759,300 18,020,000 850,000 446,250 Income Before Tax 19,909,300 17,573,750 Taxes (Tax rate is 30%) 5,972,790 5,272,125 Net Income 13,936,510 12,301,625 FIN301 1. Calculate the company's free cash flow by doing the following 3-step calculation. Again, you MUST show your work to earn credit. (To be more specific, for each calculation, you should firstly show the formula, input values, 1 or more calculation steps (when needed) and result.)... The tax rate is 30%. (1) Capital expenditure CAPEX2020 = (2) Change in net operating working capital NOWC2020 NOWC2019 ANOWC2020-NOWC2020-NOWC2019 (3) Free cash flow FCF2020