Answered step by step

Verified Expert Solution

Question

1 Approved Answer

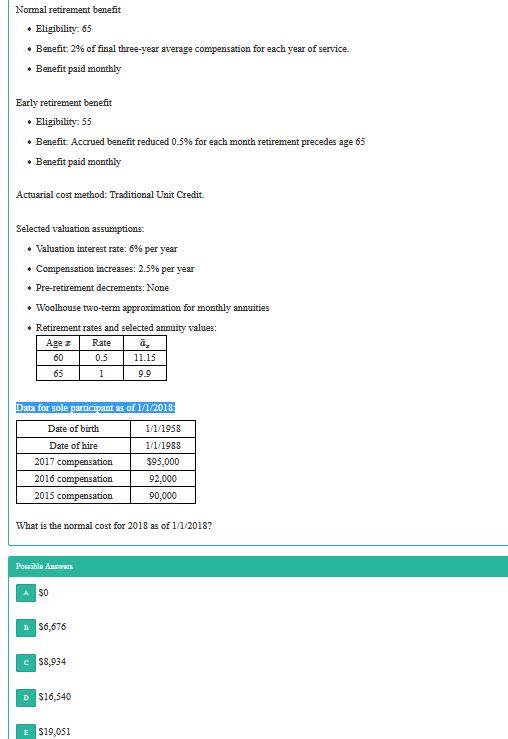

Normal retirement benefit Eligibility: 65 Benefit. 2% of final three-year average compensation for each year of service. Benefit paid monthly Early retirement benefit Eligibility: 55

Normal retirement benefit Eligibility: 65 Benefit. 2% of final three-year average compensation for each year of service. Benefit paid monthly Early retirement benefit Eligibility: 55 Benefit Accrued benefit reduced 0.5% for each month retirement precedes age 65 Benefit paid monthly Actuarial cost method: Traditional Unit Credit. . . Selected valuation assumptions Valuation interest rate: 6% per year Compensation increases: 2.5% per year Pre-retirement decrements: None Woolhouse two-term approximation for monthly annuities Retirement rates and selected annuity values: Age z Rate a. 60 0.5 11.15 65 1 9.9 Data for sole participant as of 1/1/2018 Date of birth Date of hire 2017 compensation 2016 compensation 2015 compensation 1/1/1958 1/1/1988 $95,000 92,000 90,000 What is the normal cost for 2018 as of 1/1/2018? Possible Answers A $0 S6,676 c 58,934 D $16,540 E $19,051 Normal retirement benefit Eligibility: 65 Benefit. 2% of final three-year average compensation for each year of service. Benefit paid monthly Early retirement benefit Eligibility: 55 Benefit Accrued benefit reduced 0.5% for each month retirement precedes age 65 Benefit paid monthly Actuarial cost method: Traditional Unit Credit. . . Selected valuation assumptions Valuation interest rate: 6% per year Compensation increases: 2.5% per year Pre-retirement decrements: None Woolhouse two-term approximation for monthly annuities Retirement rates and selected annuity values: Age z Rate a. 60 0.5 11.15 65 1 9.9 Data for sole participant as of 1/1/2018 Date of birth Date of hire 2017 compensation 2016 compensation 2015 compensation 1/1/1958 1/1/1988 $95,000 92,000 90,000 What is the normal cost for 2018 as of 1/1/2018? Possible Answers A $0 S6,676 c 58,934 D $16,540 E $19,051

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started