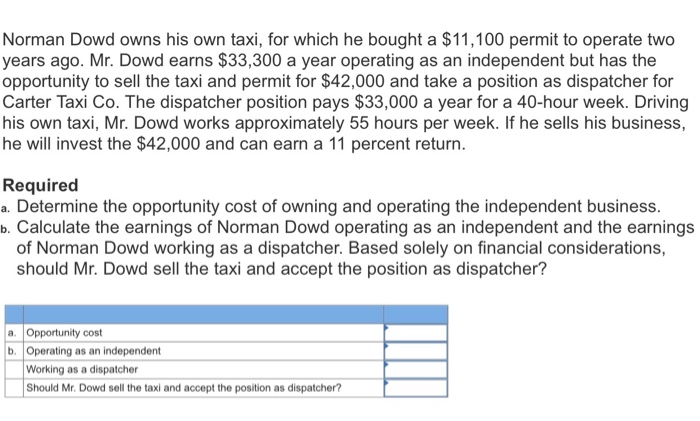

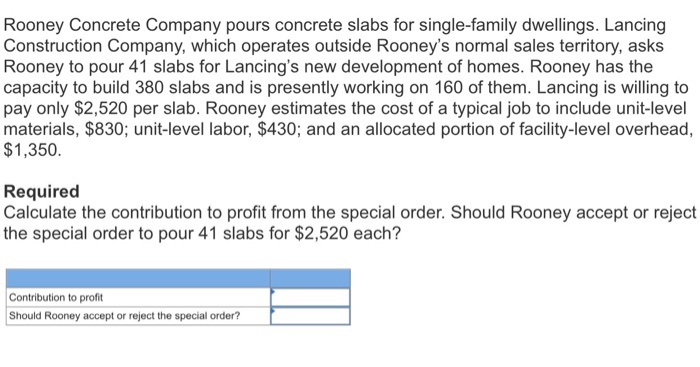

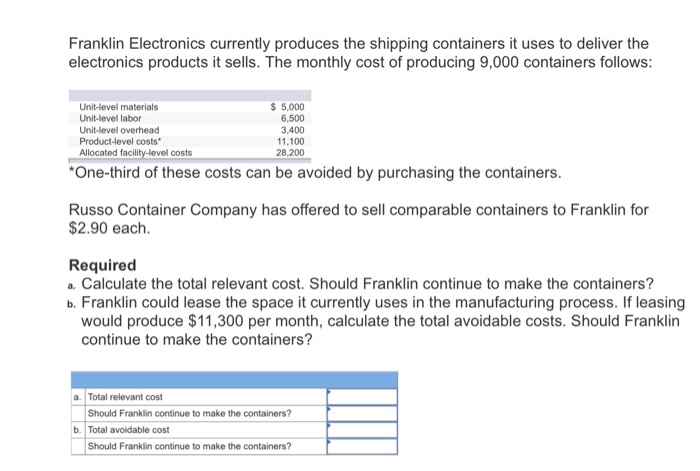

Norman Dowd owns his own taxi, for which he bought a $11,100 permit to operate two years ago. Mr. Dowd earns $33,300 a year operating as an independent but has the opportunity to sell the taxi and permit for $42,000 and take a position as dispatcher for Carter Taxi Co. The dispatcher position pays $33,000 a year for a 40-hour week. Driving his own taxi, Mr. Dowd works approximately 55 hours per week. If he sells his business, he will invest the $42,000 and can earn a 11 percent return. Required a. Determine the opportunity cost of owning and operating the independent business. b. Calculate the earnings of Norman Dowd operating as an independent and the earnings of Norman Dowd working as a dispatcher. Based solely on financial considerations, should Mr. Dowd sell the taxi and accept the position as dispatcher? a. Opportunity cost b. Operating as an independent Working as a dispatcher Should Mr. Dowd sell the taxi and accept the position as dispatcher? Rooney Concrete Company pours concrete slabs for single-family dwellings. Lancing Construction Company, which operates outside Rooney's normal sales territory, asks Rooney to pour 41 slabs for Lancing's new development of homes. Rooney has the capacity to build 380 slabs and is presently working on 160 of them. Lancing is willing to pay only $2,520 per slab. Rooney estimates the cost of a typical job to include unit-level materials, $830; unit-level labor, $430; and an allocated portion of facility-level overhead, $1,350. Required Calculate the contribution to profit from the special order. Should Rooney accept or reject the special order to pour 41 slabs for $2,520 each? Contribution to profit Should Rooney accept or reject the special order? Franklin Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,000 containers follows: Unit-level materials Unit-level labor Unit-level overhead Product-level costs Allocated facility-level costs $ 5.000 6,500 3,400 11,100 28,200 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Franklin for $2.90 each. Required a. Calculate the total relevant cost. Should Franklin continue to make the containers? b. Franklin could lease the space it currently uses in the manufacturing process. If leasing would produce $11,300 per month, calculate the total avoidable costs. Should Franklin continue to make the containers? a Total relevant cost Should Franklin continue to make the containers? Total avoidable cost Should Franklin continue to make the containers