Answered step by step

Verified Expert Solution

Question

1 Approved Answer

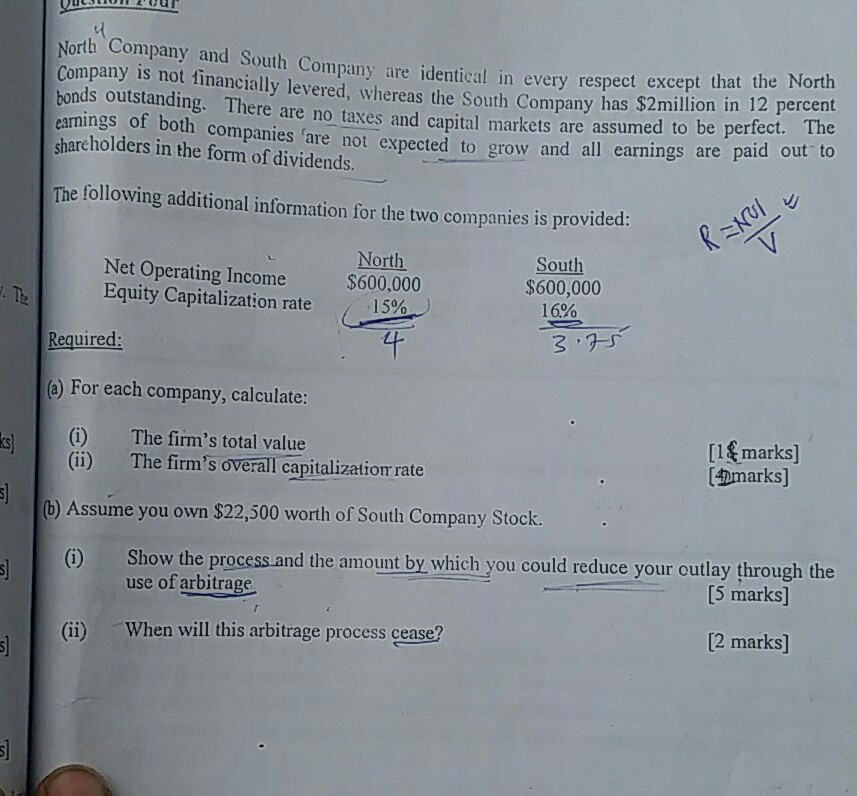

North Company and South Company are identic Company is not tinancially levered, whereas the South Company has $2million in 12 percen every respect except that

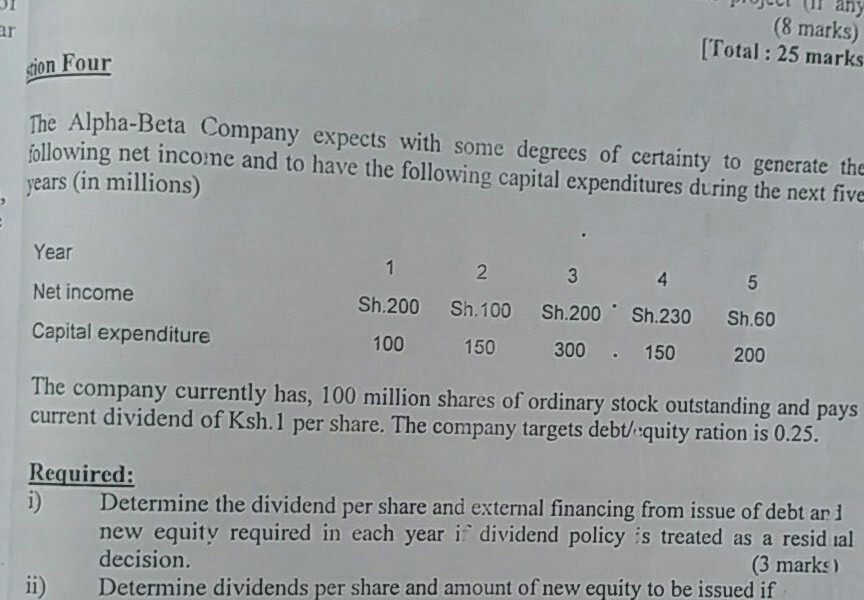

North Company and South Company are identic Company is not tinancially levered, whereas the South Company has $2million in 12 percen every respect except that the North bonds outstanding. There are no ta shareholders in the form of dividends. The following additional information for the two companies is provided xes and capital markets are assumed to be perfect. Ihe oth companies are not expected to grow and all earnings are paid out to Net Operating Income Equity Capitalization rate North $600,000 South $600,000 16% . The (15% 39- Required: (a) For each company, calculate: (i) The firm's total value (i) The firm's overall capitalization rate [l&marks] Mmarks] b) Assume you own $22,500 worth of South Company Stock. nd the amount by which you could reduce your outlay through the 5 marks] use of arbitrage [2 marks] (ii) When will this arbitrage process cease

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started