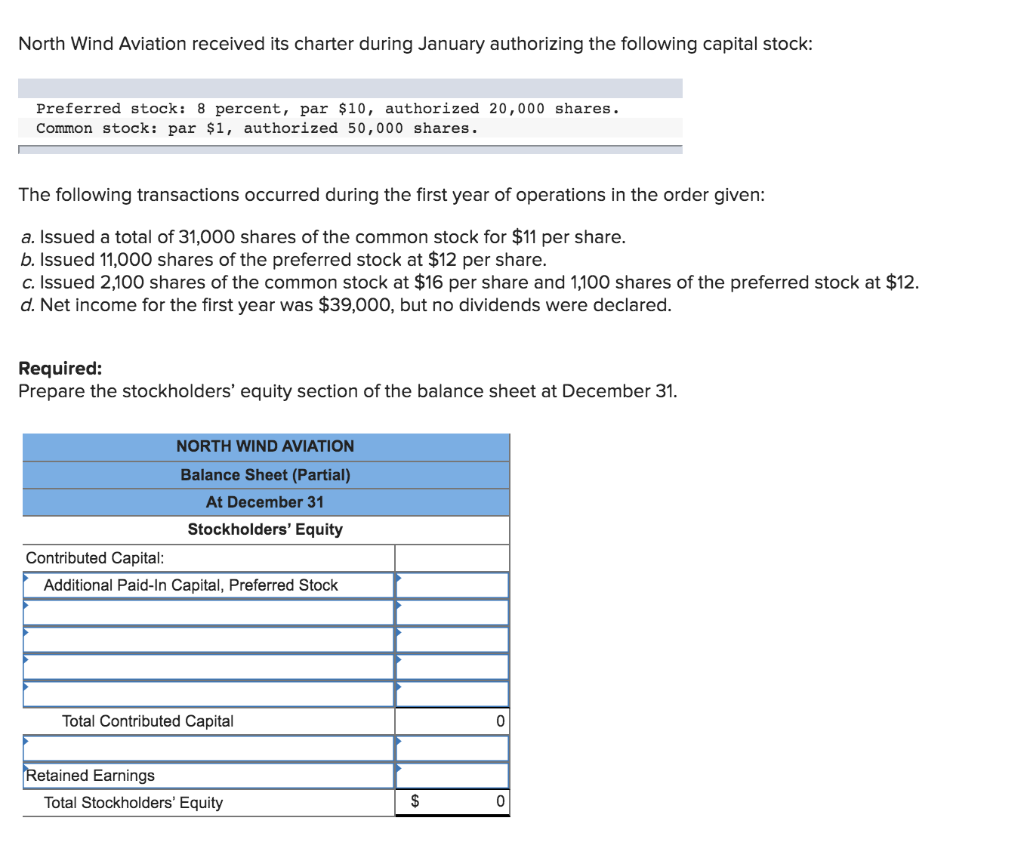

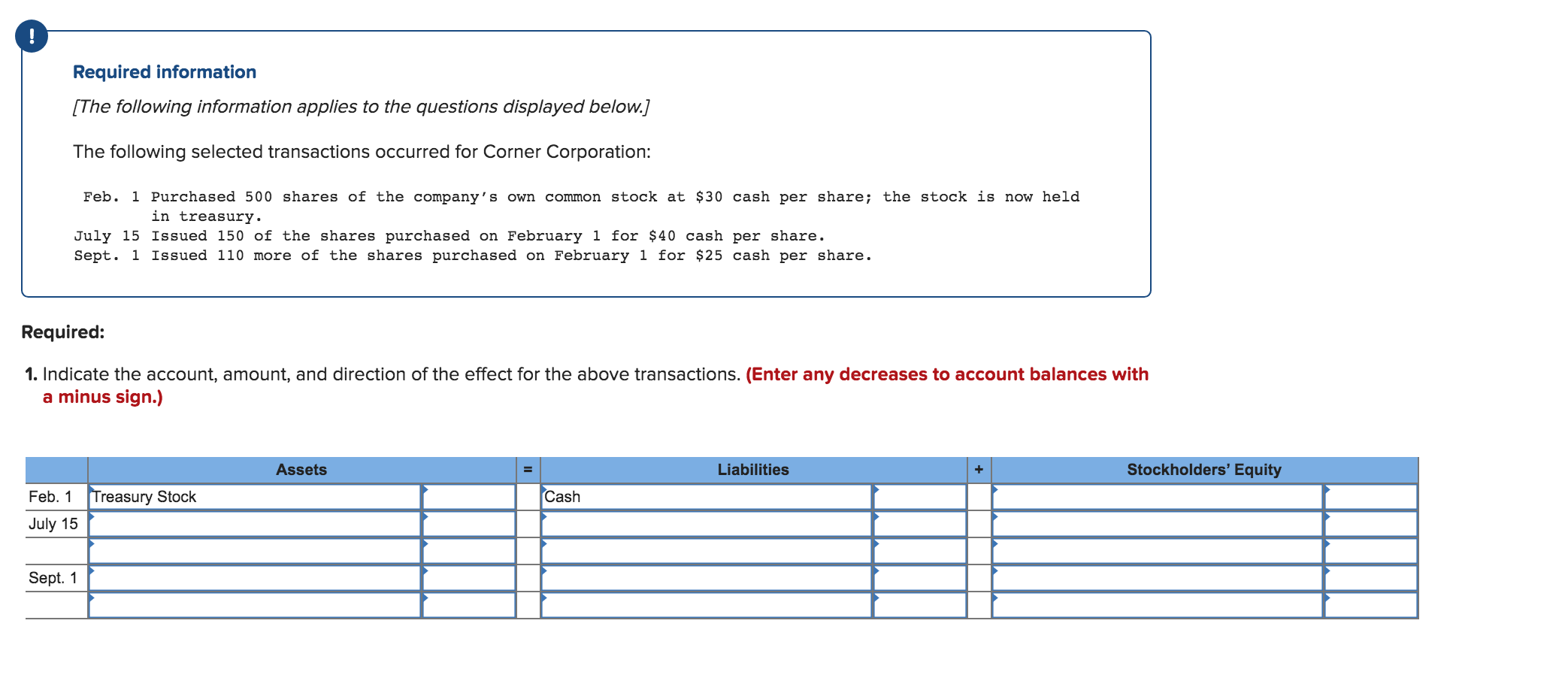

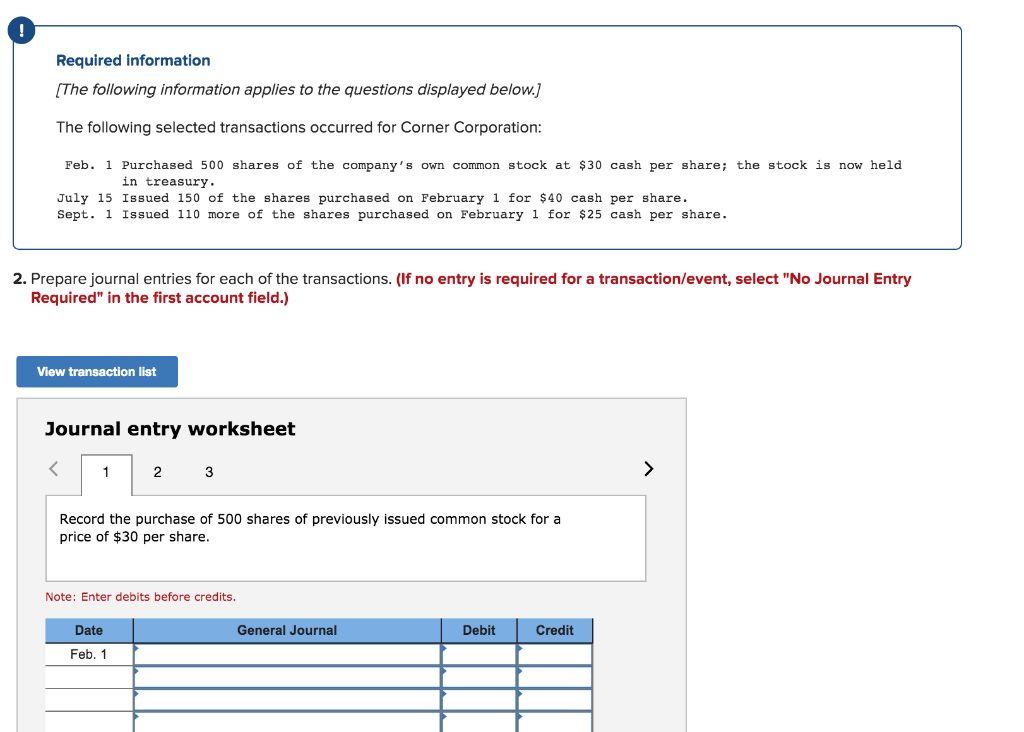

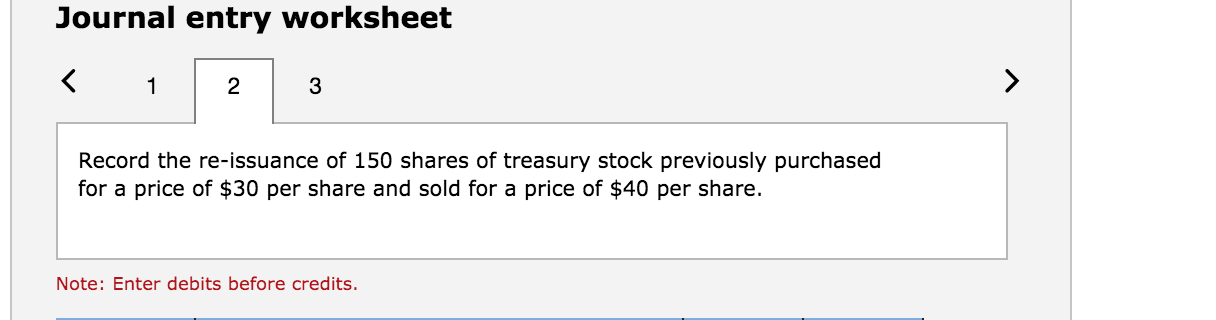

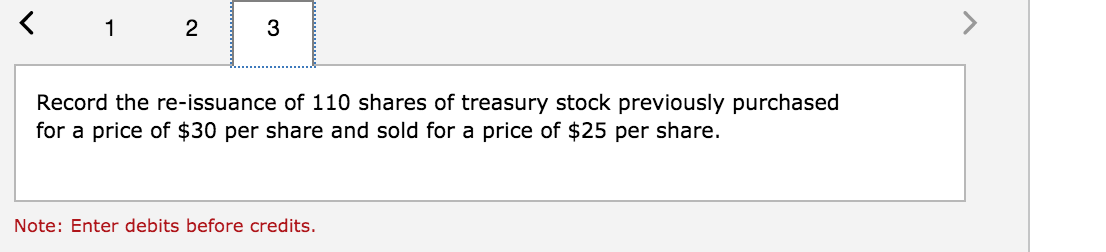

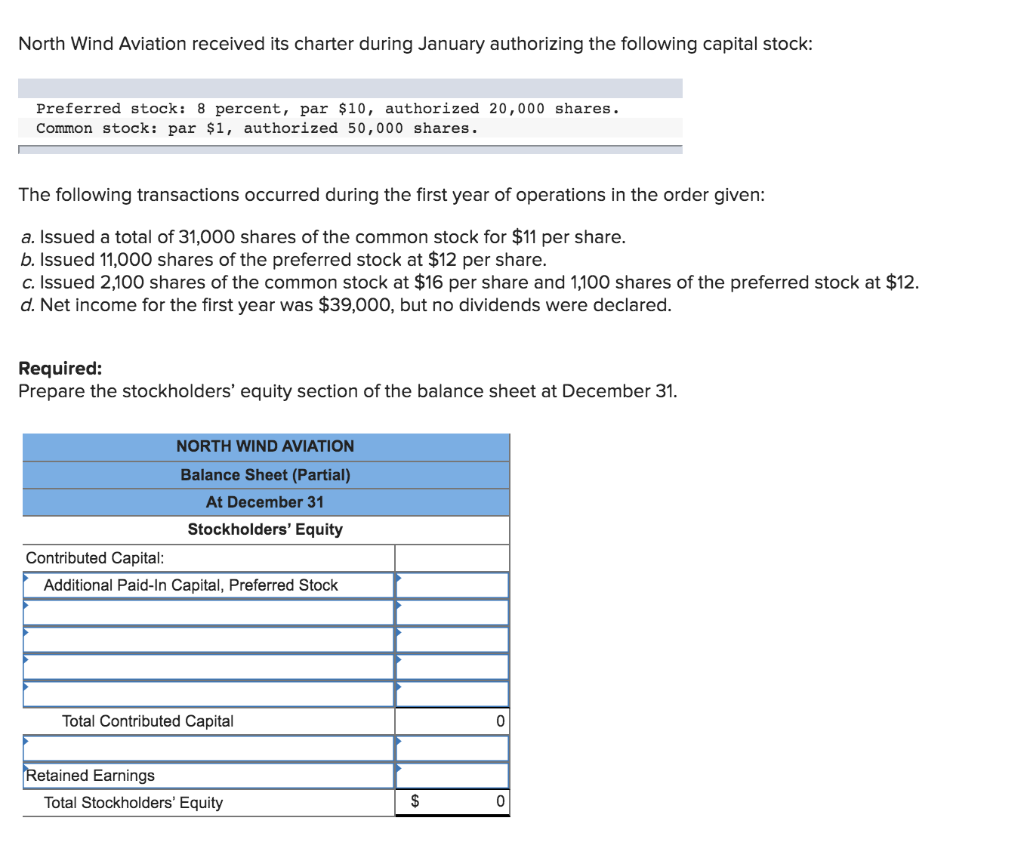

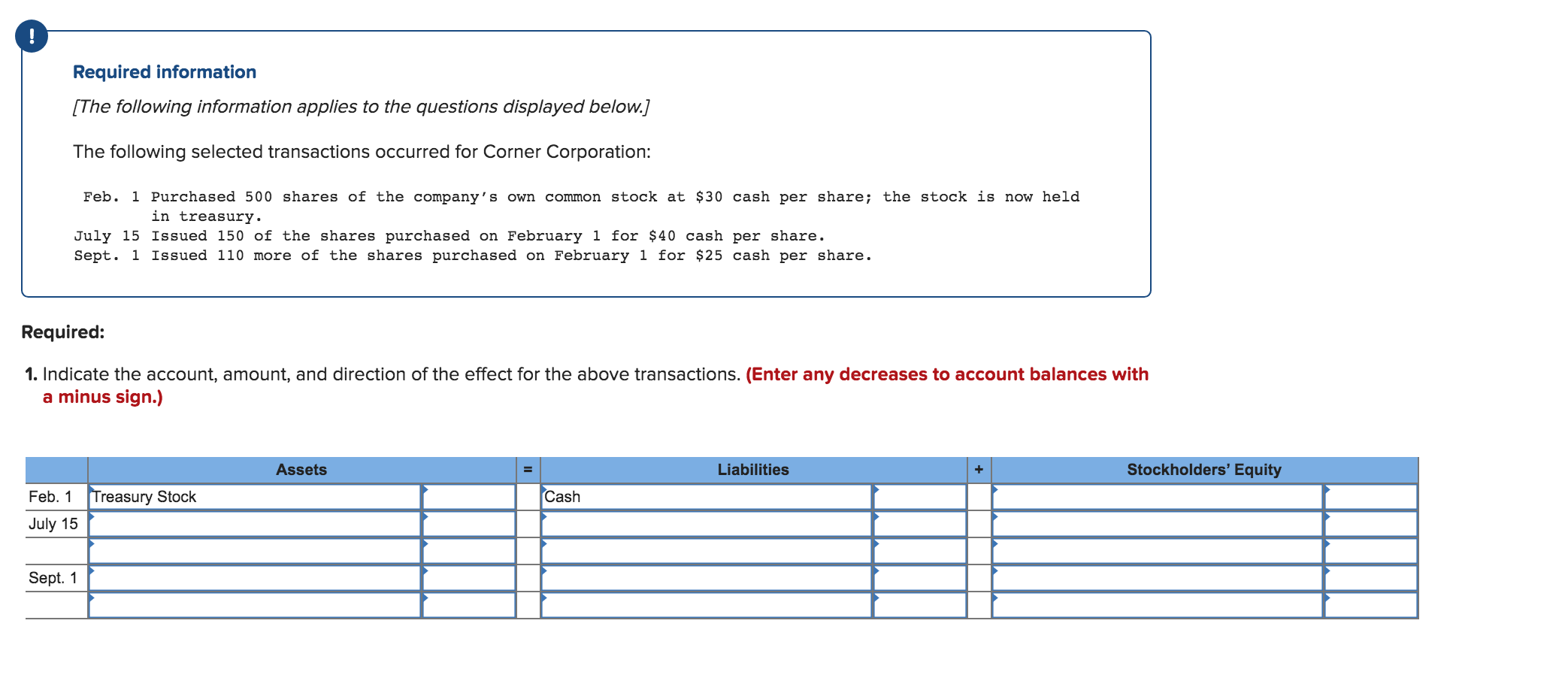

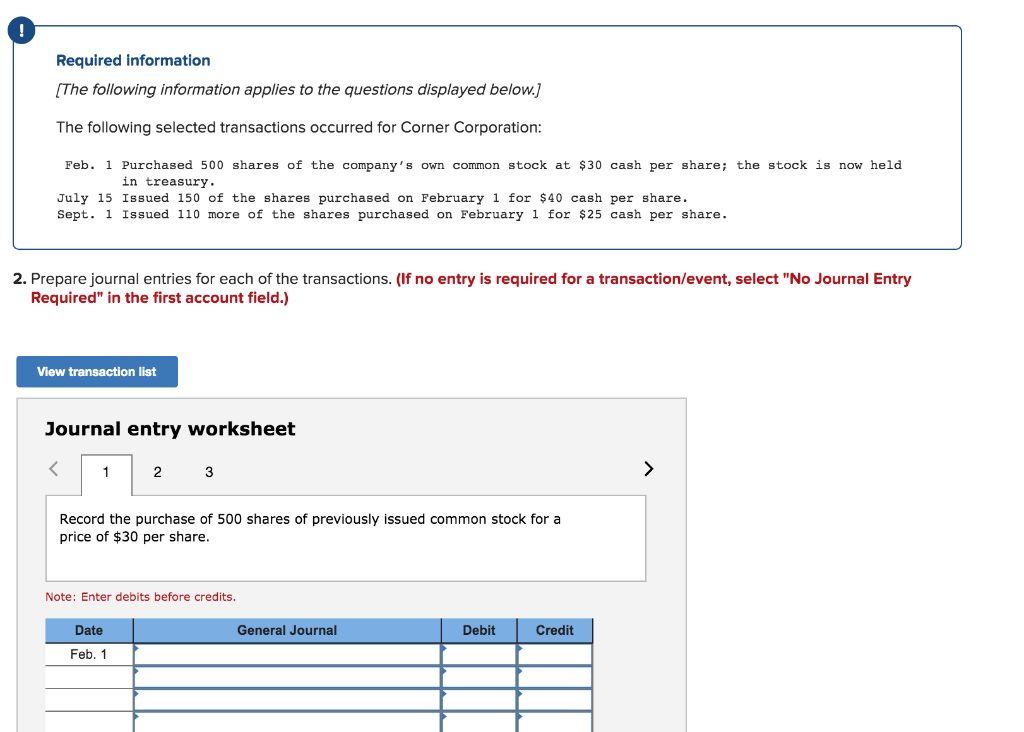

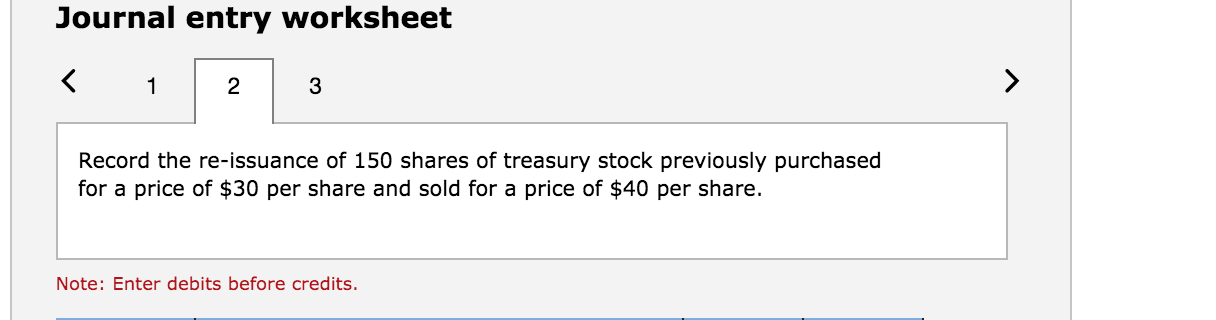

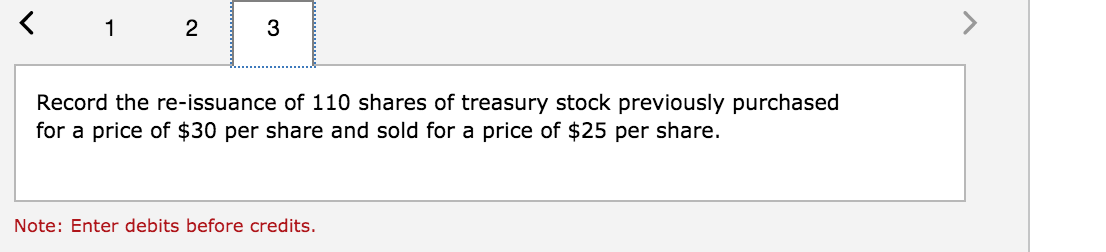

North Wind Aviation received its charter during January authorizing the following capital stock: Preferred stock: 8 percent, par $10, authorized 20,000 shares. Common stock: par $1, authorized 50,000 shares. The following transactions occurred during the first year of operations in the order given: a. Issued a total of 31,000 shares of the common stock for $11 per share. b. Issued 11,000 shares of the preferred stock at $12 per share. c. Issued 2,100 shares of the common stock at $16 per share and 1,100 shares of the preferred stock at $12. d. Net income for the first year was $39,000, but no dividends were declared. Required: Prepare the stockholders' equity section of the balance sheet at December 31. NORTH WIND AVIATION Balance Sheet (Partial) At December 31 Stockholders' Equity Contributed Capital: Additional Paid-In Capital, Preferred Stock Total Contributed Capital Retained Earnings Total Stockholders' Equity Required information [The following information applies to the questions displayed below.) The following selected transactions occurred for Corner Corporation: Feb. 1 Purchased 500 shares of the company's own common stock at $30 cash per share; the stock is now held in treasury. July 15 Issued 150 of the shares purchased on February 1 for $40 cash per share. Sept. 1 Issued 110 more of the shares purchased on February 1 for $25 cash per share. Required: 1. Indicate the account, amount, and direction of the effect for the above transactions. (Enter any decreases to account balances with a minus sign.) Assets Liabilities Stockholders' Equity Treasury Stock Cash Feb. 1 July 15 Sept. 1 Required information (The following information applies to the questions displayed below.) The following selected transactions occurred for Corner Corporation: Feb. 1 Purchased 500 shares of the company's own common stock at $30 cash per share; the stock is now held in treasury. July 15 Issued 150 of the shares purchased on February 1 for $40 cash per share. Sept. 1 Issued 110 more of the shares purchased on February 1 for $25 cash per share. 2. Prepare journal entries for each of the transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 3 Record the purchase of 500 shares of previously issued common stock for a price of $30 per share. Note: Enter debits before credits. Date General Journal Debit Credit Feb. 1 Journal entry worksheet Record the re-issuance of 150 shares of treasury stock previously purchased for a price of $30 per share and sold for a price of $40 per share. Note: Enter debits before credits.