Answered step by step

Verified Expert Solution

Question

1 Approved Answer

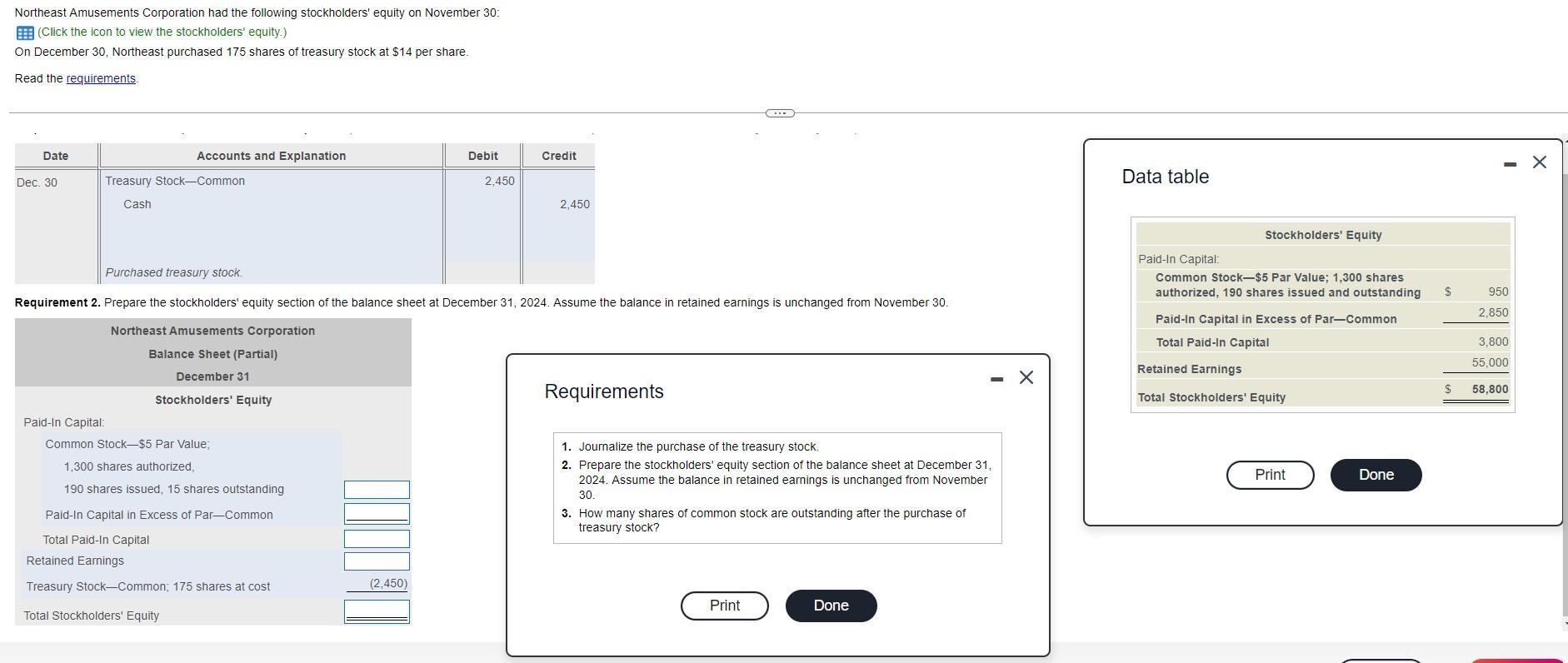

Northeast Amusements Corporation had the following stockholders' equity on November 30: (Click the icon to view the stockholders' equity.) On December 30, Northeast purchased

Northeast Amusements Corporation had the following stockholders' equity on November 30: (Click the icon to view the stockholders' equity.) On December 30, Northeast purchased 175 shares of treasury stock at $14 per share. Read the requirements. Date Dec. 30 Accounts and Explanation Treasury Stock-Common Cash Paid-In Capital: Common Stock-$5 Par Value; 1,300 shares authorized, 190 shares issued, 15 shares outstanding Paid-In Capital in Excess of Par-Common Total Paid-In Capital Retained Earnings Treasury Stock-Common; 175 shares at cost Total Stockholders' Equity Purchased treasury stock. Requirement 2. Prepare the stockholders' equity section of the balance sheet at December 31, 2024. Assume the balance in retained earnings is unchanged from November 30. Northeast Amusements Corporation Balance Sheet (Partial) December 31 Stockholders' Equity 0:00 Debit (2,450) 2,450 Credit 2,450 Requirements 1. Journalize the purchase of the treasury stock. 2. Prepare the stockholders' equity section of the balance sheet at December 31, 2024. Assume the balance in retained earnings is unchanged from November 30. 3. How many shares of common stock are outstanding after the purchase of treasury stock? Print Done X Data table Stockholders' Equity Paid-In Capital: Common Stock-$5 Par Value; 1,300 shares authorized, 190 shares issued and outstanding Paid-In Capital in Excess of Par-Common Total Paid-In Capital Retained Earnings Total Stockholders' Equity Print Done $ $ - X 950 2,850 3,800 55,000 58,800

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Date Account titles and explanation Debit Credit Dec 30 Tre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started