Question

Northern Company processes 100 gallons of raw materials into 75 gallons of product GS-50 and 25 gallons of GS-80. GS-50 is further processed into 50

Northern Company processes 100 gallons of raw materials into 75 gallons of product GS-50 and 25 gallons of GS-80. GS-50 is further processed into 50 gallons of product GS-505 at a cost of $7,250, and GS-80 is processed into 50 gallons of product GS-805 at a cost of $5,750.

The production process starts at point 1. A total of $20,000 in joint manufacturing costs are incurred in reaching point 2. Point 2 is the split-off point of the process that manufactures GS-50 and GS-80. At this point, GS-50 can be sold for $725 a gallon, and GS-80 can be sold for $145 a gallon. The process is completed at point 3products GS-505 and GS-805 have a sales price of $585 a gallon and $225 a gallon, respectively.

Required:

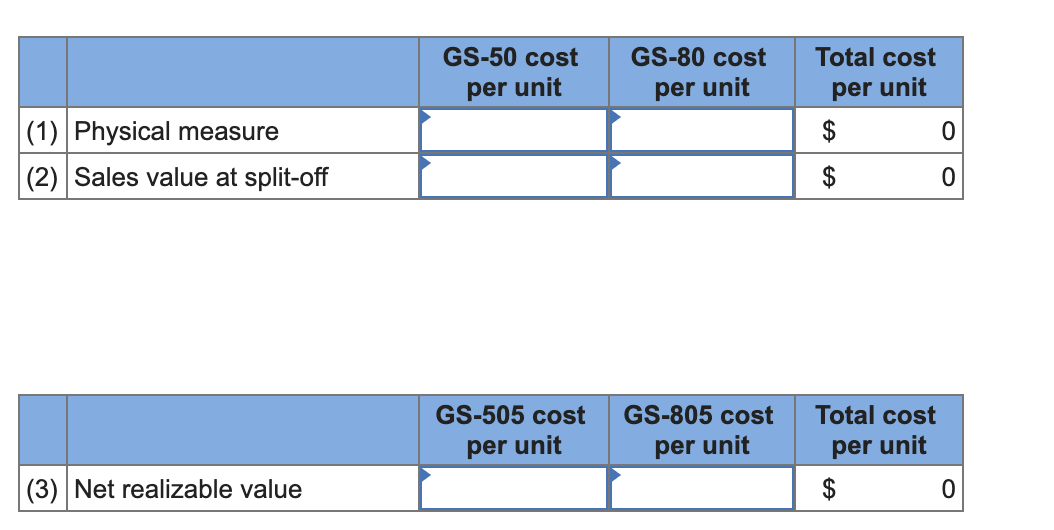

Allocate the joint product costs and then compute the cost per unit using each of the following methods: (1) physical measure, (2) sales value at split-off, and (3) net realizable value. (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.)

2.

HomeLife Life Insurance Company has two service departments (actuarial and premium rating) and two production departments (advertising and sales). The distribution of each service departments efforts (in percentages) to the other departments is shown in the following table:

| To | ||||

|---|---|---|---|---|

| From | Actuarial | Premium Rating | Advertising | Sales |

| Actuarial | 80% | 15% | 5% | |

| Premium | 25% | 15 | 60 | |

The direct operating costs of the departments (including both variable and fixed costs) are:

| Actuarial | $ 84,000 |

|---|---|

| Premium rating | 19,000 |

| Advertising | 64,000 |

| Sales | 44,000 |

Required:

1. Determine the total costs of the advertising and sales departments after using the direct method of allocation.

2. Determine the total costs of the advertising and sales departments after using the step method of allocation.

3. Determine the total costs of the advertising and sales departments after using the reciprocal method of allocation.

Determine the total costs of the advertising and sales departments after using the direct method of allocation.

|

Determine the total costs of the advertising and sales departments after using the step method of allocation.

|

Determine the total costs of the advertising and sales departments after using the reciprocal method of allocation. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.)

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started