Answered step by step

Verified Expert Solution

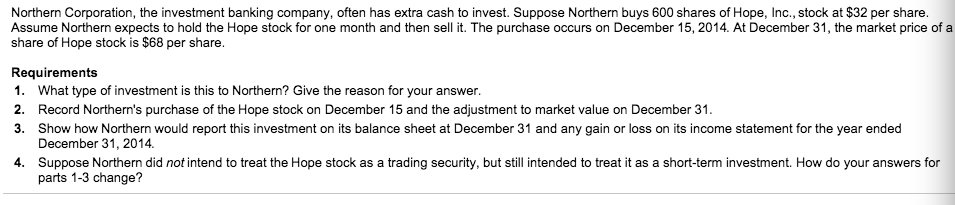

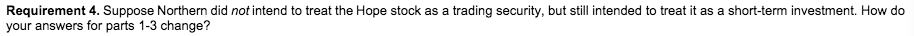

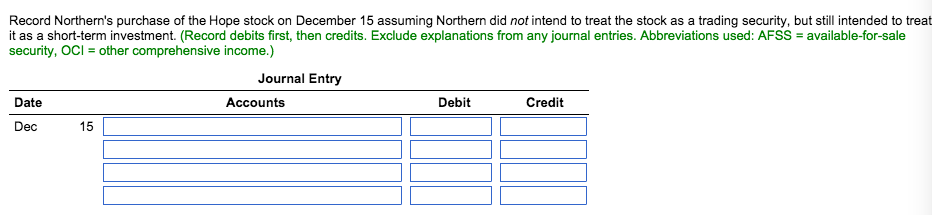

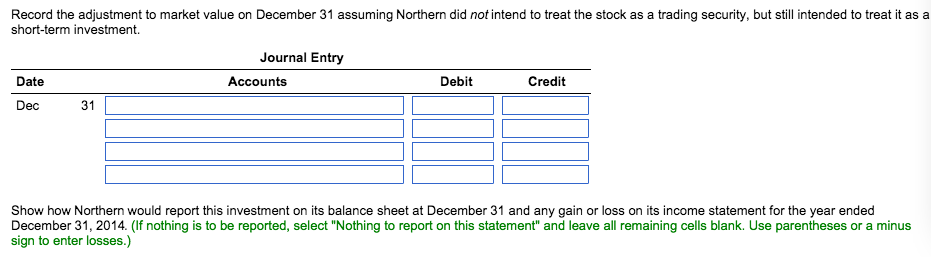

Question

1 Approved Answer

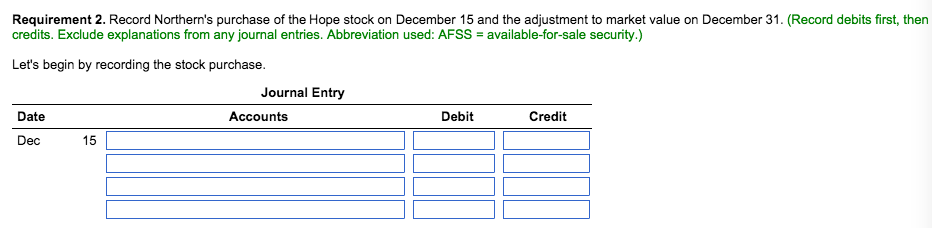

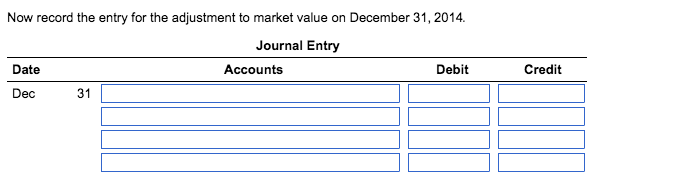

Northern's investment is (an-available-for-sale security/a trading security) because the company intends to sell the stock (after one year/within a short time) This is (an available-for-sale/a

Northern's investment is (an-available-for-sale security/a trading security) because the company intends to sell the stock (after one year/within a short time)

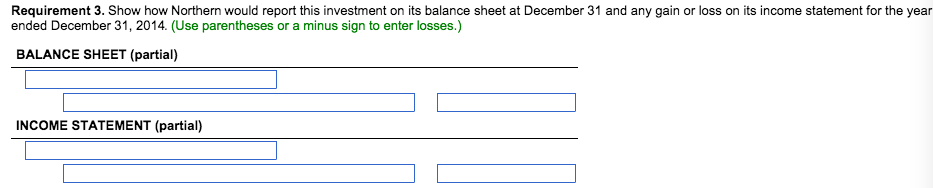

This is (an available-for-sale/a held to maturity) security because it is not a trading security.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started