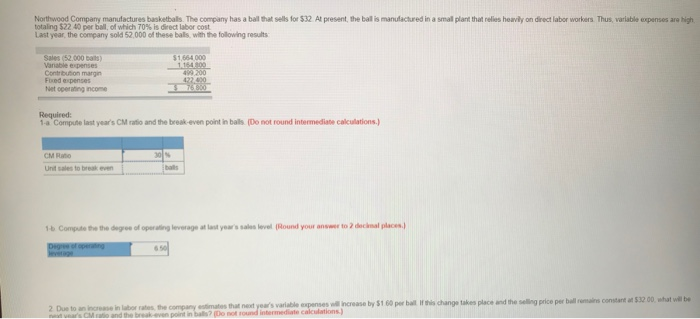

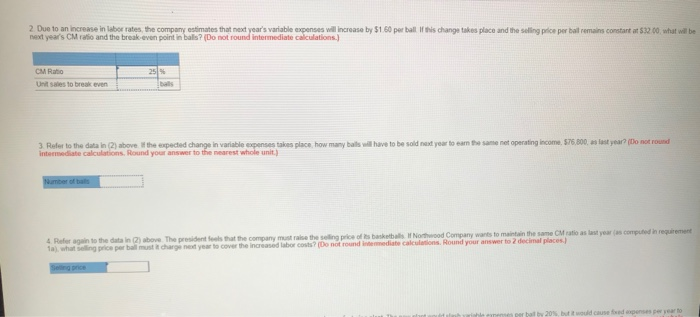

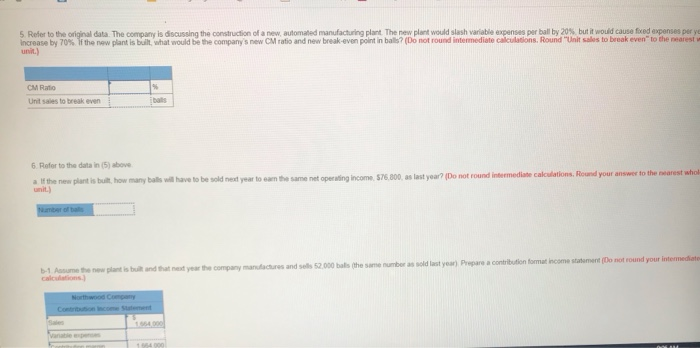

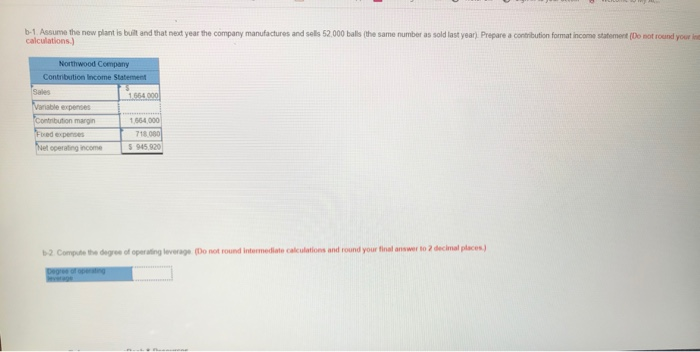

Northwood Company manufactures basketbals The company has a ball that sells for $32 At present the balls manufactured in a small plant that relies heavily on direct labor workers. Thus, variable compenses are high totaling $22 40 per ball of which 70% is direct labor cost Last year, the company sold 52 000 of these balls with the following results 11400 Variable expenses Contribution margin Fored expenses Netocong income Required: 1- Compute last year's CM and the break-even point in balls (Do not found intermediate calculations.) CMR Un sales to break even 1- Complete the degree of operating leverage at last year's sal level Round your an De opening constant 53000. what will be 2 Due to b e in laborates the company states that next year's variable expenses will increase by 51 60 per ball of this change takes place and the sing price perballe and the break even point in bas e not round intermediate calculations) Me 2 Due to an increase in laborates the company estimates that next year's variable expenses will increase by $150 per ball of this change takes place and the selling price per ball remains constant at 53200 what will be next year's CM radio and the break even point in balls? Do not round intermediate calculations.) CM Ratio Units to break even have to be sold next year to earn the same net operating income. 576.800 as fast year? (Do not round 3. Refer to the data in 2) above the expected change in variable expenses takes place how many ball intermediate calculations, Round your answer to the nearest whole unit) Number of bats year computed in requirement 4. Refer to the data in 2) above. The president that the company straise the sing price of tal whatsing price perball must change next year to cover the increased labor cos? (Do not found basketball Northwood Company wants to maintain the same CM atas mediate calculations. Round your answer to 2 decimal places) Lahat 20 de 5. Refer to the original data. The company is discussing the construction of a new, automated manufacturing plant. The new plant would slash variable expenses per ballby 20% but it would cause fixed expenses per ye Increase by 70% the new plant is built what would be the company's new CM ratio and new break-even point in balls? (Do not round intermediate calculations, Round "Unit alles to break even to the nearest unit.) CM Ratio Unit sales to break even 6. Refer to the data in (5) above alf the new plant is built how many balls will have to be sold next year to the same net operating income 576 800. as last year? (Do not found intermediate calculations. Round your answer to the Number of next year the company manufactures and sells 52 000 bols the same number as sold last year) Prepare a contribution format income statement Do not found your inte 1 Asume the new plant is built and calculations.) b-1. Assume the new plant is built and that next year the company manufactures and sells 52,000 balls (the same number as sold last year). Prepare a contribution format income statement (Do not round your in calculations) Northwood Company Contribution Income Statement Sales able expenses Contribution margin 1564,00 Fred expenses 71800 Net operating income 5945.920 2 Compute the degree of operating leverage (Do not round Interm