Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Norwood Corporation is considering changing its method of inventory valuation from absorption costing to direct costing and engaged you to determine the effect of

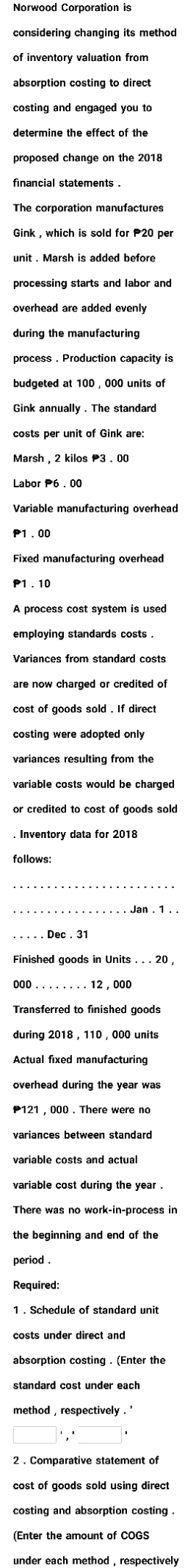

Norwood Corporation is considering changing its method of inventory valuation from absorption costing to direct costing and engaged you to determine the effect of the proposed change on the 2018 financial statements. The corporation manufactures Gink, which is sold for $20 per unit. Marsh is added before processing starts and labor and overhead are added evenly during the manufacturing process. Production capacity is budgeted at 100, 000 units of Gink annually. The standard costs per unit of Gink are: Marsh, 2 kilos P3.00 Labor P6.00 Variable manufacturing overhead P1.00 Fixed manufacturing overhead P1.10 A process cost system is used employing standards costs. Variances from standard costs are now charged or credited of cost of goods sold. If direct costing were adopted only variances resulting from the variable costs would be charged or credited to cost of goods sold . Inventory data for 2018 follows: . . . . . Dec. 31 Jan. 1.. Finished goods in Units... 20, 000 12,000 Transferred to finished goods during 2018, 110, 000 units Actual fixed manufacturing overhead during the year was P121,000. There were no variances between standard variable costs and actual variable cost during the year. There was no work-in-process in the beginning and end of the period. Required: 1. Schedule of standard unit costs under direct and absorption costing. (Enter the standard cost under each method, respectively.' 2. Comparative statement of cost of goods sold using direct costing and absorption costing. (Enter the amount of COGS under each method, respectively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the problem stepbystep to determine the effect of changing the inventory valuation method from absorption costing to direct costing on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started