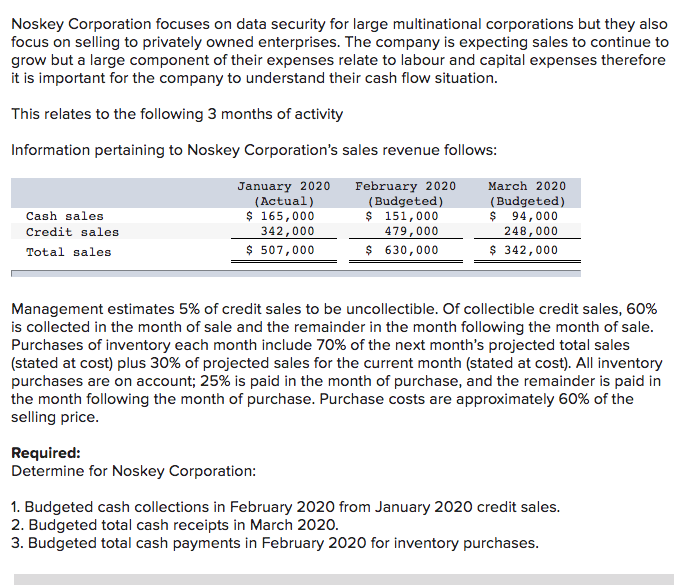

Noskey Corporation focuses on data security for large multinational corporations but they also focus on selling to privately owned enterprises. The company is expecting sales to continue to grow but a large component of their expenses relate to labour and capital expenses therefore it is important for the company to understand their cash flow situation. This relates to the following 3 months of activity Information pertaining to Noskey Corporation's sales revenue follows: Cash sales Credit sales Total sales January 2020 (Actual) $ 165,000 342,000 $ 507,000 February 2020 (Budgeted) $ 151,000 479,000 $ 630,000 March 2020 (Budgeted) $ 94,000 248,000 $ 342,000 Management estimates 5% of credit sales to be uncollectible. Of collectible credit sales, 60% is collected in the month of sale and the remainder in the month following the month of sale. Purchases of inventory each month include 70% of the next month's projected total sales (stated at cost) plus 30% of projected sales for the current month (stated at cost). All inventory purchases are on account; 25% is paid in the month of purchase, and the remainder is paid in the month following the month of purchase. Purchase costs are approximately 60% of the selling price. Required: Determine for Noskey Corporation: 1. Budgeted cash collections in February 2020 from January 2020 credit sales. 2. Budgeted total cash receipts in March 2020. 3. Budgeted total cash payments in February 2020 for inventory purchases. Noskey Corporation focuses on data security for large multinational corporations but they also focus on selling to privately owned enterprises. The company is expecting sales to continue to grow but a large component of their expenses relate to labour and capital expenses therefore it is important for the company to understand their cash flow situation. This relates to the following 3 months of activity Information pertaining to Noskey Corporation's sales revenue follows: Cash sales Credit sales Total sales January 2020 (Actual) $ 165,000 342,000 $ 507,000 February 2020 (Budgeted) $ 151,000 479,000 $ 630,000 March 2020 (Budgeted) $ 94,000 248,000 $ 342,000 Management estimates 5% of credit sales to be uncollectible. Of collectible credit sales, 60% is collected in the month of sale and the remainder in the month following the month of sale. Purchases of inventory each month include 70% of the next month's projected total sales (stated at cost) plus 30% of projected sales for the current month (stated at cost). All inventory purchases are on account; 25% is paid in the month of purchase, and the remainder is paid in the month following the month of purchase. Purchase costs are approximately 60% of the selling price. Required: Determine for Noskey Corporation: 1. Budgeted cash collections in February 2020 from January 2020 credit sales. 2. Budgeted total cash receipts in March 2020. 3. Budgeted total cash payments in February 2020 for inventory purchases