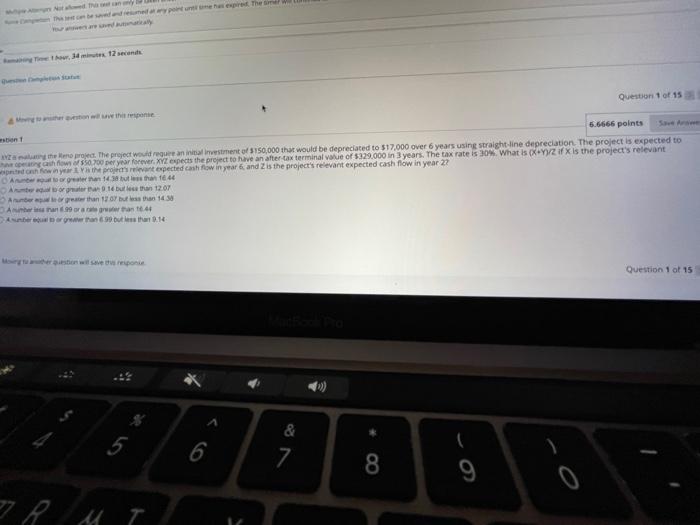

Not allowed. This set can only The sec be saved and resumed at any point untime has expired. The smel Reming Time 1hour, 34 minutes, 12 seconds &M to her question will save this response Question 1 of 15 6.6666 points 22 maluating the Reno project. The project would require an initial investment of $150,000 that would be depreciated to $17,000 over 6 years using straight-line depreciation. The project is expected to have operating cash flowns of $50.700 per year forever. XYZ expects the project to have an after-tax terminal value of $329,000 in 3 years. The tax rate is 30%. What is (X+Y)/2 if X is the project's relevant wpected onth flow in year & Vis the project's relevant expected cash flow in year 6 and 2 is the project's relevant expected cash flow in year 27 Anumber put to or greater than 14.38 but less than 16.44 Anumber al to or greater than 0.14 but less than 12.07 than 707 but less than 14.38 Anumber Anumber is han 6.99 or a rate greater than 16.44 than 699 but less than 0.14 Moing to another question will save this responie Question 1 of 15 & 8 9 RM T 6 7 Not allowed. This set can only The sec be saved and resumed at any point untime has expired. The smel Reming Time 1hour, 34 minutes, 12 seconds &M to her question will save this response Question 1 of 15 6.6666 points 22 maluating the Reno project. The project would require an initial investment of $150,000 that would be depreciated to $17,000 over 6 years using straight-line depreciation. The project is expected to have operating cash flowns of $50.700 per year forever. XYZ expects the project to have an after-tax terminal value of $329,000 in 3 years. The tax rate is 30%. What is (X+Y)/2 if X is the project's relevant wpected onth flow in year & Vis the project's relevant expected cash flow in year 6 and 2 is the project's relevant expected cash flow in year 27 Anumber put to or greater than 14.38 but less than 16.44 Anumber al to or greater than 0.14 but less than 12.07 than 707 but less than 14.38 Anumber Anumber is han 6.99 or a rate greater than 16.44 than 699 but less than 0.14 Moing to another question will save this responie Question 1 of 15 & 8 9 RM T 6 7