Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please answer all of the questions on the page this is the third time I have posted this now 10.) True or False:

can you please answer all of the questions on the page this is the third time I have posted this now

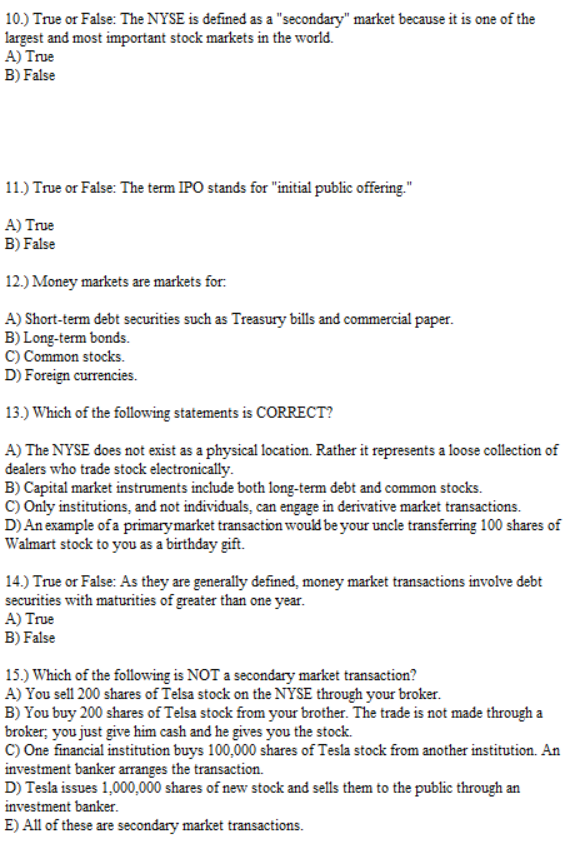

10.) True or False: The NYSE is defined as a "secondary" market because it is one of the largest and most important stock markets in the world. A) True B) False 11.) True or False: The term IPO stands for "initial public offering." A) True B) False 12.) Money markets are markets for: A) Short-term debt securities such as Treasury bills and commercial paper. B) Long-term bonds. C) Common stocks. D) Foreign currencies. 13.) Which of the following statements is CORRECT? A) The NYSE does not exist as a physical location. Rather it represents a loose collection of dealers who trade stock electronically. B) Capital market instruments include both long-term debt and common stocks. C) Only institutions, and not individuals, can engage in derivative market transactions. D) An example of a primarymarket transaction would be your uncle transferring 100 shares of Walmart stock to you as a birthday gift. 14.) True or False: As they are generally defined, money market transactions involve debt securities with maturities of greater than one year. A) True B) False 15.) Which of the following is NOT a secondary market transaction? A) You sell 200 shares of Telsa stock on the NYSE through your broker. B) You buy 200 shares of Telsa stock from your brother. The trade is not made through a broker; you just give him cash and he gives you the stock. C) One financial institution buys 100,000 shares of Tesla stock from another institution. An investment banker arranges the transaction. D) Tesla issues 1,000,000 shares of new stock and sells them to the public through an investment banker. E) All of these are secondary market transactions

10.) True or False: The NYSE is defined as a "secondary" market because it is one of the largest and most important stock markets in the world. A) True B) False 11.) True or False: The term IPO stands for "initial public offering." A) True B) False 12.) Money markets are markets for: A) Short-term debt securities such as Treasury bills and commercial paper. B) Long-term bonds. C) Common stocks. D) Foreign currencies. 13.) Which of the following statements is CORRECT? A) The NYSE does not exist as a physical location. Rather it represents a loose collection of dealers who trade stock electronically. B) Capital market instruments include both long-term debt and common stocks. C) Only institutions, and not individuals, can engage in derivative market transactions. D) An example of a primarymarket transaction would be your uncle transferring 100 shares of Walmart stock to you as a birthday gift. 14.) True or False: As they are generally defined, money market transactions involve debt securities with maturities of greater than one year. A) True B) False 15.) Which of the following is NOT a secondary market transaction? A) You sell 200 shares of Telsa stock on the NYSE through your broker. B) You buy 200 shares of Telsa stock from your brother. The trade is not made through a broker; you just give him cash and he gives you the stock. C) One financial institution buys 100,000 shares of Tesla stock from another institution. An investment banker arranges the transaction. D) Tesla issues 1,000,000 shares of new stock and sells them to the public through an investment banker. E) All of these are secondary market transactions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started