Answered step by step

Verified Expert Solution

Question

1 Approved Answer

not change during the year. What do 5. Prepare the closing entries at December 31, 2017 Recording Adjust rding Adjusting and Closing Entries, Preparing a

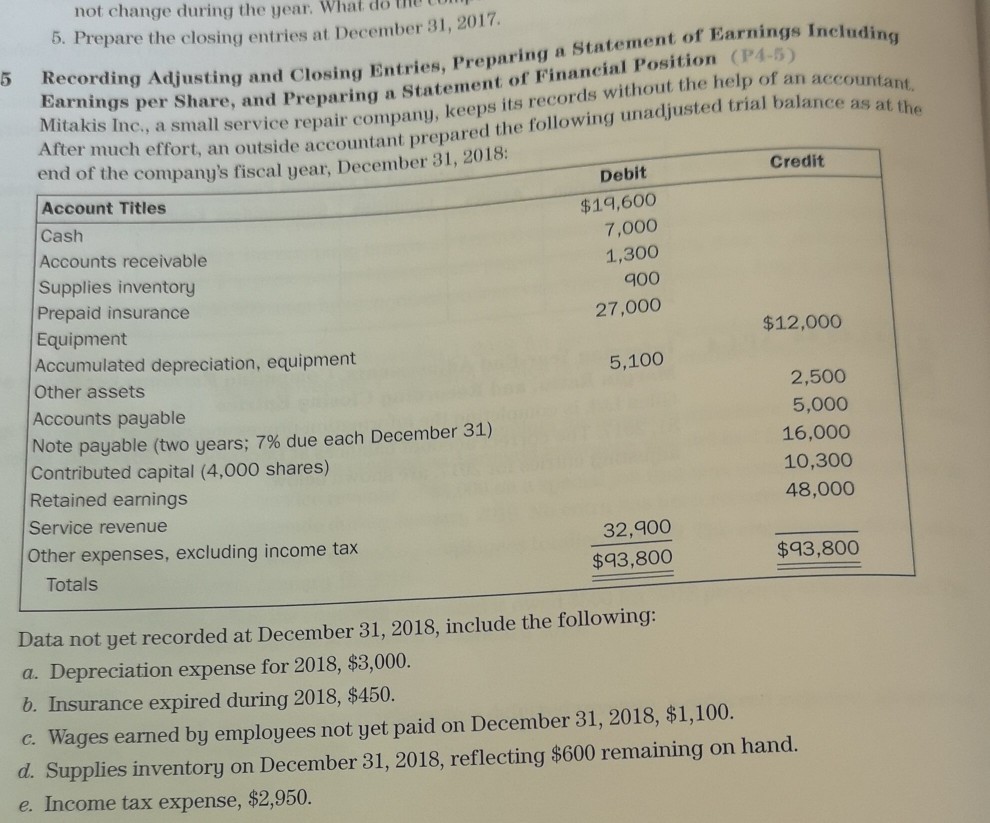

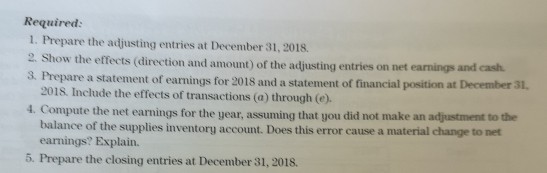

not change during the year. What do 5. Prepare the closing entries at December 31, 2017 Recording Adjust rding Adjusting and Closing Entries, Preparing a Statement of Earnings Inelud r hare, and Preparing a Statement of Financial Position (P4-5) n small service repair company, keeps its records without the help of an acco than outside accountant prepared the following unadjusted trial balance as at n Earnings per itakis Inc., a small service repair company, keeps After much effort, an end of the company's fiscal year, December 31, 2018: Account Titles Cash Accounts receivable Supplies inventory Prepaid insurance Equipment Accumulated depreciation, equipment Credit Debit $19,600 7,000 1,300 goo 27,000 $12,000 5,100 Other assets 2,500 5,000 16,000 10,300 48,000 Accounts payable Note payable (two years; 7% due each December 31) Contributed capital (4,000 shares) Retained earnings Service revenue Other expenses, excluding income tax 32,900 $93,800 $93,800 Totals Data not yet recorded at December 31, 2018, include the following: a. Depreciation expense for 2018, $3,000. b. Insurance expired during 2018, $450. C. Wages earned by employees not yet paid on December 31, 2018, $1,100. d. Supplies inventory on December 31, 2018, reflecting $600 remaining on hand. e. Income tax expense, $2,950

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started