Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Not sure about the question. Can someone help me with the answers to this question, and explain the work please. Thank you. JPM, Inc. a

Not sure about the question. Can someone help me with the answers to this question, and explain the work please. Thank you.

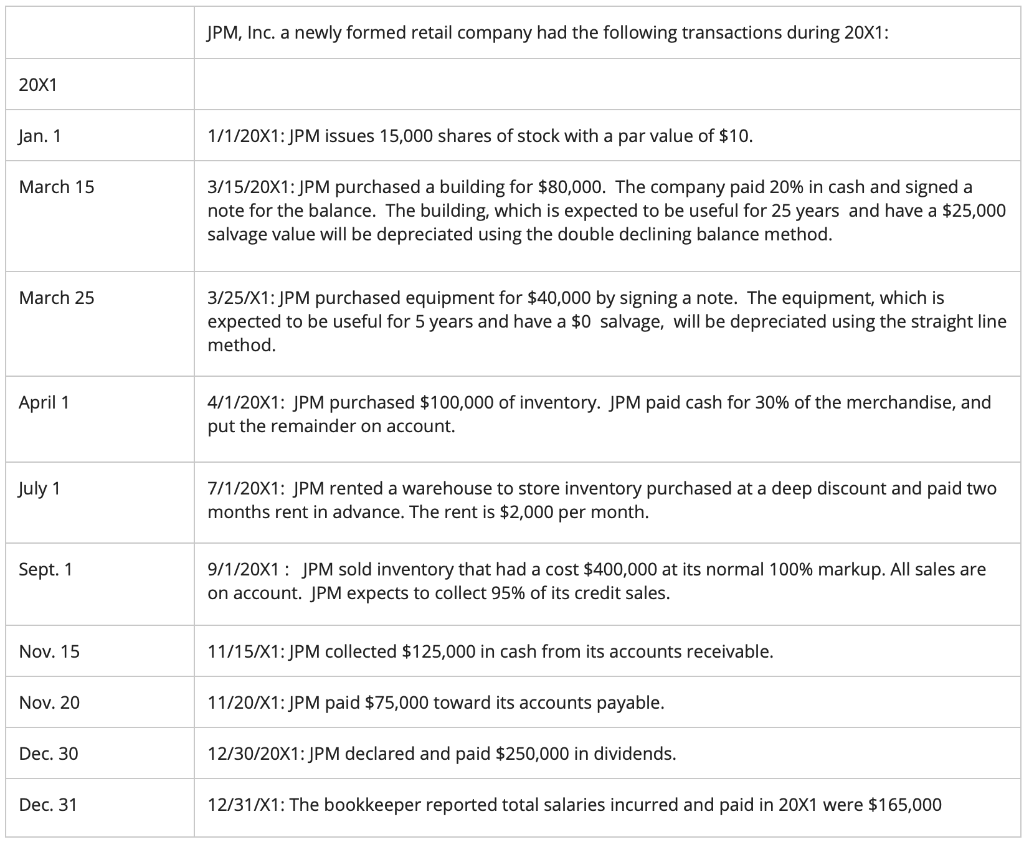

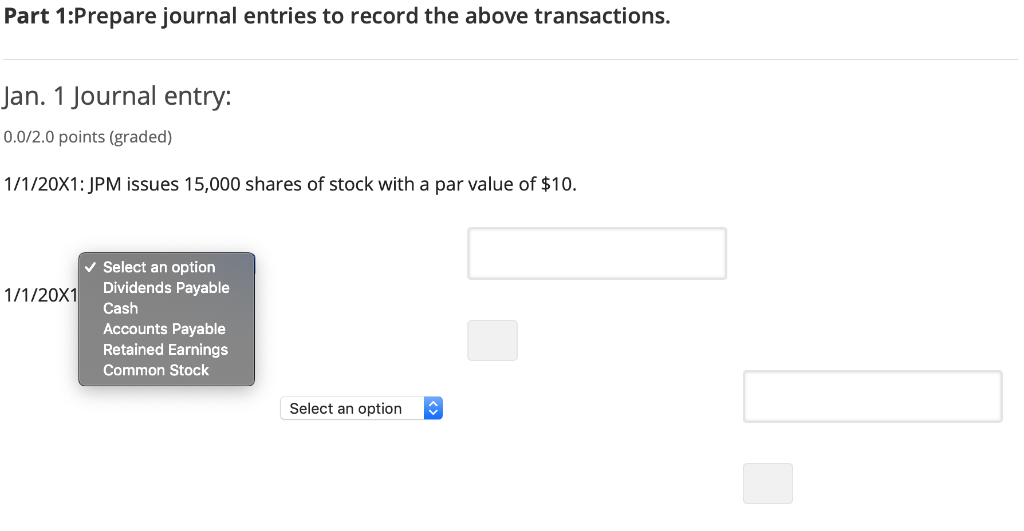

JPM, Inc. a newly formed retail company had the following transactions during 20X1: 20X1 Jan. 1 1/1/20X1: JPM issues 15,000 shares of stock with a par value of $10. March 15 3/15/20X1: JPM purchased a building for $80,000. The company paid 20% in cash and signed a note for the balance. The building, which is expected to be useful for 25 years and have a $25,000 salvage value will be depreciated using the double declining balance method. March 25 3/25/X1: JPM purchased equipment for $40,000 by signing a note. The equipment, which is expected to be useful for 5 years and have a $0 salvage, will be depreciated using the straight line method. April 1 4/1/20X1: JPM purchased $100,000 of inventory. JPM paid cash for 30% of the merchandise, and put the remainder on account. July 1 7/1/20X1: JPM rented a warehouse to store inventory purchased at a deep discount and paid two months rent in advance. The rent is $2,000 per month. Sept. 1 9/1/20X1: JPM sold inventory that had a cost $400,000 at its normal 100% markup. All sales are on account. JPM expects to collect 95% of its credit sales. Nov. 15 11/15/X1: JPM collected $125,000 in cash from its accounts receivable. Nov. 20 11/20/X1: JPM paid $75,000 toward its accounts payable. Dec. 30 12/30/20X1: JPM declared and paid $250,000 in dividends. Dec. 31 12/31/X1: The bookkeeper reported total salaries incurred and paid in 20X1 were $165,000 Part 1:Prepare journal entries to record the above transactions. Jan. 1 Journal entry: 0.0/2.0 points (graded) 1/1/20X1: JPM issues 15,000 shares of stock with a par value of $10. Select an option 1/1/20X1 Dividends Payable Cash Accounts Payable Retained Earnings Common Stock Select an optionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started