Answered step by step

Verified Expert Solution

Question

1 Approved Answer

not sure Any help would be awesome . This is all the information I have I dont know whats not clear about it the problem

not sure

Any help would be awesome .

This is all the information I have I dont know whats not clear about it the problem and questions are written all right there.

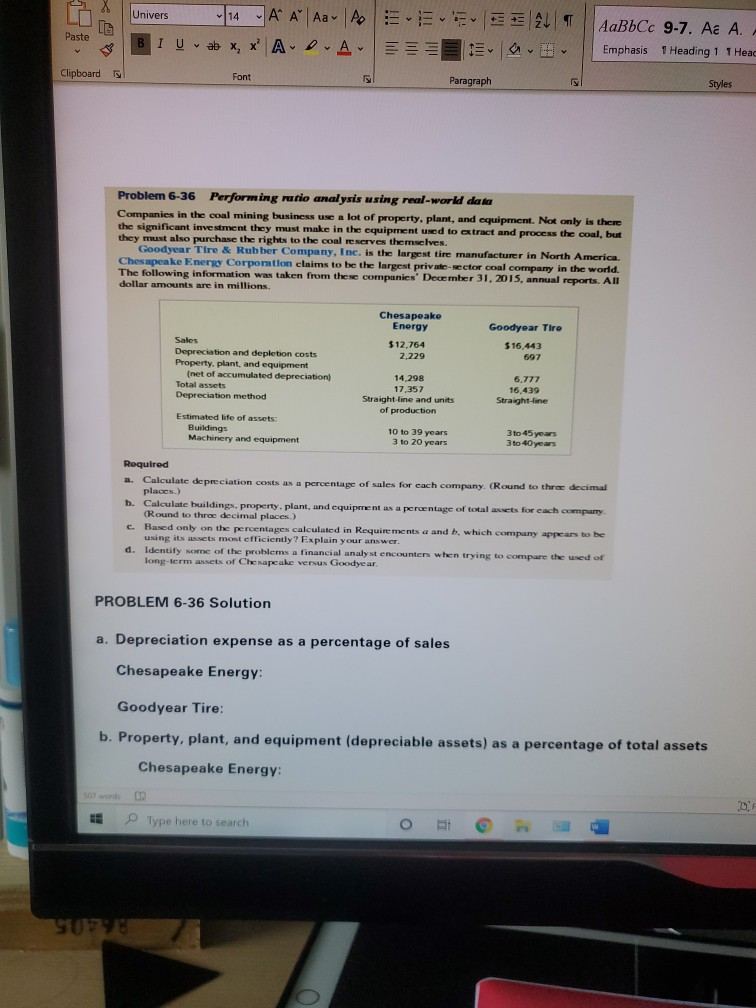

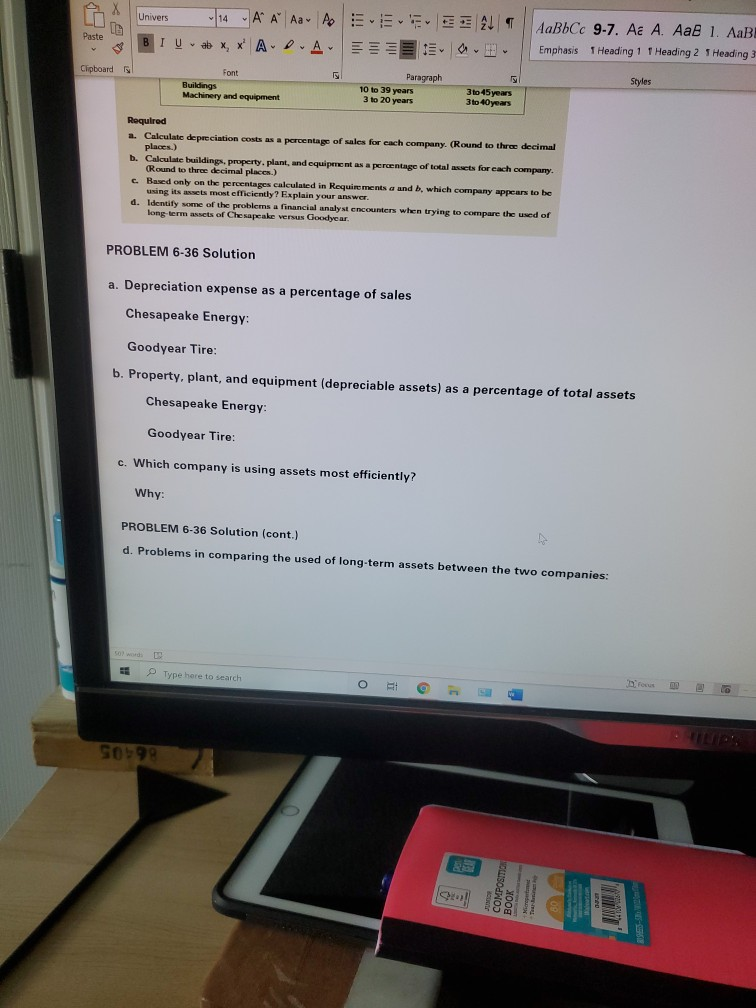

Univers Paste 14 A A Aa A E AL ab X, X A DA- BIU AaBbCc 9-7. Ac A. Emphasis 1 Heading 1 T Head y Clipboard Font Paragraph E Styles Problem 6-36 Performing ratio analysis using real-world data Companies in the coal mining business use a lot of property, plant, and equipment. Not only is there the significant investment they must make in the equipment used to extract and process the coal, but they must also purchase the rights to the coal reserves themselves. Goodyear Tire & Rubber Company, Inc. is the largest tire manufacturer in North America. Chesapeake Energy Corporation claims to be the largest private sector coal company in the world. The following information was taken from these companies' December 31, 2015, annual reports. All dollar amounts are in millions 3 to 45 years Chesapeake Energy Goodyear Tire Sales $12.764 $16.443 Depreciation and depletion costs 2,229 697 Property, plant, and equipment (net of accumulated depreciation 14.298 6.777 Total assets 17,357 16.439 Depreciation method Straight line and units Straight-line of production Estimated life of assets: Buildings 10 to 39 years Machinery and equipment 3 to 20 years 3 to 40 years Required a. Calculate depreciation costs as a percentage of sales for each company. (Round to three decimal places) b. Calculate buildings.property.plant, and equipment as a percentage of total assets for each company (Round to three decimal places.) c. Based only on the percentages calculated in Requirements a and h, which company appears to be using its assets most efficiently? Explain your answer d. Identity some of the problems a financial analyst encounters when trying to compare the used of long-term acts of Chesapeake versus Goodyear PROBLEM 6-36 Solution a. Depreciation expense as a percentage of sales Chesapeake Energy: Goodyear Tire: b. Property, plant, and equipment (depreciable assets) as a percentage of total assets Chesapeake Energy BE Type here to search SUYU X Univers 14 - A A Aa- A EEEEE 24 T BI Ueb X, X ADA Paste AaBbCc 9-7. Ac A. AaB 1. AaB Emphasis T Heading 1 T Heading 2 Heading 3 v Clipboard Paragraph Font Buildings Machinery and equipment Styles 10 to 39 years 3 to 20 years 3 to 45 years 3 to 40 years Required a. Calculate depreciation costs as a percentage of sales for each company. (Round to three decimal places.) b. Calculate buildings, property, plant, and equipment as a percentage of total assets for each company. Round to three decimal places) c. Based only on the percentages calculated in Requirements a and b, which company appears to be using its assets most efficiently? Explain your answer. d. Identify some of the problems a financial analyst encounters when trying to compare the used of long term assets of Chesapeake versus Goodyear PROBLEM 6-36 Solution a. Depreciation expense as a percentage of sales Chesapeake Energy: Goodyear Tire: b. Property, plant, and equipment (depreciable assets) as a percentage of total assets Chesapeake Energy Goodyear Tire: c. Which company is using assets most efficiently? Why PROBLEM 6-36 Solution (cont.) d. Problems in comparing the used of long-term assets between the two companies: Type here to search O S0599Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started