Answered step by step

Verified Expert Solution

Question

1 Approved Answer

not sure if 5 is correct or not please help w all What is Dollar General's debt to total assets ratio? Round your response to

not sure if 5 is correct or not please help w all

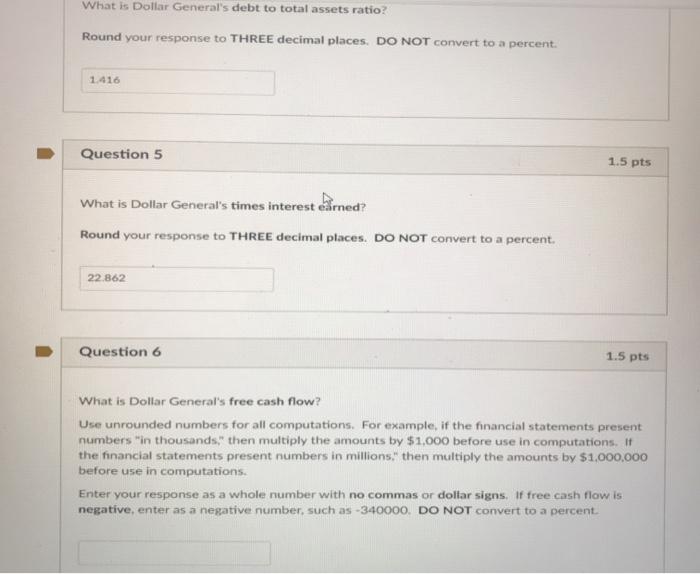

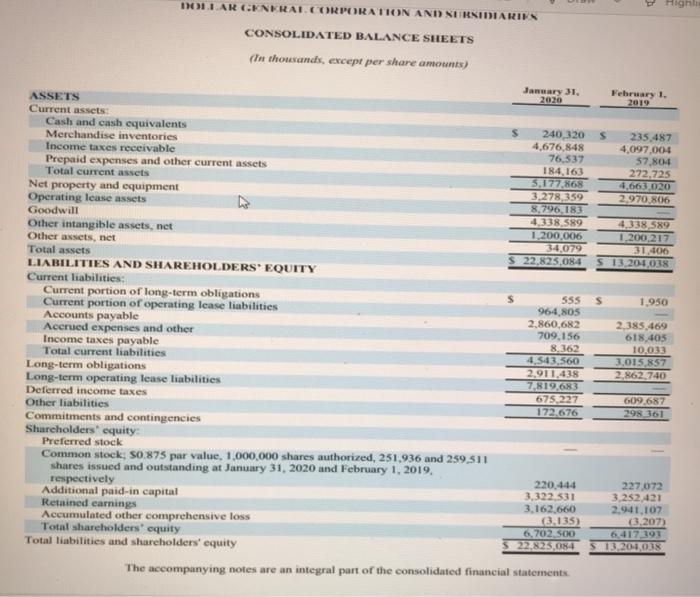

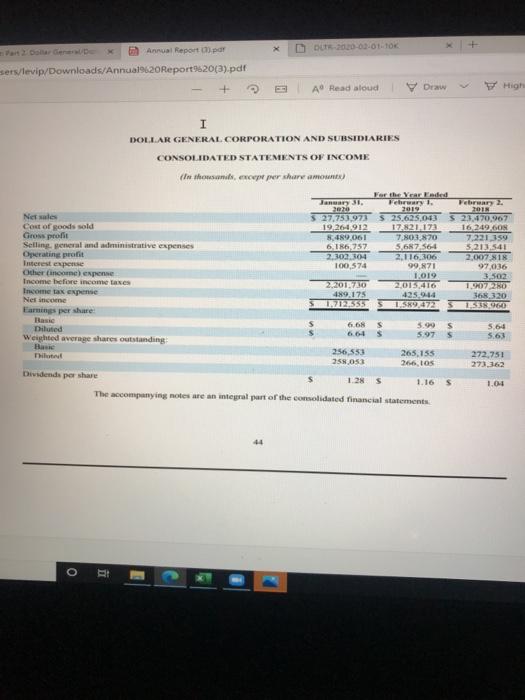

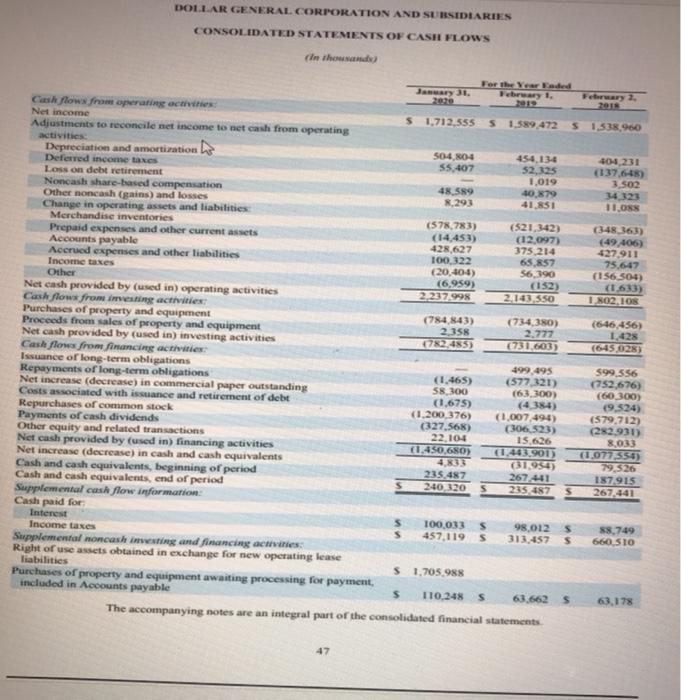

What is Dollar General's debt to total assets ratio? Round your response to THREE decimal places. DO NOT convert to a percent. 1.416 Question 5 1.5 pts What is Dollar General's times interest earned? Round your response to THREE decimal places. DO NOT convert to a percent. 22.862 Question 6 1.5 pts What is Dollar General's free cash flow? Use unrounded numbers for all computations. For example, if the financial statements present numbers in thousands," then multiply the amounts by $1,000 before use in computations. It the financial statements present numbers in millions." then multiply the amounts by $1,000,000 before use in computations. Enter your response as a whole number with no commas or dollar signs of free cash flow is negative, enter as a negative number, such as - 340000. DO NOT convert to a percent. DOLLAR GENERAL CORPORATION AND NURSIDIARIES CONSOLIDATED BALANCE SHEETS (in thousands, except per share amounts) February 1. 2019 S 235.487 4,097.004 57.804 272.725 4.663.020 2.970 806 4.338.589 1.200.217 31,400 13.20-6.038 s 1.950 January 31. ASSETS 2020 Current assets Cash and cash equivalents 240 320 Merchandise inventories 4.676,848 Income taxes receivable 76.537 Prepaid expenses and other current assets 184,163 Total current assets 5,177,868 Net property and equipment 3,278,359 Operating lease assets 8.796,183 Goodwill 4,338,589 Other intangible assets, net 1.200.006 Other assets, net 34,079 Total assets 22,825.084 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long-term obligations 555 Current portion of operating lease liabilities 96-4,805 Accounts payable 2.860.682 Accrued expenses and other 709,156 Income taxes payable 8.362 Total current liabilities 4,543,560 Long-term obligations 2,911.438 Long-term operating lease liabilities 7,819,683 Deferred income taxes 675,227 Other liabilities 172.676 Commitments and contingencies Shareholders' equity Preferred stock Common stock; 30.875 par value, 1,000,000 shares authorized, 251,936 and 259,511 shares issued and outstanding at January 31, 2020 and February 1, 2019, respectively 220,444 Additional paid-in capital 3,322,331 Retained earnings 3,162,660 Accumulated other comprehensive loss 3.135) Total shareholders' equity 6,702 500 Total liabilities and shareholders' equity 22,825.084 The accompanying notes are an integral part of the consolidated financial statements 2.385,469 618,405 10,033 3,015,857 2.862,740 609.687 298 361 227,072 3.252,421 2.941,107 (3.207) 13.20-101 2000-01.10 Annual Report por sers/levip/Downloads/Annua19620Report9620(3).pdf + A Read aloud De High I DOLLAR GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (int honum, encarpe per share amount) Janary I. Ferry.. 20 2013 Netales 27.753.973 S 25.625,043 $ 23,470.907 Cost of goods sold 1926-1912 17.821.173 16.249.60 Gross profit 8.489,061 7,803,870 7.221.359 Selling general and administrative expenses 6,186,757 5.687,566 5.213.541 Operating probit 2.302104 2.116.06 2.007 818 Interest expense 100,574 99,871 97,036 Other Come expense 1.019 3 502 Income before income taxes 2120137 27015 416 1.50720 Income tax expense 489,175 425 44 368 320 Nesince 17125555 1.589.472 13.960 Earnings per share 6.6 $ 5.00 5 5.64 Diluted 60 $ 5.97 5 5.63 Weighted average shares outstanding 256,553 265.155 272,751 25.053 266,10 273_162 Dividende per share s 18 8 1.16 5 1.044 The accompanying notes are an integral part of the consolidated financial statements 44 O i DOLLAR GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS cinho January 31, February 1 February 2 Cash flows from operating active Net income 1.712.555 51.589,472 5 1,538,960 Adjustments to reconcile net income to net cash from operating Depreciation and amortization ho 504,804 454.134 4044 231 Deferred income taxes 55.407 52,325 (137,645) Loss on debt retirement 1,019 3.502 Noncash share-based compensation 48.589 40.879 34 323 Other noncash (gains) and losses 8.293 41.81 11.08 Change in operating assets and liabilities Merchandise inventories (578,783) (521,342) Prepaid expenses and other current assets (14.453) (12.097) (49.406) Accounts payable 428,627 375 214 427,911 Accrued expenses and other liabilities 100,322 65.857 75.647 Income taxes (20.40-4) 56,390 (156_504) Other (6,959) (152) Net cash provided by (used in) operating activities 2.237.99% 2.143.550 1 02.10 Cash flows from investing activities Purchases of property and equipment (784 843) (734,380) (646,456) Proceeds from sales of property and equipment 2.358 2.777 1,428 Net cash provided by (used in) investing activities 782,485) (731.603) (6435028) Cash flow from financing activities: Issuance of long-term obligations 499,495 599,556 Repayments of long-term obligations (1.465) Net increase (decrease) in commercial paper outstanding (577 321) 752.676) 58,300 (63.300) (60.300) Costs associated with issuance and retirement of debt (1.675) (9.524) Repurchases of common stock (1.200,376) (1.007 494) (579,712) Payments of cash dividends (327,568) (306, 523) (282.931) Other equity and related transactions 22,104 15.626 8.033 Net cash provided by (used in) financing activities (1.450,680) 61.443 901) (1.077 354) Net increase (decrease) in cash and cash equivalents (1954) 79,326 Cash and cash equivalents, beginning of period 235.487 267.441 187915 Cash and cash equivalents, end of period 5 240 320 235.487 267.441 Supplemental cash flow information Cash paid for Interest 100,033 s 98.012 5 58,749 Income taxes $ 457,119 S 313.457 $ 660. SIO Supplemental noncash investing and financing activities Right of use assets obtained in exchange for new operating lease liabilities $ 1.705.988 Purchases of property and equipment awaiting processing for payment, included in Accounts payable s 110.248 S 63.662 s 63.178 The accompanying notes are an integral part of the consolidated financial statements 47 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started