Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Not sure if I am on the right track with solving this or not... A piece of new equipment has been proposed by engineers to

Not sure if I am on the right track with solving this or not...

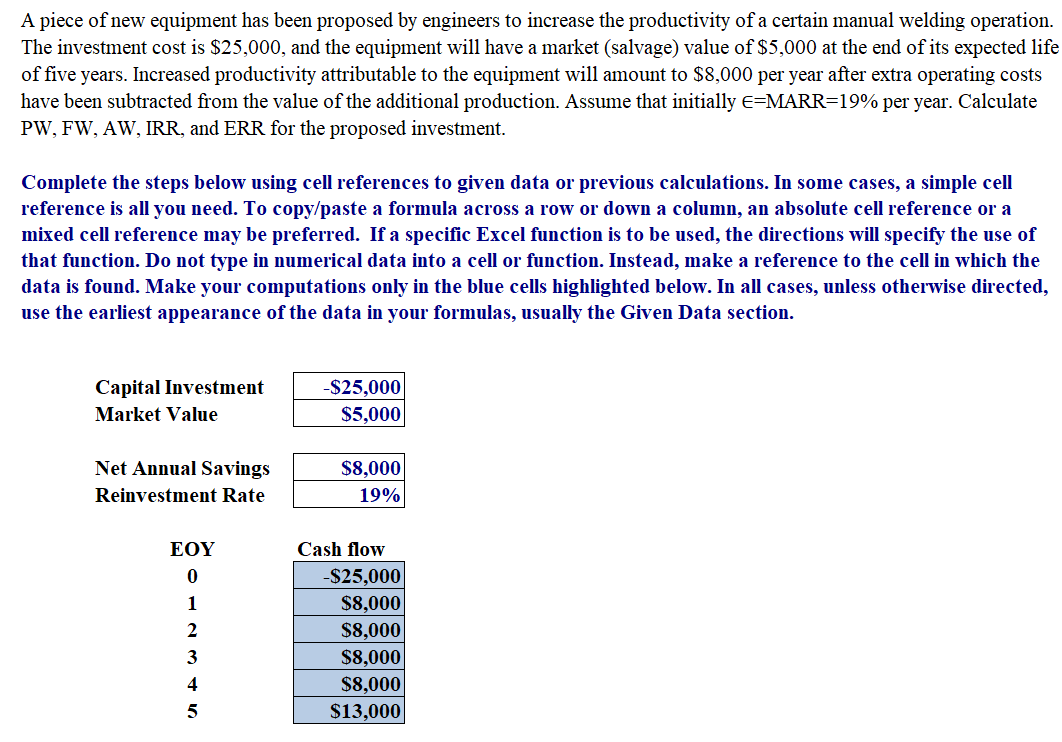

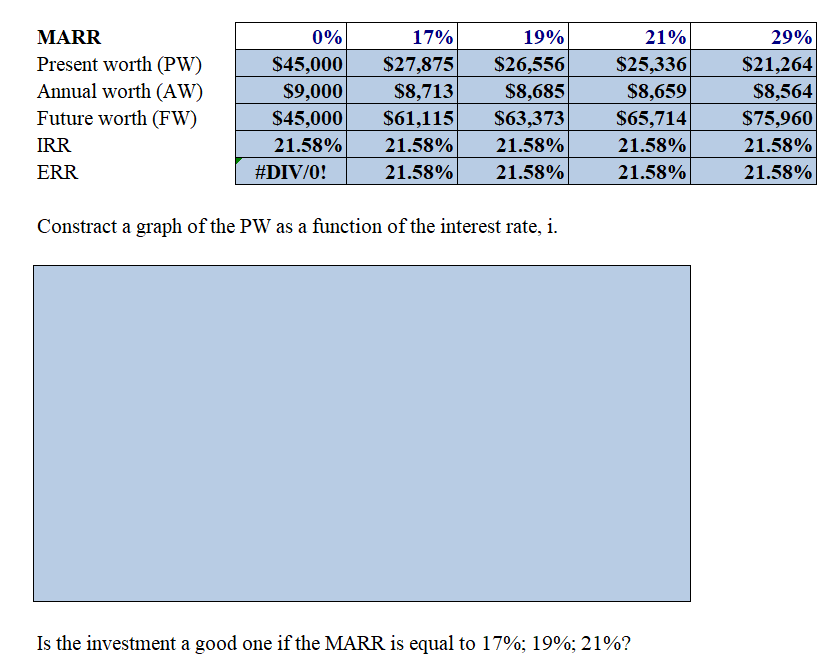

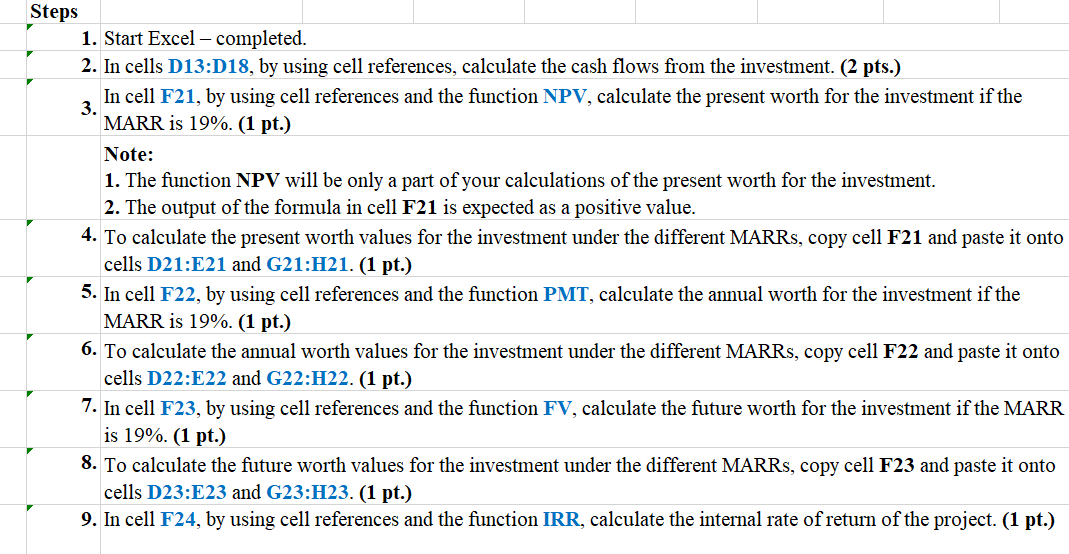

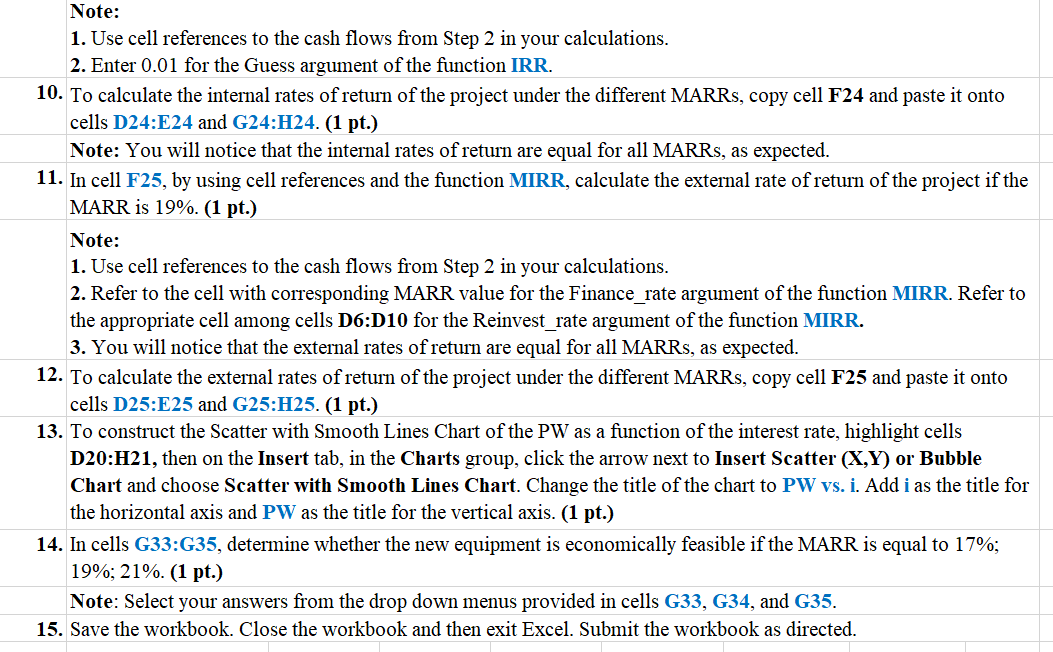

A piece of new equipment has been proposed by engineers to increase the productivity of a certain manual welding operation. The investment cost is $25,000, and the equipment will have a market (salvage) value of $5,000 at the end of its expected life of five years. Increased productivity attributable to the equipment will amount to $8,000 per year after extra operating costs have been subtracted from the value of the additional production. Assume that initially E=MARR=19% per year. Calculate PW, FW, AW, IRR, and ERR for the proposed investment. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. Capital Investment Market Value -$25,000 $5,000 Net Annual Savings Reinvestment Rate $8,000 19% EOY 0 1 2 3 4 5 Cash flow -$25,000 $8,000 $8,000 $8,000 $8,000 $13,000 MARR Present worth (PW) Annual worth (AW) Future worth (FW) IRR ERR 0% $45,000 $9,000 $45,000 21.58% #DIV/0! 17% $27,875 $8,713 $61,115 21.58% 21.58% 19% $26,556 $8,685 $63,373 21.58% 21.58% 21% $25,336 $8,659 $65,714 21.58% 21.58% 29% $21,264 $8,564 $75,960 21.58% 21.58% Constract a graph of the PW as a function of the interest rate, i. Is the investment a good one if the MARR is equal to 17%; 19%; 21%? Steps 1. Start Excel - completed. 2. In cells D13:D18, by using cell references, calculate the cash flows from the investment. (2 pts.) In cell F21, by using cell references and the function NPV, calculate the present worth for the investment if the 3. MARR is 19%. (1 pt.) Note: 1. The function NPV will be only a part of your calculations of the present worth for the investment. 2. The output of the formula in cell F21 is expected as a positive value. 4. To calculate the present worth values for the investment under the different MARRs, copy cell F21 and paste it onto cells D21:E21 and G21:H21. (1 pt.) 5. In cell F22, by using cell references and the function PMT, calculate the annual worth for the investment if the MARR is 19%. (1 pt.) 6. To calculate the annual worth values for the investment under the different MARRs, copy cell F22 and paste it onto cells D22:E22 and G22:H22. (1 pt.) 7. In cell F23, by using cell references and the function FV, calculate the future worth for the investment if the MARR is 19%. (1 pt.) 8. To calculate the future worth values for the investment under the different MARRs, copy cell F23 and paste it onto cells D23:E23 and G23:H23. (1 pt.) 9. In cell F24, by using cell references and the function IRR, calculate the internal rate of return of the project. (1 pt.) Note: 1. Use cell references to the cash flows from Step 2 in your calculations. 2. Enter 0.01 for the Guess argument of the function IRR. 10. To calculate the internal rates of return of the project under the different MARRs, copy cell F24 and paste it onto cells D24:E24 and G24:H24. (1 pt.) Note: You will notice that the internal rates of return are equal for all MARRs, as expected. 11. In cell F25, by using cell references and the function MIRR, calculate the external rate of return of the project if the MARR is 19%. (1 pt.) Note: 1. Use cell references to the cash flows from Step 2 in your calculations. 2. Refer to the cell with corresponding MARR value for the Finance_rate argument of the function MIRR. Refer to the appropriate cell among cells D:D10 for the Reinvest_rate argument of the function MIRR. 3. You will notice that the external rates of return are equal for all MARRs, as expected. 12. To calculate the external rates of return of the project under the different MARRs, copy cell F25 and paste it onto cells D25:E25 and G25:H25. (1 pt.) 13. To construct the Scatter with Smooth Lines Chart of the PW as a function of the interest rate, highlight cells D20:H21, then on the Insert tab, in the Charts group, click the arrow next to Insert Scatter (X,Y) or Bubble Chart and choose Scatter with Smooth Lines Chart. Change the title of the chart to PW vs. I. Add i as the title for the horizontal axis and PW as the title for the vertical axis. (1 pt.) 14. In cells G33:G35, determine whether the new equipment is economically feasible if the MARR is equal to 17%; 19%; 21%. (1 pt.) Note: Select your answers from the drop down menus provided in cells G33, G34, and G35. 15. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed. A piece of new equipment has been proposed by engineers to increase the productivity of a certain manual welding operation. The investment cost is $25,000, and the equipment will have a market (salvage) value of $5,000 at the end of its expected life of five years. Increased productivity attributable to the equipment will amount to $8,000 per year after extra operating costs have been subtracted from the value of the additional production. Assume that initially E=MARR=19% per year. Calculate PW, FW, AW, IRR, and ERR for the proposed investment. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. Capital Investment Market Value -$25,000 $5,000 Net Annual Savings Reinvestment Rate $8,000 19% EOY 0 1 2 3 4 5 Cash flow -$25,000 $8,000 $8,000 $8,000 $8,000 $13,000 MARR Present worth (PW) Annual worth (AW) Future worth (FW) IRR ERR 0% $45,000 $9,000 $45,000 21.58% #DIV/0! 17% $27,875 $8,713 $61,115 21.58% 21.58% 19% $26,556 $8,685 $63,373 21.58% 21.58% 21% $25,336 $8,659 $65,714 21.58% 21.58% 29% $21,264 $8,564 $75,960 21.58% 21.58% Constract a graph of the PW as a function of the interest rate, i. Is the investment a good one if the MARR is equal to 17%; 19%; 21%? Steps 1. Start Excel - completed. 2. In cells D13:D18, by using cell references, calculate the cash flows from the investment. (2 pts.) In cell F21, by using cell references and the function NPV, calculate the present worth for the investment if the 3. MARR is 19%. (1 pt.) Note: 1. The function NPV will be only a part of your calculations of the present worth for the investment. 2. The output of the formula in cell F21 is expected as a positive value. 4. To calculate the present worth values for the investment under the different MARRs, copy cell F21 and paste it onto cells D21:E21 and G21:H21. (1 pt.) 5. In cell F22, by using cell references and the function PMT, calculate the annual worth for the investment if the MARR is 19%. (1 pt.) 6. To calculate the annual worth values for the investment under the different MARRs, copy cell F22 and paste it onto cells D22:E22 and G22:H22. (1 pt.) 7. In cell F23, by using cell references and the function FV, calculate the future worth for the investment if the MARR is 19%. (1 pt.) 8. To calculate the future worth values for the investment under the different MARRs, copy cell F23 and paste it onto cells D23:E23 and G23:H23. (1 pt.) 9. In cell F24, by using cell references and the function IRR, calculate the internal rate of return of the project. (1 pt.) Note: 1. Use cell references to the cash flows from Step 2 in your calculations. 2. Enter 0.01 for the Guess argument of the function IRR. 10. To calculate the internal rates of return of the project under the different MARRs, copy cell F24 and paste it onto cells D24:E24 and G24:H24. (1 pt.) Note: You will notice that the internal rates of return are equal for all MARRs, as expected. 11. In cell F25, by using cell references and the function MIRR, calculate the external rate of return of the project if the MARR is 19%. (1 pt.) Note: 1. Use cell references to the cash flows from Step 2 in your calculations. 2. Refer to the cell with corresponding MARR value for the Finance_rate argument of the function MIRR. Refer to the appropriate cell among cells D:D10 for the Reinvest_rate argument of the function MIRR. 3. You will notice that the external rates of return are equal for all MARRs, as expected. 12. To calculate the external rates of return of the project under the different MARRs, copy cell F25 and paste it onto cells D25:E25 and G25:H25. (1 pt.) 13. To construct the Scatter with Smooth Lines Chart of the PW as a function of the interest rate, highlight cells D20:H21, then on the Insert tab, in the Charts group, click the arrow next to Insert Scatter (X,Y) or Bubble Chart and choose Scatter with Smooth Lines Chart. Change the title of the chart to PW vs. I. Add i as the title for the horizontal axis and PW as the title for the vertical axis. (1 pt.) 14. In cells G33:G35, determine whether the new equipment is economically feasible if the MARR is equal to 17%; 19%; 21%. (1 pt.) Note: Select your answers from the drop down menus provided in cells G33, G34, and G35. 15. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started