Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Not sure what you mean Gavin and Holly purchased a $665,000 condominium in Toronto. They paid 20% of the amount as a down payment and

Not sure what you mean

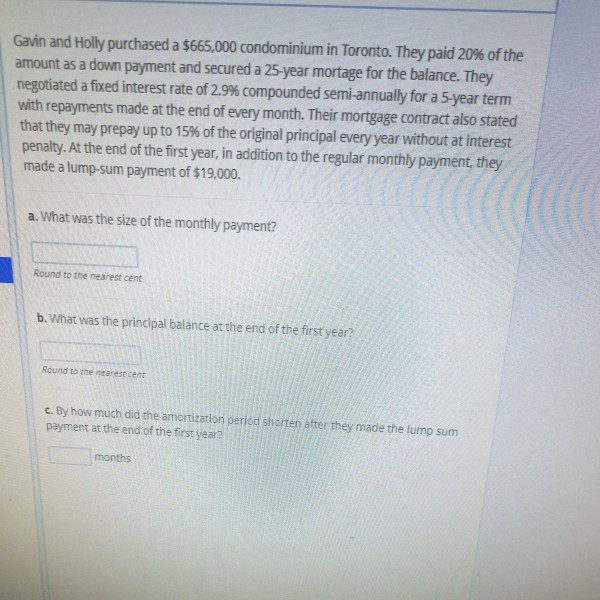

Gavin and Holly purchased a $665,000 condominium in Toronto. They paid 20% of the amount as a down payment and secured a 25-year mortage for the balance. They negotiated a fixed interest rate of 2.9% compounded semi-annually for a 5-year term with repayments made at the end of every month. Their mortgage contract also stated that they may prepay up to 15% of the original principal every year without at interest penalty. At the end of the first year, in addition to the regular monthly payment, they made a lump-sum payment of $19,000. a. What was the size of the monthly payment? Round to the nearest cent b. What was the principal balance at the end of the first year? Round to the nearest cent c. By how much did the amortization period shorten after they made the lump sum payment at the end of the first year? monthsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started