Question

Not sure where I kept getting wrong and other than the answer I should have got no other explanation is given so I don't repeat

Not sure where I kept getting wrong and other than the answer I should have got no other explanation is given so I don't repeat the errors can anyone help me figure out how questions 1,2, and 4 are calculated to get those answers.

Instructions

Customer Lifetime Value

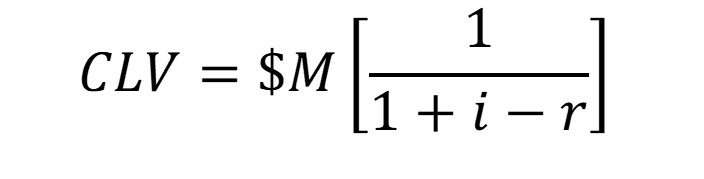

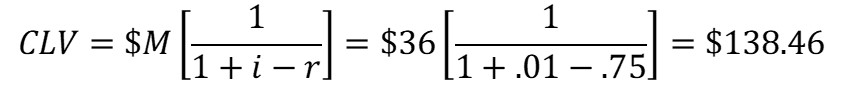

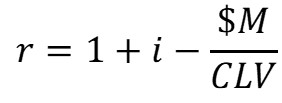

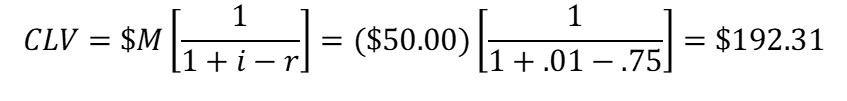

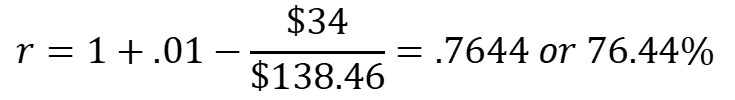

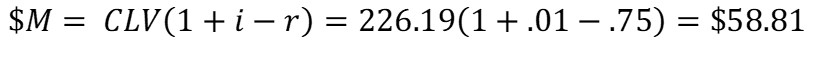

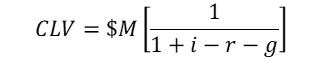

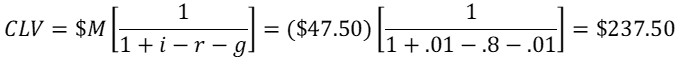

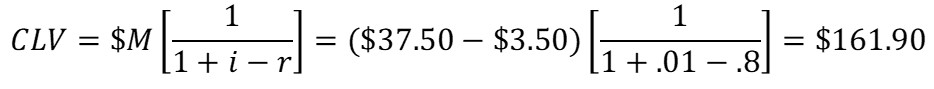

An important metric that attempts to capture the relationship between customer satisfaction and repeat sales is Customer Lifetime Value (CLV), the present value of the stream of lifetime purchases made by repeat customers. CLV incorporates the joint effects of retention rate (r) and margin per customer ($M) into a single metric. CLV is the present value of the customer relationship developed with that customer. The higher the CLV, the more valuable is a given customer to the firm. The CLV metric requires three pieces of information as inputs for its computation. These three input variables should make sense:

- The dollar contribution per period (can be any defined period, but the period analyzed is usually a month, a quarter, or a year) for retaining a given customer. This contribution is estimated as we have seen before, as the difference between the sales revenue generated by the customer and the variable costs needed to retain that customer.

- The retention rate (r) is the probability that a given customer will be retained for the period analyzed.

- The interest rate used for discounting future cash flows from the customer to their present values.

The formula capturing the relationships between these variables is:

(1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started