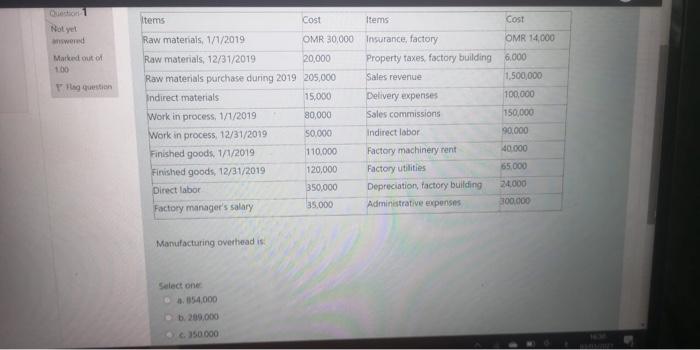

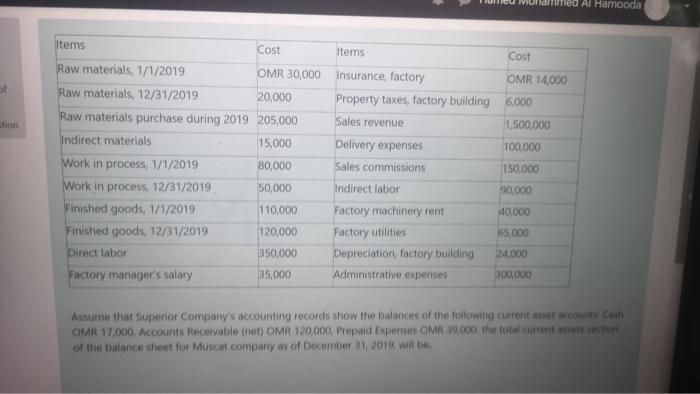

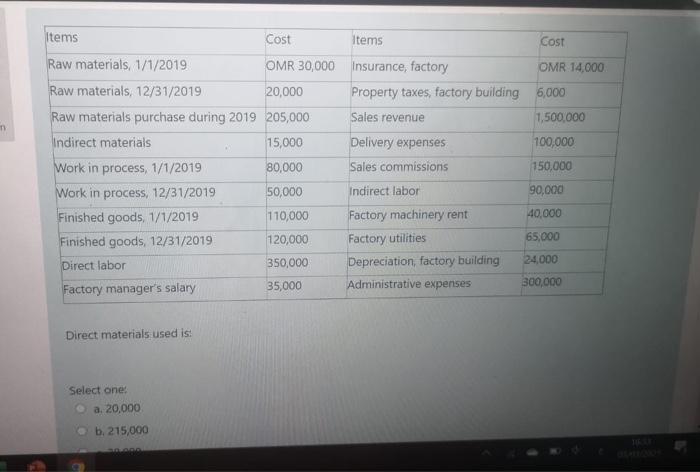

Not yet answered Marked out of 100 Tag question Items Cost Items Cost Raw materials, 1/1/2019 OMR 30,000 Insurance, factory OMR 14,000 Raw materials, 12/31/2019 20,000 Property taxes, factory building 6.000 Raw materials purchase during 2019 205,000 Sales revenue 1,500,000 Indirect materials 15,000 Delivery expenses 100,000 Work in process, 1/1/2019 80,000 Sales commissions 150,000 Work in process, 12/31/2019 50.000 Indirect labor 90.000 Finished goods, 1/1/2019 110,000 Factory machinery rent 40.000 Finished goods, 12/31/2019 120,000 Factory utilities 65.000 Direct labor 350.000 Depreciation, factory building 24.000 35.000 Factory manager's salary Administrative expenses 300.000 Manufacturing overhead is: Select one 054000 6.209.000 Al Hamooda items Cost 51 stion Raw materials, 1/1/2019 OMR 30,000 Raw materials, 12/31/2019 20,000 Raw materials purchase during 2019 205,000 Indirect materials 15,000 Work in process, 1/1/2019 80,000 Work in process, 12/31/2019 50,000 Finished goods, 1/1/2019 110,000 Finished goods, 12/31/2019 120,000 Direct labor 350,000 Factory manager's salary 35,000 Items Cost Insurance, factory OMR 14,000 Property taxes, factory building 6.000 Sales revenue 1,500,000 Delivery expenses 100,000 Sales commissions 150,000 Indirect labor 90,000 Factory machinery rent 40.000 Factory utilities 65.000 Depreciation, factory building 24,000 Administrative expenses 300.000 Assume that superior Company's accounting records show the balances of the following current assets can OMR 17,000, Accounts Receivable (net) OMR 120,000. Prepaid Expenses OMR 19,000, the total current echo of the balance sheet for Muscal company as of December 11, 2019 will be Items Cost Items COST Raw materials, 1/1/2019 OMR 30,000 Insurance, factory OMR 14,000 Raw materials, 12/31/2019 20,000 Property taxes, factory building 6,000 Raw materials purchase during 2019 205,000 Sales revenue 1,500,000 Indirect materials 15,000 Delivery expenses 100,000 Work in process, 1/1/2019 80,000 Sales commissions 150,000 Work in process, 12/31/2019 50,000 Indirect labor 90,000 Finished goods, 1/1/2019 110,000 Factory machinery rent 40,000 Finished goods, 12/31/2019 120,000 Factory utilities 65,000 350,000 Direct labor 24,000 Depreciation factory building 35,000 Factory manager's salary Administrative expenses 300,000 Direct materials used is: Select one: a 20,000 b, 215,000