Answered step by step

Verified Expert Solution

Question

1 Approved Answer

notate pls, there are 4 points in this question M2-25 (Algo) Analyzing the Impact of Transactions on the Current Ratio [LO 2-5] BSO, Incorporated, has

notate pls, there are 4 points in this question

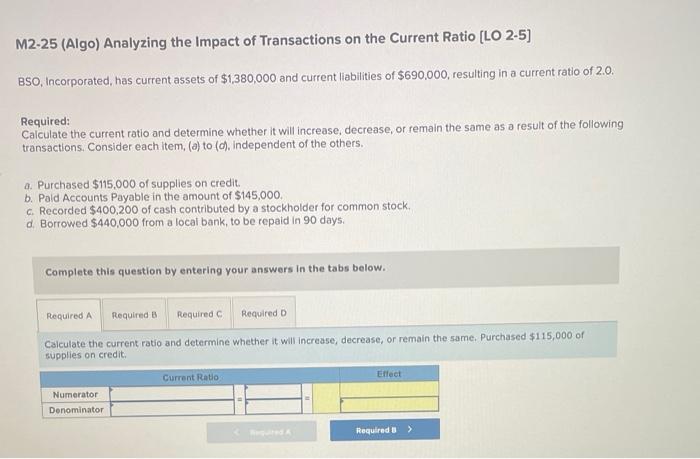

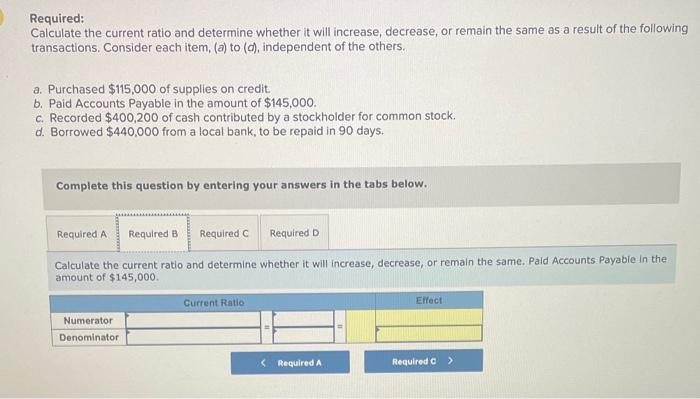

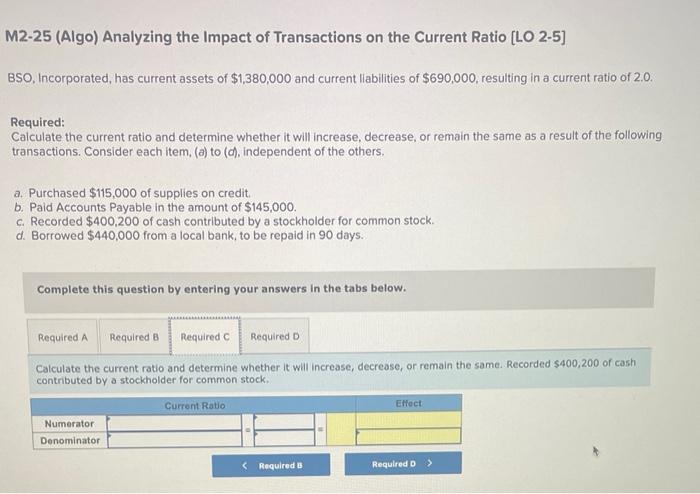

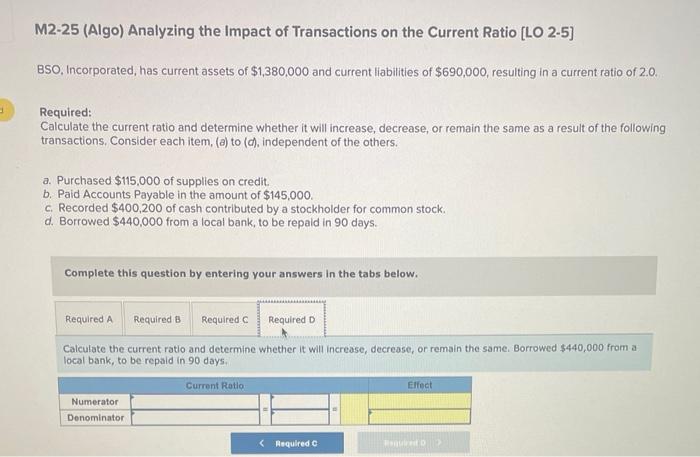

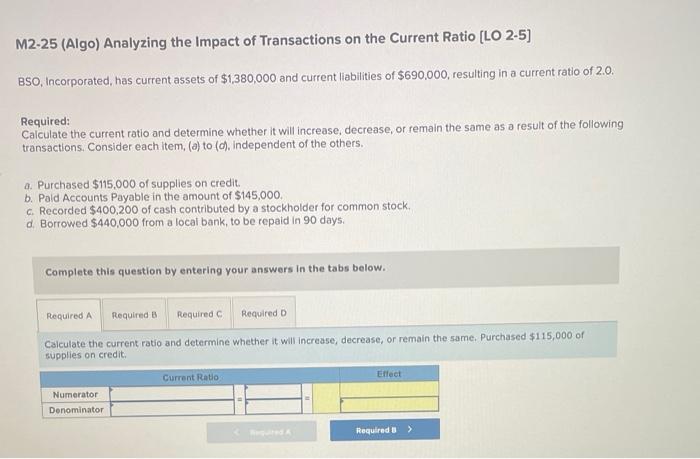

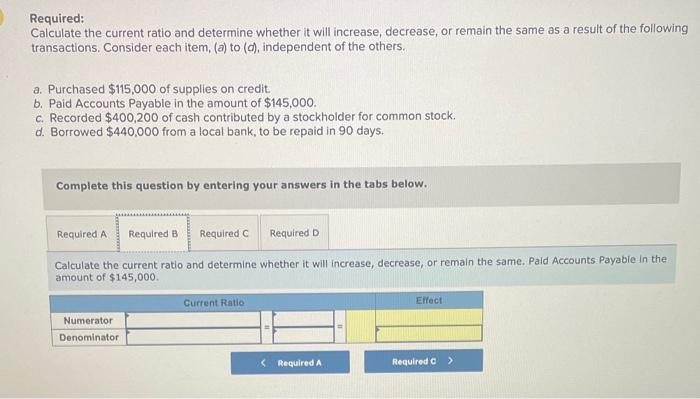

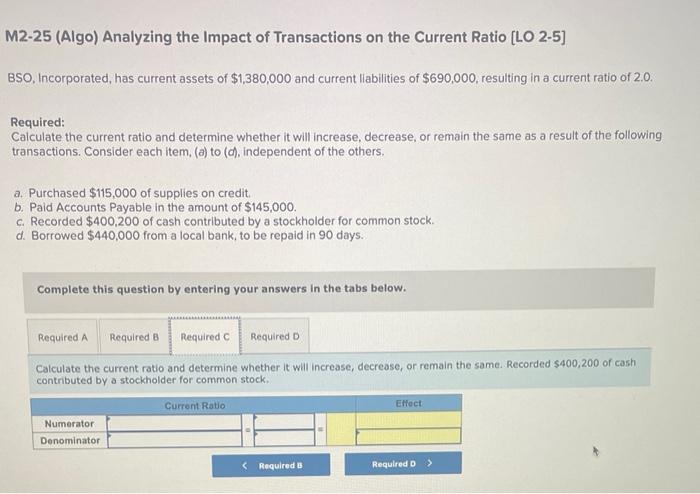

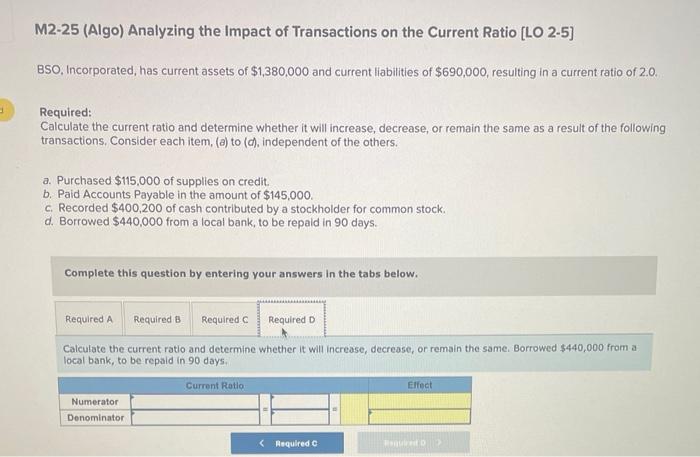

M2-25 (Algo) Analyzing the Impact of Transactions on the Current Ratio [LO 2-5] BSO, Incorporated, has current assets of $1,380,000 and current liabilities of $690,000, resulting in a current ratio of 2.0. Required: Calculate the current ratio and determine whether it will increase, decrease, or remain the same as a result of the following transactions. Consider each item, (a) to (d). Independent of the others. a. Purchased $115,000 of supplies on credit. b. Pald Accounts Payable in the amount of $145,000. c. Recorded $400,200 of cash contributed by a stockholder for common stock. d. Borrowed $440,000 from a local bank, to be repaid in 90 days. Complete this question by entering your answers in the tabs below. Calculate the current ratio and determine whether it will increase, decrease, or remain the same. Purchased $115,000 of supplies on credit. Required: Calculate the current ratio and determine whether it will increase, decrease, or remain the same as a result of the following transactions. Consider each item, (a) to (d), independent of the others. a. Purchased $115,000 of supplies on credit. b. Paid Accounts Payable in the amount of $145,000. c. Recorded $400,200 of cash contributed by a stockholder for common stock. d. Borrowed $440,000 from a local bank, to be repaid in 90 days. Complete this question by entering your answers in the tabs below. Calculate the current ratio and determine whether it will increase, decrease, or remain the same. Paid Accounts Payabie in the amount of $145,000. M2-25 (Algo) Analyzing the Impact of Transactions on the Current Ratio [LO 2-5] BSO, Incorporated, has current assets of $1,380,000 and current liabilities of $690,000, resulting in a current ratio of 2.0. Required: Calculate the current ratio and determine whether it will increase, decrease, or remain the same as a result of the following transactions. Consider each item, (a) to (d), independent of the others. a. Purchased $115,000 of supplies on credit. b. Paid Accounts Payable in the amount of $145,000. c. Recorded $400,200 of cash contributed by a stockholder for common stock. d. Borrowed $440,000 from a local bank, to be repaid in 90 days. Complete this question by entering your answers in the tabs below. Calculate the current ratio and determine whether it will increase, decrease, or remain the same. Recorded $400,200 of cash contributed by a stockholder for common stock. M2-25 (Algo) Analyzing the Impact of Transactions on the Current Ratio [LO 2-5] BSO, Incorporated, has current assets of $1,380,000 and current liabilities of $690,000, resulting in a current ratio of 2.0. Required: Calculate the current ratio and determine whether it will increase, decrease, or remain the same as a result of the following transactions. Consider each item, (a) to (d), independent of the others. a. Purchased $115.000 of supplies on credit. b. Paid Accounts Payable in the amount of $145,000. c. Recorded $400,200 of cash contributed by a stockholder for common stock. d. Borrowed $440,000 from a local bank, to be repaid in 90 days. Complete this question by entering your answers in the tabs below. Calculate the current ratio and determine whether it will increase, decrease, or remain the same. Borrowed $440,000 from a local bank, to be repaid in 90 days

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started