Question

Note 1: Unless otherwise indicated, all cash flows given in the problems represent after-tax cash flows in current dollars. Note 2: Unless otherwise noted, all

Note 1: Unless otherwise indicated, all cash flows given in the problems represent after-tax cash flows in current dollars. Note 2: Unless otherwise noted, all interest rates presented in this problem set assume annual compounding.

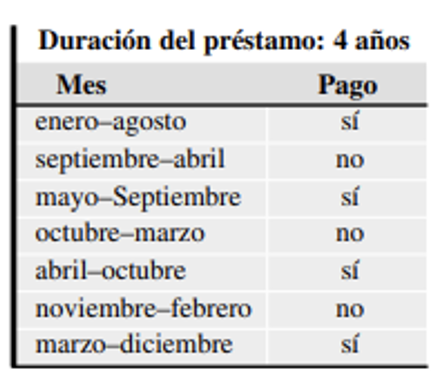

6. Consider the case of Gizmo, a small manufacturing company whose management wants to reduce overhead by installing a new energy-efficient heating system. The new system costs $100,000. Faced with the company's low cash reserves, management determined that borrowing is the only way to finance this desirable improvement. A problem arises when Gizmo's accountant points out that a standard direct reduction loan will severely limit the company's cash flow during the season when the heating is needed. To overcome this difficulty, the accountant suggests a payment schedule in a linear periodic gradient series with the gradient G=$75 on an alternating payment loan. The accountant proposed the following settlement schedule: The lender quoted an APR of 12%. Determine the payment schedule over four years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started