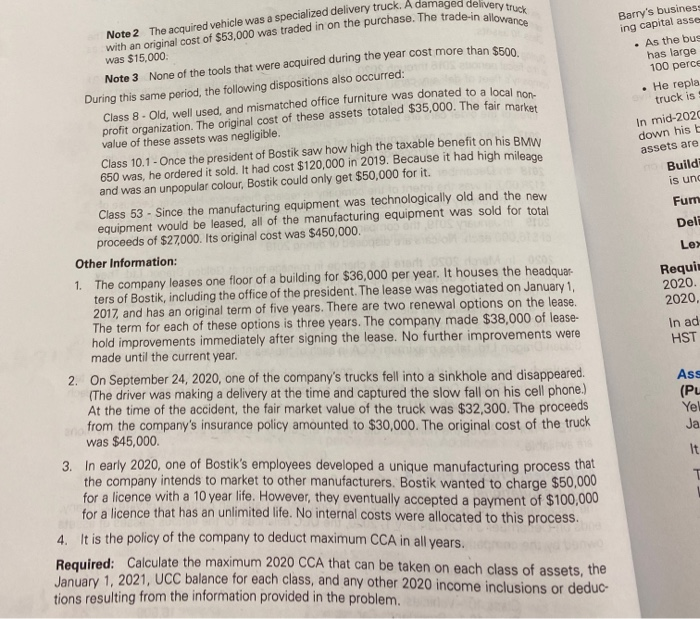

Note 2 The acquired vehicle was a specialized delivery truck. A damaged delivery truck with an original cost of $53,000 was traded in on the purchase. The trade-in allowance Barry's business ing capital asse . As the bus has large 100 perce repla truck is In mid-2020 down his assets are Build is und Fum was $15,000 Note 3 None of the tools that were acquired during the year cost more than $500. During this same period, the following dispositions also occurred: Class 8 - Old, well used, and mismatched office furniture was donated to a local non- profit organization. The original cost of these assets totaled $35,000. The fair market value of these assets was negligible. Class 10.1 - Once the president of Bostik saw how high the taxable benefit on his BMW 650 was, he ordered it sold. It had cost $120,000 in 2019. Because it had high mileage and was an unpopular colour, Bostik could only get $50,000 for it. Class 53 - Since the manufacturing equipment was technologically old and the new equipment would be leased, all of the manufacturing equipment was sold for total proceeds of $27,000. Its original cost was $450,000. Other Information: 1. The company leases one floor of a building for $36,000 per year. It houses the headquar- ters of Bostik, including the office of the president. The lease was negotiated on January 1, 2017, and has an original term of five years. There are two renewal options on the lease. The term for each of these options is three years. The company made $38,000 of lease- hold improvements immediately after signing the lease. No further improvements were made until the current year. Delf Lex Requit 2020 2020, In ad HST Ass (PL Yel Ja It 2. On September 24, 2020, one of the company's trucks fell into a sinkhole and disappeared. (The driver was making a delivery at the time and captured the slow fall on his cell phone. At the time of the accident , the fair market value of the truck was $32,300. The proceeds from the company's insurance policy amounted to $30,000. The original cost of the truck was $45,000 3. In early 2020, one of Bostik's employees developed a unique manufacturing process that the company intends to market to other manufacturers. Bostik wanted to charge $50,000 for a licence with a 10 year life. However, they eventually accepted a payment of $100,000 for a licence that has an unlimited life. No internal costs were allocated to this process. 4. It is the policy of the company to deduct maximum CCA in all years. Required: Calculate the maximum 2020 CCA that can be taken on each class of assets, the January 1, 2021, UCC balance for each class, and any other 2020 income inclusions or deduc- tions resulting from the information provided in the problem. Note 2 The acquired vehicle was a specialized delivery truck. A damaged delivery truck with an original cost of $53,000 was traded in on the purchase. The trade-in allowance Barry's business ing capital asse . As the bus has large 100 perce repla truck is In mid-2020 down his assets are Build is und Fum was $15,000 Note 3 None of the tools that were acquired during the year cost more than $500. During this same period, the following dispositions also occurred: Class 8 - Old, well used, and mismatched office furniture was donated to a local non- profit organization. The original cost of these assets totaled $35,000. The fair market value of these assets was negligible. Class 10.1 - Once the president of Bostik saw how high the taxable benefit on his BMW 650 was, he ordered it sold. It had cost $120,000 in 2019. Because it had high mileage and was an unpopular colour, Bostik could only get $50,000 for it. Class 53 - Since the manufacturing equipment was technologically old and the new equipment would be leased, all of the manufacturing equipment was sold for total proceeds of $27,000. Its original cost was $450,000. Other Information: 1. The company leases one floor of a building for $36,000 per year. It houses the headquar- ters of Bostik, including the office of the president. The lease was negotiated on January 1, 2017, and has an original term of five years. There are two renewal options on the lease. The term for each of these options is three years. The company made $38,000 of lease- hold improvements immediately after signing the lease. No further improvements were made until the current year. Delf Lex Requit 2020 2020, In ad HST Ass (PL Yel Ja It 2. On September 24, 2020, one of the company's trucks fell into a sinkhole and disappeared. (The driver was making a delivery at the time and captured the slow fall on his cell phone. At the time of the accident , the fair market value of the truck was $32,300. The proceeds from the company's insurance policy amounted to $30,000. The original cost of the truck was $45,000 3. In early 2020, one of Bostik's employees developed a unique manufacturing process that the company intends to market to other manufacturers. Bostik wanted to charge $50,000 for a licence with a 10 year life. However, they eventually accepted a payment of $100,000 for a licence that has an unlimited life. No internal costs were allocated to this process. 4. It is the policy of the company to deduct maximum CCA in all years. Required: Calculate the maximum 2020 CCA that can be taken on each class of assets, the January 1, 2021, UCC balance for each class, and any other 2020 income inclusions or deduc- tions resulting from the information provided in the