Answered step by step

Verified Expert Solution

Question

1 Approved Answer

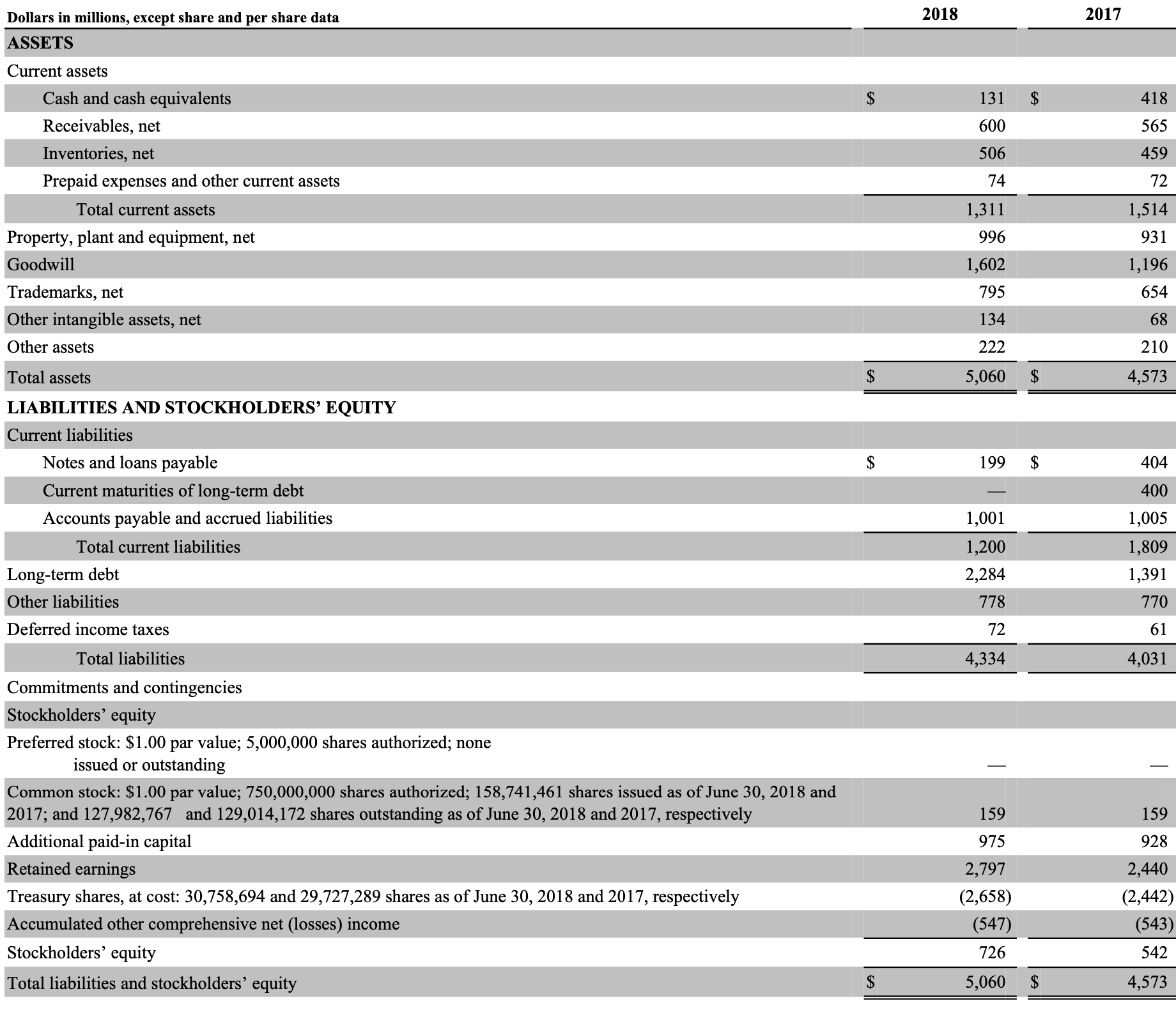

Note 5. discloses that Clorox has $375 of Capitalized Software Costs at June 30, 2018. If Clorox had instead chosen never to capitalize its software

Note 5. discloses that Clorox has $375 of Capitalized Software Costs at June 30, 2018. If Clorox had instead chosen never to capitalize its software development costs, how would its end of fiscal year 2018 balance sheet be different?

Group of answer choices:

Noncurrent assets would be higher, Shareholders Equity would be higher.

Noncurrent assets would be lower, Shareholders Equity would be lower.

Noncurrent assets would be higher, Shareholders Equity would be lower.

Noncurrent assets would be lower, Shareholders Equity would be higher.

\begin{tabular}{|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} Dollars in millions, except share and per share data \\ ASSETS \end{tabular}} & \multicolumn{2}{|c|}{2018} & \multicolumn{2}{|c|}{2017} \\ \hline & & & & \\ \hline \multicolumn{5}{|l|}{ Current assets } \\ \hline Cash and cash equivalents & $ & 131 & $ & 418 \\ \hline Receivables, net & & 600 & & 565 \\ \hline Inventories, net & & 506 & & 459 \\ \hline Prepaid expenses and other current assets & & 74 & & 72 \\ \hline Total current assets & & 1,311 & & 1,514 \\ \hline Property, plant and equipment, net & & 996 & & 931 \\ \hline Goodwill & & 1,602 & & 1,196 \\ \hline Trademarks, net & & 795 & & 654 \\ \hline Other intangible assets, net & & 134 & & 68 \\ \hline Other assets & & 222 & & 210 \\ \hline Total assets & $ & 5,060 & $ & 4,573 \\ \hline \multicolumn{5}{|l|}{ LIABILITIES AND STOCKHOLDERS' EQUITY } \\ \hline \multicolumn{5}{|l|}{ Current liabilities } \\ \hline Notes and loans payable & $ & 199 & $ & 404 \\ \hline Current maturities of long-term debt & & - & & 400 \\ \hline Accounts payable and accrued liabilities & & 1,001 & & 1,005 \\ \hline Total current liabilities & & 1,200 & & 1,809 \\ \hline Long-term debt & & 2,284 & & 1,391 \\ \hline Other liabilities & & 778 & & 770 \\ \hline Deferred income taxes & & 72 & & 61 \\ \hline Total liabilities & & 4,334 & & 4,031 \\ \hline \multicolumn{5}{|l|}{ Commitments and contingencies } \\ \hline \multicolumn{5}{|l|}{ Stockholders' equity } \\ \hline \begin{tabular}{l} Preferred stock: $1.00 par value; 5,000,000 shares authorized; none \\ issued or outstanding \end{tabular} & & - & & - \\ \hline \begin{tabular}{l} Common stock: $1.00 par value; 750,000,000 shares authorized; 158,741,461 shares issued as of June 30,2018 and \\ 2017 ; and 127,982,767 and 129,014,172 shares outstanding as of June 30,2018 and 2017 , respectively \end{tabular} & & 159 & & 159 \\ \hline Additional paid-in capital & & 975 & & 928 \\ \hline Retained earnings & & 2,797 & & 2,440 \\ \hline Treasury shares, at cost: 30,758,694 and 29,727,289 shares as of June 30,2018 and 2017, respectively & & (2,658) & & (2,442) \\ \hline Accumulated other comprehensive net (losses) income & & (547) & & (543) \\ \hline Stockholders' equity & & 726 & & 542 \\ \hline Total liabilities and stockholders' equity & $ & 5,060 & $ & 4,573 \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} Dollars in millions, except share and per share data \\ ASSETS \end{tabular}} & \multicolumn{2}{|c|}{2018} & \multicolumn{2}{|c|}{2017} \\ \hline & & & & \\ \hline \multicolumn{5}{|l|}{ Current assets } \\ \hline Cash and cash equivalents & $ & 131 & $ & 418 \\ \hline Receivables, net & & 600 & & 565 \\ \hline Inventories, net & & 506 & & 459 \\ \hline Prepaid expenses and other current assets & & 74 & & 72 \\ \hline Total current assets & & 1,311 & & 1,514 \\ \hline Property, plant and equipment, net & & 996 & & 931 \\ \hline Goodwill & & 1,602 & & 1,196 \\ \hline Trademarks, net & & 795 & & 654 \\ \hline Other intangible assets, net & & 134 & & 68 \\ \hline Other assets & & 222 & & 210 \\ \hline Total assets & $ & 5,060 & $ & 4,573 \\ \hline \multicolumn{5}{|l|}{ LIABILITIES AND STOCKHOLDERS' EQUITY } \\ \hline \multicolumn{5}{|l|}{ Current liabilities } \\ \hline Notes and loans payable & $ & 199 & $ & 404 \\ \hline Current maturities of long-term debt & & - & & 400 \\ \hline Accounts payable and accrued liabilities & & 1,001 & & 1,005 \\ \hline Total current liabilities & & 1,200 & & 1,809 \\ \hline Long-term debt & & 2,284 & & 1,391 \\ \hline Other liabilities & & 778 & & 770 \\ \hline Deferred income taxes & & 72 & & 61 \\ \hline Total liabilities & & 4,334 & & 4,031 \\ \hline \multicolumn{5}{|l|}{ Commitments and contingencies } \\ \hline \multicolumn{5}{|l|}{ Stockholders' equity } \\ \hline \begin{tabular}{l} Preferred stock: $1.00 par value; 5,000,000 shares authorized; none \\ issued or outstanding \end{tabular} & & - & & - \\ \hline \begin{tabular}{l} Common stock: $1.00 par value; 750,000,000 shares authorized; 158,741,461 shares issued as of June 30,2018 and \\ 2017 ; and 127,982,767 and 129,014,172 shares outstanding as of June 30,2018 and 2017 , respectively \end{tabular} & & 159 & & 159 \\ \hline Additional paid-in capital & & 975 & & 928 \\ \hline Retained earnings & & 2,797 & & 2,440 \\ \hline Treasury shares, at cost: 30,758,694 and 29,727,289 shares as of June 30,2018 and 2017, respectively & & (2,658) & & (2,442) \\ \hline Accumulated other comprehensive net (losses) income & & (547) & & (543) \\ \hline Stockholders' equity & & 726 & & 542 \\ \hline Total liabilities and stockholders' equity & $ & 5,060 & $ & 4,573 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started