Question

(Note: All ratio calculations must be rounded up to the nearest two decimal Mr. Ali own a business producing banana chips for local market. The

(Note: All ratio calculations must be rounded up to the nearest two decimal

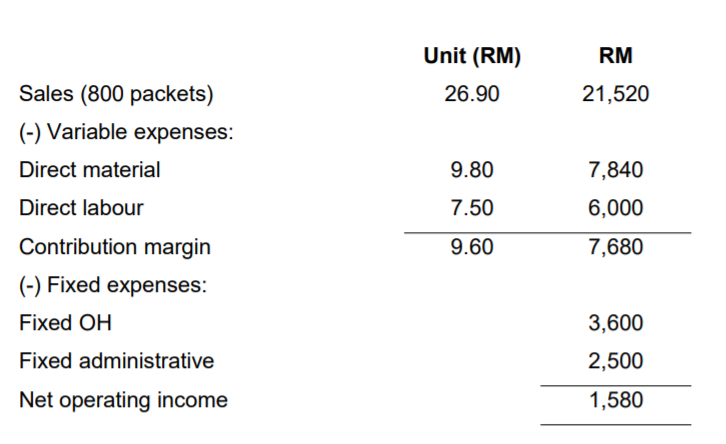

Mr. Ali own a business producing banana chips for local market. The following are cost information for the business:

Required:

(a) Compute the companys contribution margin ratio. (2 marks)

(b) Compute break-even point (BEP) in both units and sales value. (4 marks)

(c) Assume next year the company want to earn a profit of RM5,000, how many packet of banana chips will have to be sold to earn the target profit? (2 marks)

(d) Mr. Ali is anxious to increase the company profit by expanding the business to Brunei market. This expanding process will require company to spend an extra of 10% in fixed administrative cost which is used for advertising purpose. The fixed overhead costs are reported to remain the same as the production is still working within its capacity. With the extra spending of advertising cost, the number of sales will increase to 1,600 packets of banana chips. Due to the limited resources of material and labour during pandemic, the material cost is expected to increase by 5% and labour cost to increase by RM0.50 per packet produced. Meanwhile all other costs are reported to remain the same as original data. Analysis on the current market price has made the company to decide on the price increment to RM28.90 per packet of banana chips.

(i) Prepare a projected contribution income statement. (10 marks)

(ii) Compute new BEP in both units and sales value. (4 marks)

(iii) Would you recommend Mr. Ali to adopt this expanding project?Justify. (4 marks)

Unit (RM) RM 26.90 21,520 Sales (800 packets) (-) Variable expenses: Direct material 9.80 7,840 Direct labour 7.50 6,000 7,680 9.60 Contribution margin (-) Fixed expenses: Fixed OH Fixed administrative Net operating income 3,600 2,500 1,580Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started