Question

Note - all the images are clear - download them!!! Compute and Interpret Z-score Balance sheets and income statements for Lockheed Martin Corporation follow. Refer

Note - all the images are clear - download them!!!

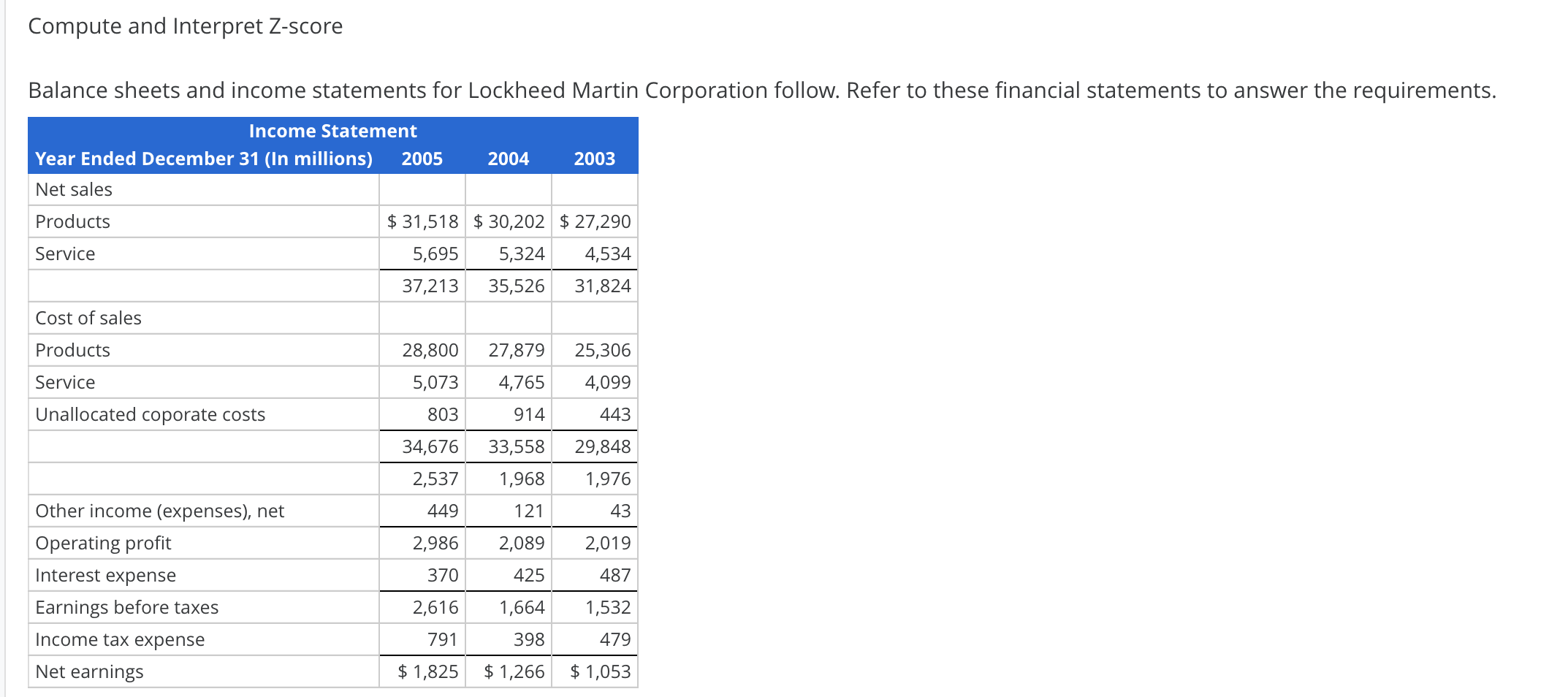

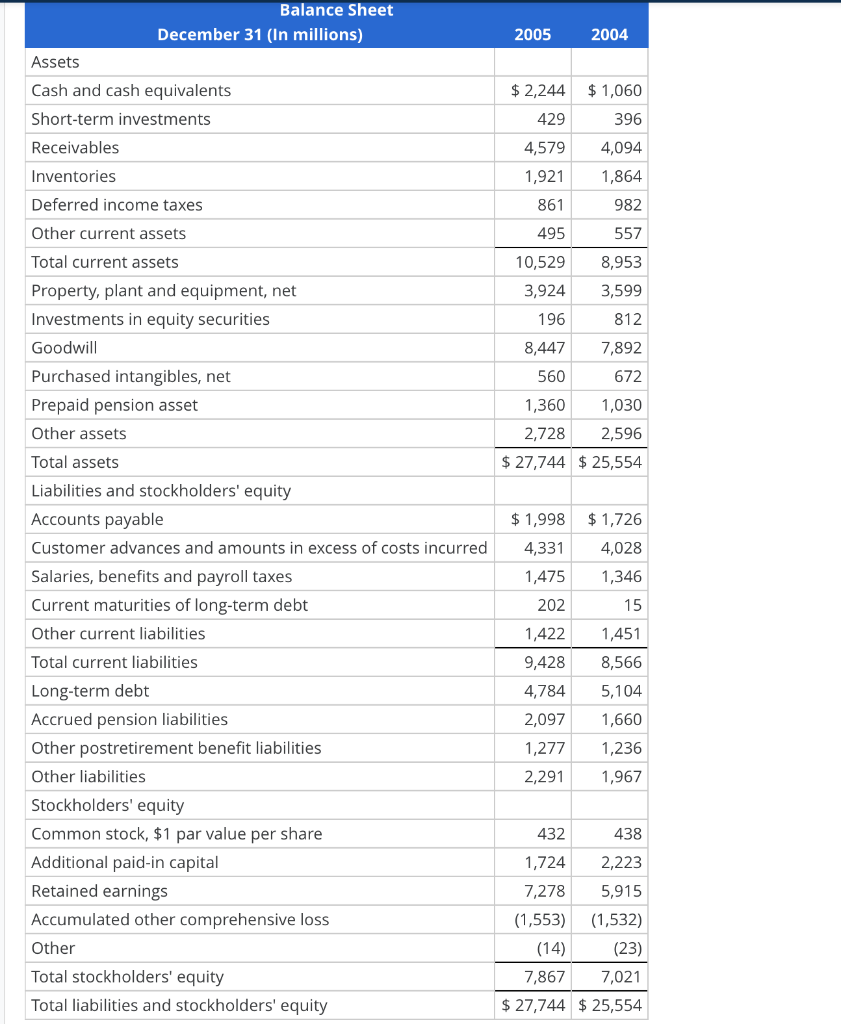

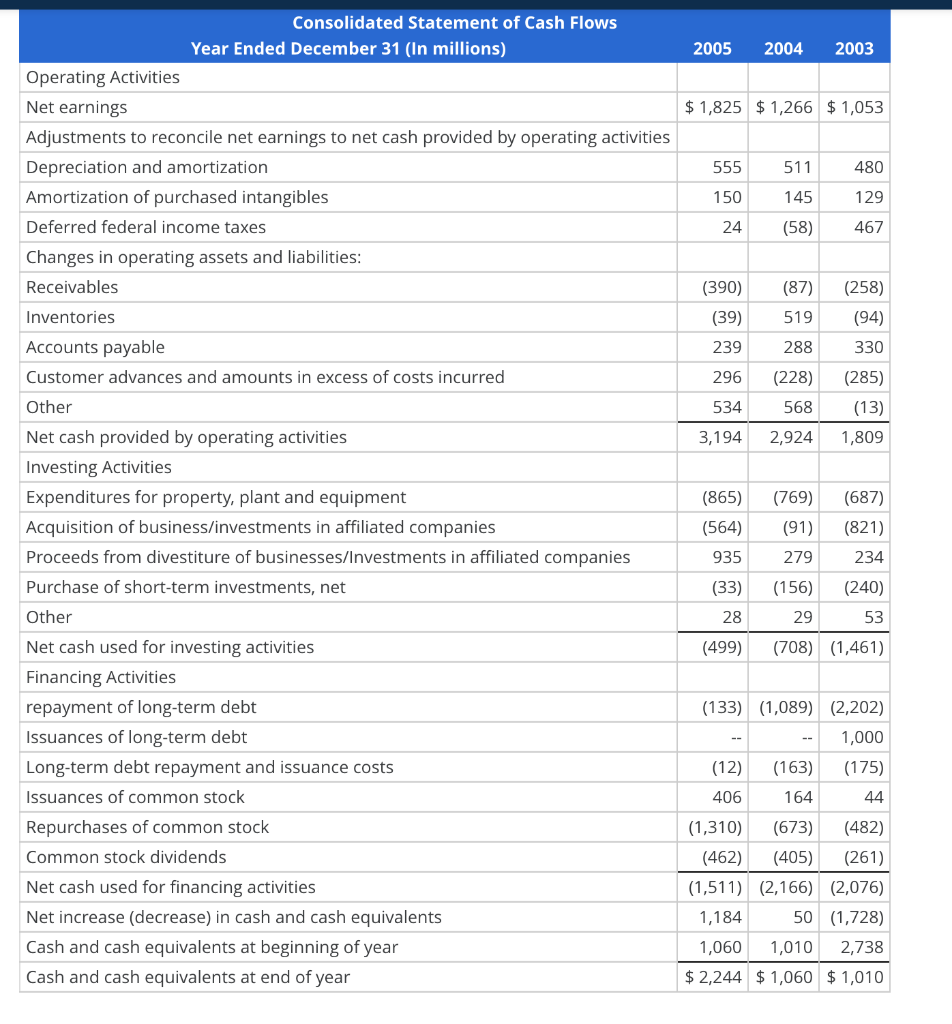

Compute and Interpret Z-score Balance sheets and income statements for Lockheed Martin Corporation follow. Refer to these financial statements to answer the requirements.

As of December 31, there were the approximate shares outstanding: 2005 - 434,264,432 2004 - 440,445,630 As of December 31, the company's stock closed at the following values: 2005 - $63.63 2004 - $55.55 (a) Compute and compare the Altman Z-scores for both years. (Do not round until your final answer; then round your answers to two decimal places.)

2005 z-score = _____

2004 z-score = _____ Which of the following explain the trend in the Z-scores from 2004 to 2005? (Select all that apply.) yeso The market value of Lockheed's equity improved somewhat over the year. yeso Lockheed improved its short-term liquidity by increasing cash. yeso Lockheed decreased its liquidity due to an increase in retained earnings. yeso Lcokheed improved its long-term liquidity by decreasing total liabilities. (b) Which of the following statements best describes the company's Altman Z-scores?

1.Both the Altman Z-scores are above 3.00 which indicate the company has a very low probability of bankruptcy.

2.Both the Altman Z-scores are below 1.80 which indicate the company has a very high probability of bankruptcy.

3.The Altman Z-scores have decreased from 2004 to 2005 which indicates the company's bankruptcy risk has increased.

4.The Altman Z-scores have increased from 2004 to 2005 which indicates the company's bankruptcy risk has decreased.

Compute and Interpret Z-score Balance sheets and income statements for Lockheed Martin Corporation follow. Refer to these financial statements to answer the requirements. Income Statement Year Ended December 31 (In millions) 2005 2004 2003 Net sales Products Service $ 31,518 $ 30,202 $ 27,290 5,695 5,324 4,534 37,213 35,526 31,824 Cost of sales Products 28,800 5,073 Service Unallocated coporate costs 803 34,676 2,537 449 2,986 27,879 4,765 914 33,558 1,968 121 2,089 25,306 4,099 443 29,848 1,976 43 2,019 370 425 15 487 Other income (expenses), net Operating profit Interest expense Earnings before taxes Income tax expense Net earnings 2,616 1,664 1,532 791 398 479 $ 1,825 $1,266 $ 1,053 2005 2004 $ 2,244 $1,060 429 396 4,579 4,094 1,921 1,864 861 982 495 557 10,529 8,953 3,924 3,599 196 812 8,447 7,892 560 672 1,360 1,030 2,728 2,596 $ 27,744 $ 25,554 Balance Sheet December 31 (In millions) Assets Cash and cash equivalents Short-term investments Receivables Inventories Deferred income taxes Other current assets Total current assets Property, plant and equipment, net Investments in equity securities Goodwill Purchased intangibles, net Prepaid pension asset Other assets Total assets Liabilities and stockholders' equity Accounts payable Customer advances and amounts in excess of costs incurred Salaries, benefits and payroll taxes Current maturities of long-term debt Other current liabilities Total current liabilities Long-term debt Accrued pension liabilities Other postretirement benefit liabilities Other liabilities Stockholders' equity Common stock, $1 par value per share Additional paid-in capital Retained earnings Accumulated other comprehensive loss Other Total stockholders' equity Total liabilities and stockholders' equity $ 1,998 4,331 1,475 202 1,422 9,428 4,784 2,097 1,277 2,291 $1,726 4,028 1,346 15 1,451 8,566 5,104 1,660 1,236 1,967 432 438 1,724 2,223 7,278 5,915 (1,553) (1,532) (14) (23) 7,867 7,021 $ 27,744 $ 25,554 2005 2004 2003 $ 1,825 $1,266 $ 1,053 555 150 - 24 511 145 (58) 480 129 467 Consolidated Statement of Cash Flows Year Ended December 31 (In millions) Operating Activities Net earnings Adjustments to reconcile net earnings to net cash provided by operating activities Depreciation and amortization Amortization of purchased intangibles Deferred federal income taxes Changes in operating assets and liabilities: Receivables Inventories Accounts payable Customer advances and amounts in excess of costs incurred Other Net cash provided by operating activities Investing Activities Expenditures for property, plant and equipment Acquisition of business/investments in affiliated companies Proceeds from divestiture of businesses/Investments in affiliated companies (390) (39) 239 296 534 3,194 (87) 519 288 (228) 568 2,924 (258) (94) 330 (285) (13) 1,809 (865) (564) 935 (33) 28 (499) (769) (687) (91) (821) 279 234 (156) (240) 29 53 (708) (1,461) Purchase of short-term investments, net Other Net cash used for investing activities Financing Activities repayment of long-term debt Issuances of long-term debt Long-term debt repayment and issuance costs Issuances of common stock Repurchases of common stock Common stock dividends Net cash used for financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year (133) (1,089) (2,202) -- 1,000 (12) (163) (175) 406 164 - 44 (1,310) (673) (482) (462) (405) (261) (1,511) (2,166) (2,076) 1,184 50 (1,728) 1,060 1,010 2,738 $ 2,244 $ 1,060 $ 1,010 Compute and Interpret Z-score Balance sheets and income statements for Lockheed Martin Corporation follow. Refer to these financial statements to answer the requirements. Income Statement Year Ended December 31 (In millions) 2005 2004 2003 Net sales Products Service $ 31,518 $ 30,202 $ 27,290 5,695 5,324 4,534 37,213 35,526 31,824 Cost of sales Products 28,800 5,073 Service Unallocated coporate costs 803 34,676 2,537 449 2,986 27,879 4,765 914 33,558 1,968 121 2,089 25,306 4,099 443 29,848 1,976 43 2,019 370 425 15 487 Other income (expenses), net Operating profit Interest expense Earnings before taxes Income tax expense Net earnings 2,616 1,664 1,532 791 398 479 $ 1,825 $1,266 $ 1,053 2005 2004 $ 2,244 $1,060 429 396 4,579 4,094 1,921 1,864 861 982 495 557 10,529 8,953 3,924 3,599 196 812 8,447 7,892 560 672 1,360 1,030 2,728 2,596 $ 27,744 $ 25,554 Balance Sheet December 31 (In millions) Assets Cash and cash equivalents Short-term investments Receivables Inventories Deferred income taxes Other current assets Total current assets Property, plant and equipment, net Investments in equity securities Goodwill Purchased intangibles, net Prepaid pension asset Other assets Total assets Liabilities and stockholders' equity Accounts payable Customer advances and amounts in excess of costs incurred Salaries, benefits and payroll taxes Current maturities of long-term debt Other current liabilities Total current liabilities Long-term debt Accrued pension liabilities Other postretirement benefit liabilities Other liabilities Stockholders' equity Common stock, $1 par value per share Additional paid-in capital Retained earnings Accumulated other comprehensive loss Other Total stockholders' equity Total liabilities and stockholders' equity $ 1,998 4,331 1,475 202 1,422 9,428 4,784 2,097 1,277 2,291 $1,726 4,028 1,346 15 1,451 8,566 5,104 1,660 1,236 1,967 432 438 1,724 2,223 7,278 5,915 (1,553) (1,532) (14) (23) 7,867 7,021 $ 27,744 $ 25,554 2005 2004 2003 $ 1,825 $1,266 $ 1,053 555 150 - 24 511 145 (58) 480 129 467 Consolidated Statement of Cash Flows Year Ended December 31 (In millions) Operating Activities Net earnings Adjustments to reconcile net earnings to net cash provided by operating activities Depreciation and amortization Amortization of purchased intangibles Deferred federal income taxes Changes in operating assets and liabilities: Receivables Inventories Accounts payable Customer advances and amounts in excess of costs incurred Other Net cash provided by operating activities Investing Activities Expenditures for property, plant and equipment Acquisition of business/investments in affiliated companies Proceeds from divestiture of businesses/Investments in affiliated companies (390) (39) 239 296 534 3,194 (87) 519 288 (228) 568 2,924 (258) (94) 330 (285) (13) 1,809 (865) (564) 935 (33) 28 (499) (769) (687) (91) (821) 279 234 (156) (240) 29 53 (708) (1,461) Purchase of short-term investments, net Other Net cash used for investing activities Financing Activities repayment of long-term debt Issuances of long-term debt Long-term debt repayment and issuance costs Issuances of common stock Repurchases of common stock Common stock dividends Net cash used for financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year (133) (1,089) (2,202) -- 1,000 (12) (163) (175) 406 164 - 44 (1,310) (673) (482) (462) (405) (261) (1,511) (2,166) (2,076) 1,184 50 (1,728) 1,060 1,010 2,738 $ 2,244 $ 1,060 $ 1,010Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started