Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: Assume a 365-day year. Required: Calculate the following ratios for the years ended 31 March 2019 and 31 March 2020: (i) Return on capital

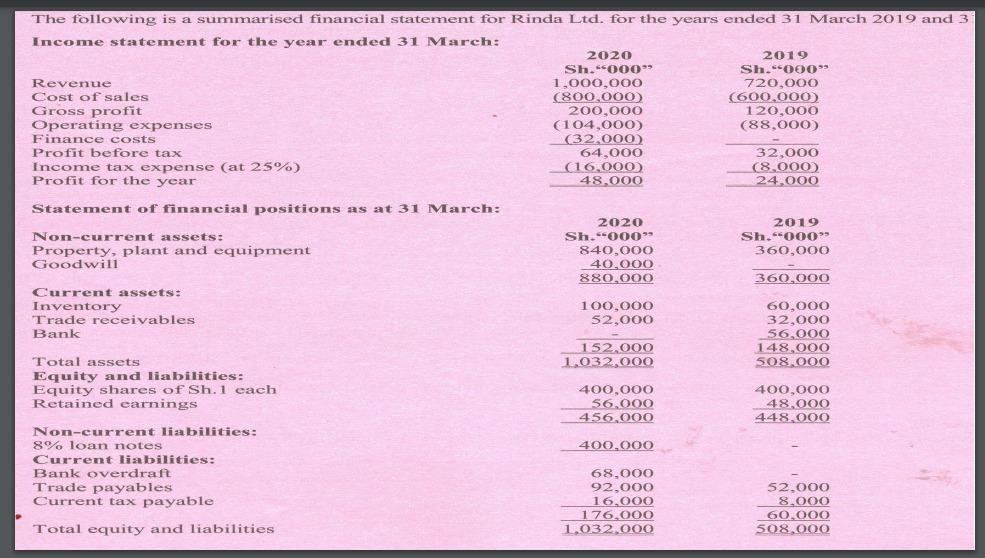

Note: Assume a 365-day year. Required: Calculate the following ratios for the years ended 31 March 2019 and 31 March 2020: (i) Return on capital employed. (2 marks) (ii) Cash ratio (2 marks) (iii) Net profit margin. (2 marks) (iv) Current ratio. (2 marks) (v) Closing inventory holding period. (2 marks) (vi) Trade receivables collection period. (2 marks) (vii) Trade payables payment period. (2 marks) (viii) Gearing (debt/equity). (2 marks) (Total: 20 marks)

T The following is a summarised financial statement for Rinda Ltd. for the years ended 31 March 2019 and 3 Income statement for the year ended 31 March: 2020 2019 Sh."-000" Sh."000" Revenue 1,000,000 720,000 Cost of sales (800,000) 600.000 Gross profit 200,000 120,000 Operating expenses (104,000) (88,000) Finance costs (32,000) Profit before tax 64,000 32,000 Income tax expense (at 25%) (16,000) (8,000) Profit for the year 48.000 24.000 Statement of financial positions as at 31 March: Non-current assets: Property, plant and equipment Goodwill 2020 Sh.Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started