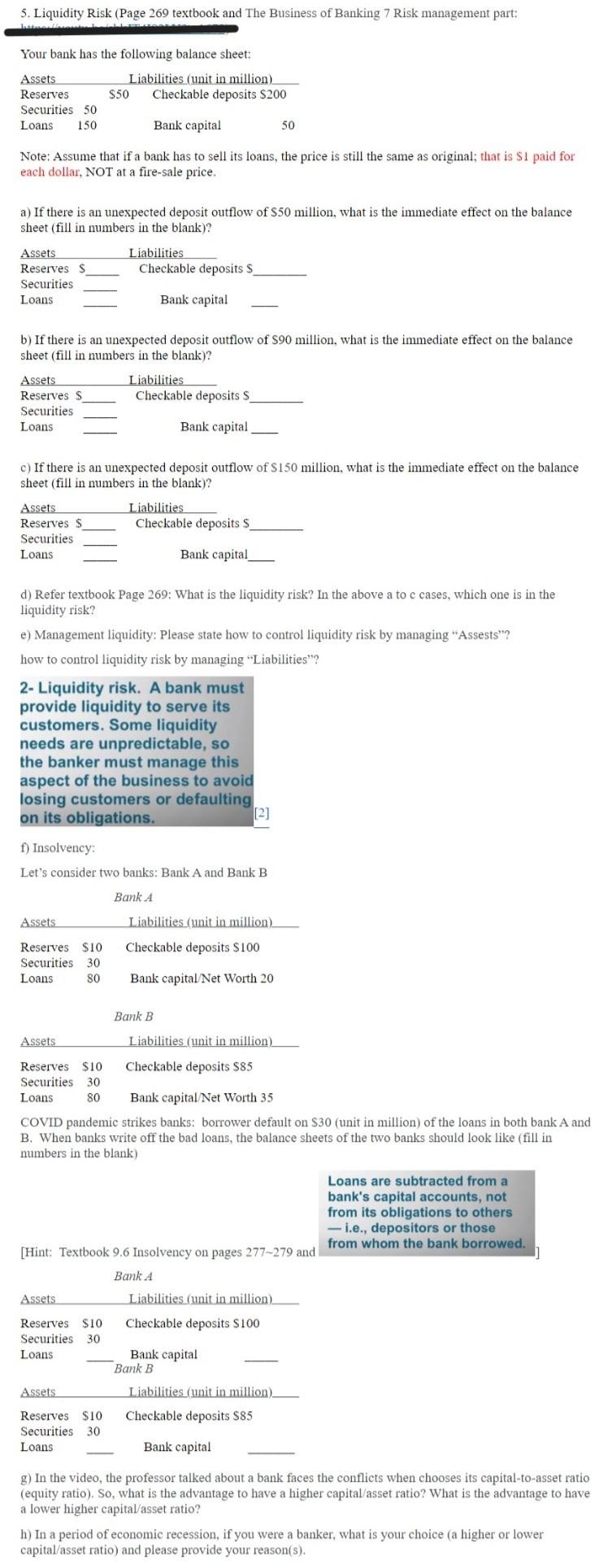

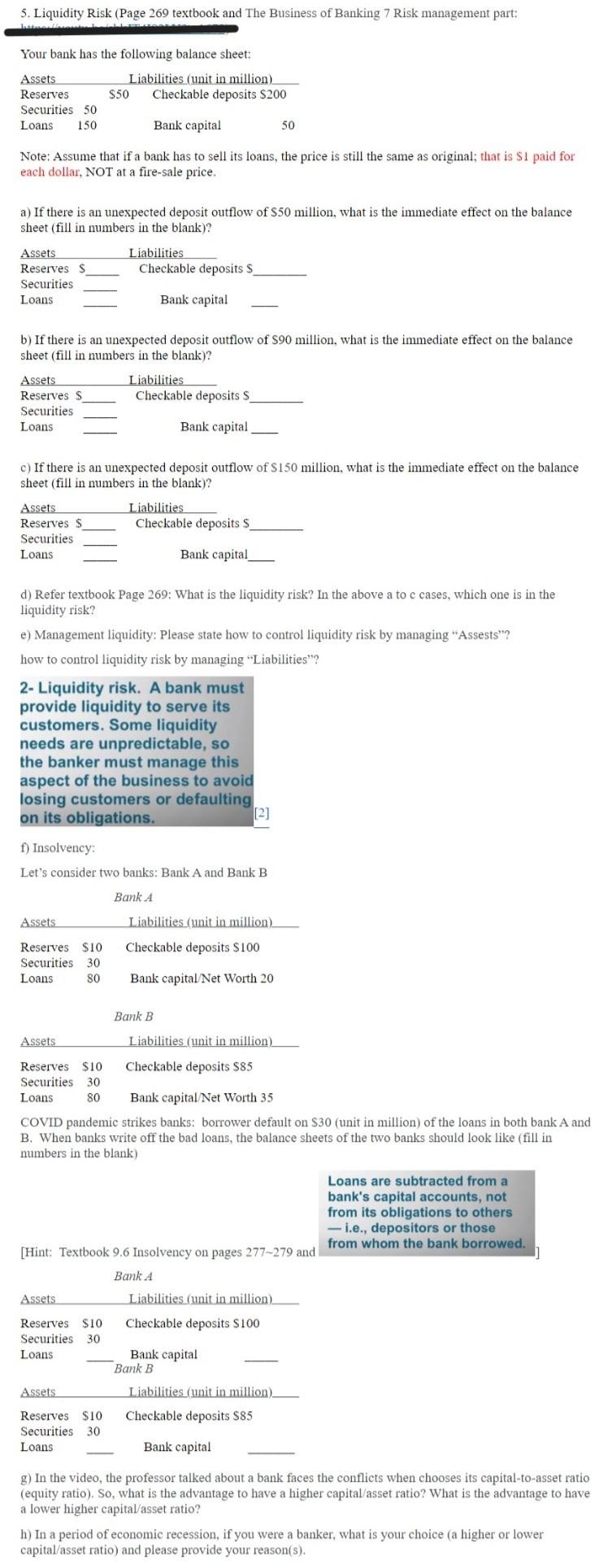

Note: Assume that if a bank has to sell its loans, the price is still the same as original; that is $1 paid for each dollar, NOT at a fire-sale price. a) If there is an unexpected deposit outflow of $50 million, what is the immediate effect on the balance sheet (fill in numbers in the blank)? b) If there is an unexpected deposit outflow of $90 million, what is the immediate effect on the balance sheet (fill in numbers in the blank)? AssetsReserves$CheckabledepositsSSecuritiesLoansBankcapitanLiabilitiesChapital c) If there is an unexpected deposit outflow of $150 million, what is the immediate effect on the balance sheet (fill in numbers in the blank)? d) Refer textbook Page 269: What is the liquidity risk? In the above a to c cases, which one is in the liquidity risk? e) Management liquidity: Please state how to control liquidity risk by managing "Assests"? how to control liquidity risk by managing "Liabilities"? Let's consider two banks: Bank A and Bank B COVID pandemic strikes banks: borrower default on $30 (unit in million) of the loans in both bank A and B. When banks write off the bad loans, the balance sheets of the two banks should look like (fill in numbers in the blank) [Hint: Textbook 9.6 Insolvency on pages 277279 and g) In the video, the professor talked about a bank faces the conflicts when chooses its capital-to-asset ratio (equity ratio). So, what is the advantage to have a higher capital/asset ratio? What is the advantage to have a lower higher capital/asset ratio? h) In a period of economic recession, if you were a banker, what is your choice (a higher or lower capital/asset ratio) and please provide your reason(s). Note: Assume that if a bank has to sell its loans, the price is still the same as original; that is $1 paid for each dollar, NOT at a fire-sale price. a) If there is an unexpected deposit outflow of $50 million, what is the immediate effect on the balance sheet (fill in numbers in the blank)? b) If there is an unexpected deposit outflow of $90 million, what is the immediate effect on the balance sheet (fill in numbers in the blank)? AssetsReserves$CheckabledepositsSSecuritiesLoansBankcapitanLiabilitiesChapital c) If there is an unexpected deposit outflow of $150 million, what is the immediate effect on the balance sheet (fill in numbers in the blank)? d) Refer textbook Page 269: What is the liquidity risk? In the above a to c cases, which one is in the liquidity risk? e) Management liquidity: Please state how to control liquidity risk by managing "Assests"? how to control liquidity risk by managing "Liabilities"? Let's consider two banks: Bank A and Bank B COVID pandemic strikes banks: borrower default on $30 (unit in million) of the loans in both bank A and B. When banks write off the bad loans, the balance sheets of the two banks should look like (fill in numbers in the blank) [Hint: Textbook 9.6 Insolvency on pages 277279 and g) In the video, the professor talked about a bank faces the conflicts when chooses its capital-to-asset ratio (equity ratio). So, what is the advantage to have a higher capital/asset ratio? What is the advantage to have a lower higher capital/asset ratio? h) In a period of economic recession, if you were a banker, what is your choice (a higher or lower capital/asset ratio) and please provide your reason(s)