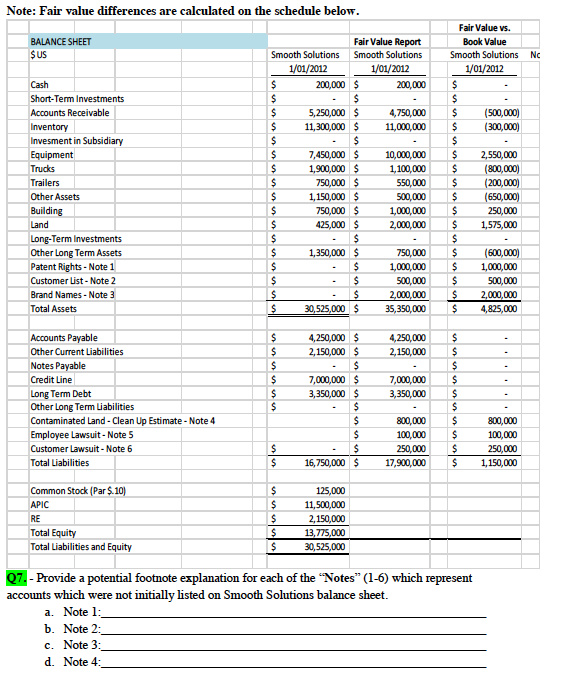

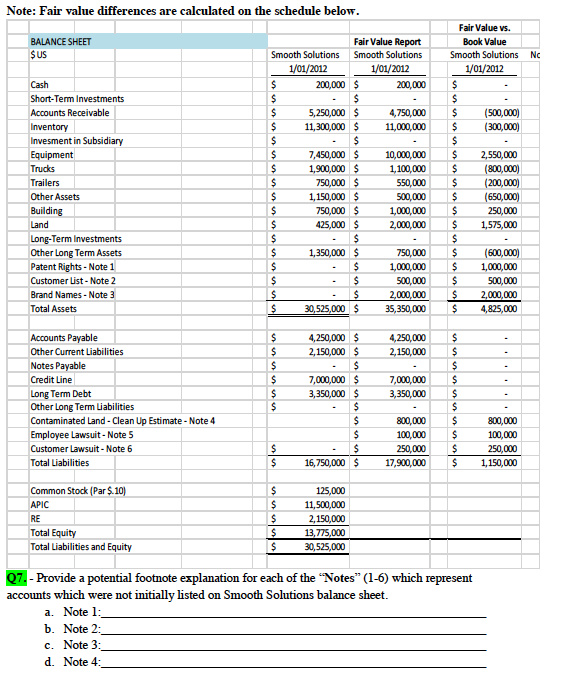

Note: Fair value differences are calculated on the schedule below Fair value FairValue Report Book Value smooth solutions smooth solutions Smooth Solutions NC 1/012012 1/01/2012 1/01/2012 cash 200,000 200,000 Short Term Investments S S 4,750,000 (500,000) Inventory 11.300,000 S 11000000 S (300,000 Invesment in subsidiary S S Equipment 7,450,000 10,000,000 2,550,000 Trailers 750,000 550,000 (200,000) other Assets 1.150,000 500,000 (650,000) Building 750,000 1.000,000 250,000 Land 425000 2,000,000 1.575,000 other Long Term Assets S ,350,000 S 750,000 (600,000 S ES 1.000,000 1.000.000 Patent Rights-Note 1 customer List-Note 2 S S 500,000 500,000 Brand Names-Note 3 IS S 2.000.000 Js 2,000,000 30,525,000 35,350,000 4,825,000 other current Liabilities 2,150,000 S 2,150,000 Notes payable ES Credit Line 7000,000 7000,000 3,350,000 S 3350,000 Long Term Debt Other Long Term Liabilities 800,000 Contaminated Land Clean Up Estimate-Note 4 S 100,000 S 100000 Employee Lawsuit-Note 5 250,000 S S 16,750,000 S 17,900,000 S 1.150,000 Total Liabilities common stock (Par 100 125000 APIC 500,000 Total Equity S 113 TSO000 Total Liabilities and Equity Q7.-Provide a potential footnote explanation for each of the "Notes" (1-6) which represent accounts which were not initially listed on Smooth Solutions balance sheet. a. Note 1 b. Note c. Note 3 d. Note 4 Note: Fair value differences are calculated on the schedule below Fair value FairValue Report Book Value smooth solutions smooth solutions Smooth Solutions NC 1/012012 1/01/2012 1/01/2012 cash 200,000 200,000 Short Term Investments S S 4,750,000 (500,000) Inventory 11.300,000 S 11000000 S (300,000 Invesment in subsidiary S S Equipment 7,450,000 10,000,000 2,550,000 Trailers 750,000 550,000 (200,000) other Assets 1.150,000 500,000 (650,000) Building 750,000 1.000,000 250,000 Land 425000 2,000,000 1.575,000 other Long Term Assets S ,350,000 S 750,000 (600,000 S ES 1.000,000 1.000.000 Patent Rights-Note 1 customer List-Note 2 S S 500,000 500,000 Brand Names-Note 3 IS S 2.000.000 Js 2,000,000 30,525,000 35,350,000 4,825,000 other current Liabilities 2,150,000 S 2,150,000 Notes payable ES Credit Line 7000,000 7000,000 3,350,000 S 3350,000 Long Term Debt Other Long Term Liabilities 800,000 Contaminated Land Clean Up Estimate-Note 4 S 100,000 S 100000 Employee Lawsuit-Note 5 250,000 S S 16,750,000 S 17,900,000 S 1.150,000 Total Liabilities common stock (Par 100 125000 APIC 500,000 Total Equity S 113 TSO000 Total Liabilities and Equity Q7.-Provide a potential footnote explanation for each of the "Notes" (1-6) which represent accounts which were not initially listed on Smooth Solutions balance sheet. a. Note 1 b. Note c. Note 3 d. Note 4