Answered step by step

Verified Expert Solution

Question

1 Approved Answer

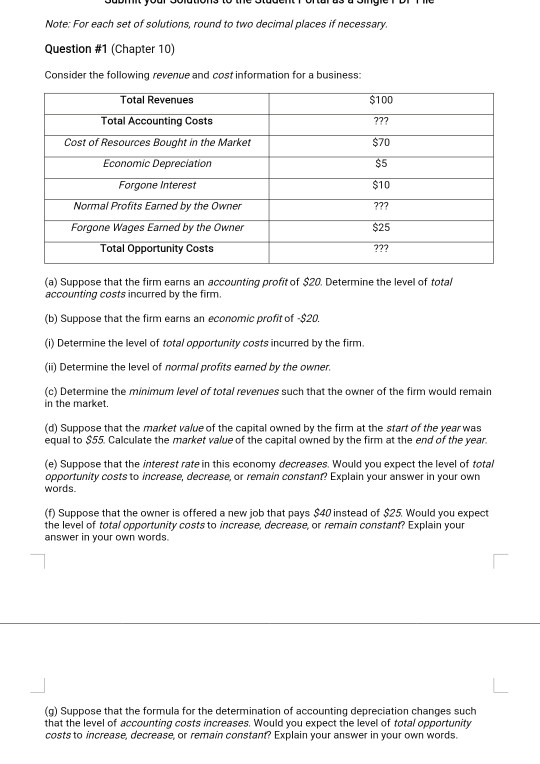

Note: For each set of solutions, round to two decimal places if necessary Question #1 (Chapter 10) Consider the following revenue and cost information for

Note: For each set of solutions, round to two decimal places if necessary Question #1 (Chapter 10) Consider the following revenue and cost information for a business: $100 272 $70 $5 Total Revenues Total Accounting Costs Cost of Resources Bought in the Market Economic Depreciation Forgone interest Normal Profits Earned by the Owner Forgone Wages Earned by the Owner Total Opportunity Costs $10 ??? $25 ??? (a) Suppose that the firm earns an accounting profit of $20. Determine the level of total accounting costs incurred by the firm. (b) Suppose that the firm earns an economic profit of $20. 0) Determine the level of total opportunity costs incurred by the firm. (1) Determine the level of normal profits earned by the owner. (c) Determine the minimum level of total revenues such that the owner of the firm would remain in the market. (d) Suppose that the market value of the capital owned by the firm at the start of the year was equal to $55. Calculate the market value of the capital owned by the firm at the end of the year. (e) Suppose that the interest rate in this economy decreases. Would you expect the level of total opportunity costs to increase, decrease or remain constant? Explain your answer in your own words. () Suppose that the owner is offered a new job that pays $40 instead of $25. Would you expect the level of total opportunity costs to increase, decrease or remain constant? Explain your answer in your own words (9) Suppose that the formula for the determination of accounting depreciation changes such that the level of accounting costs increases. Would you expect the level of total opportunity costs to increase, decrease, or remain constant? Explain your answer in your own words

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started