Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NOTE: for my revision purposes, please can you clearly state everything including: -writing the name of the formula being used e.g. (Ke = Cost of

NOTE: for my revision purposes, please can you clearly state everything including:

-writing the name of the formula being used e.g. (Ke = Cost of Equity, followed by the formula, then formula with the figures). This will help me when revising.

-Clearly state the steps used to get the final answer

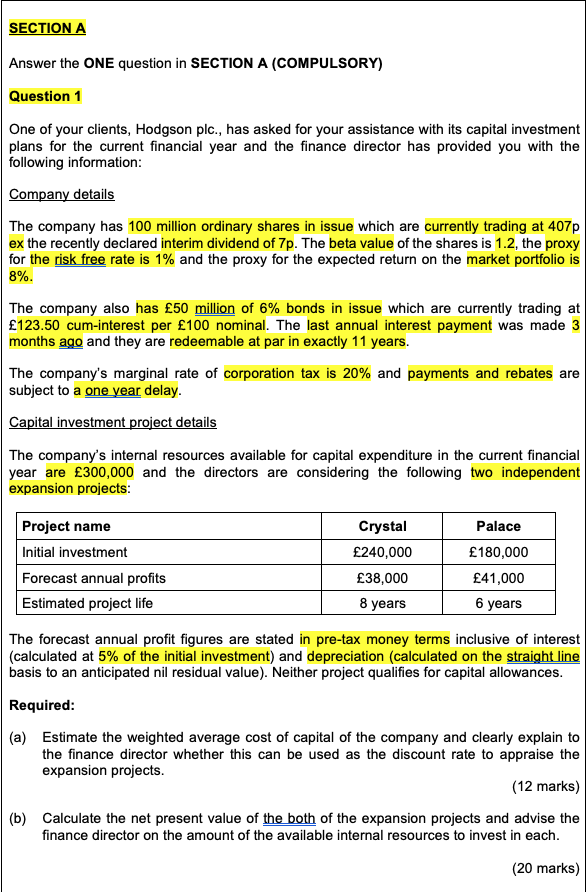

SECTION A Answer the ONE question in SECTION A (COMPULSORY) Question 1 One of your clients, Hodgson plc., has asked for your assistance with its capital investment plans for the current financial year and the finance director has provided you with the following information: Company details The company has 100 million ordinary shares in issue which are currently trading at 407p ex the recently declared interim dividend of 7p. The beta value of the shares is 1.2, the proxy for the risk free rate is 1% and the proxy for the expected return on the market portfolio is 8%. The company also has 50 million of 6% bonds in issue which are currently trading at 123.50 cum-interest per 100 nominal. The last annual interest payment was made 3 months ago and they are redeemable at par in exactly 11 years. The company's marginal rate of corporation tax is 20% and payments and rebates are subject to a one year delay. Capital investment project details The company's internal resources available for capital expenditure in the current financial year are 300,000 and the directors are considering the following two independent expansion projects: Project name Initial investment Forecast annual profits Estimated project life Crystal 240,000 38,000 8 years Palace 180,000 41,000 6 years The forecast annual profit figures are stated in pre-tax money terms inclusive of interest (calculated at 5% of the initial investment) and depreciation (calculated on the straight line basis to an anticipated nil residual value). Neither project qualifies for capital allowances. Required: (a) Estimate the weighted average cost of capital of the company and clearly explain to the finance director whether this can be used as the discount rate to appraise the expansion projects. (12 marks) (b) Calculate the net present value of the both of the expansion projects and advise the finance director on the amount of the available internal resources to invest in each. (20 marks) SECTION A Answer the ONE question in SECTION A (COMPULSORY) Question 1 One of your clients, Hodgson plc., has asked for your assistance with its capital investment plans for the current financial year and the finance director has provided you with the following information: Company details The company has 100 million ordinary shares in issue which are currently trading at 407p ex the recently declared interim dividend of 7p. The beta value of the shares is 1.2, the proxy for the risk free rate is 1% and the proxy for the expected return on the market portfolio is 8%. The company also has 50 million of 6% bonds in issue which are currently trading at 123.50 cum-interest per 100 nominal. The last annual interest payment was made 3 months ago and they are redeemable at par in exactly 11 years. The company's marginal rate of corporation tax is 20% and payments and rebates are subject to a one year delay. Capital investment project details The company's internal resources available for capital expenditure in the current financial year are 300,000 and the directors are considering the following two independent expansion projects: Project name Initial investment Forecast annual profits Estimated project life Crystal 240,000 38,000 8 years Palace 180,000 41,000 6 years The forecast annual profit figures are stated in pre-tax money terms inclusive of interest (calculated at 5% of the initial investment) and depreciation (calculated on the straight line basis to an anticipated nil residual value). Neither project qualifies for capital allowances. Required: (a) Estimate the weighted average cost of capital of the company and clearly explain to the finance director whether this can be used as the discount rate to appraise the expansion projects. (12 marks) (b) Calculate the net present value of the both of the expansion projects and advise the finance director on the amount of the available internal resources to invest in each. (20 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started