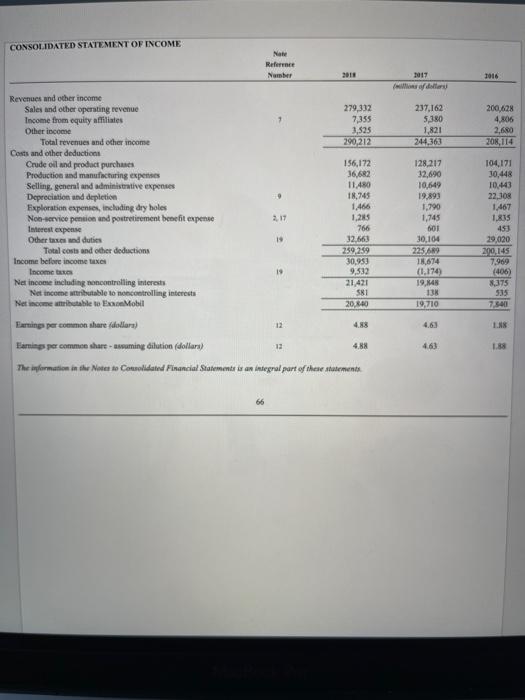

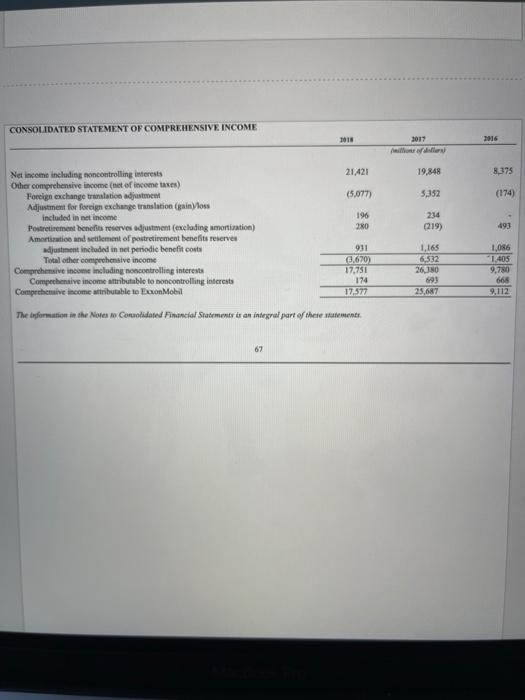

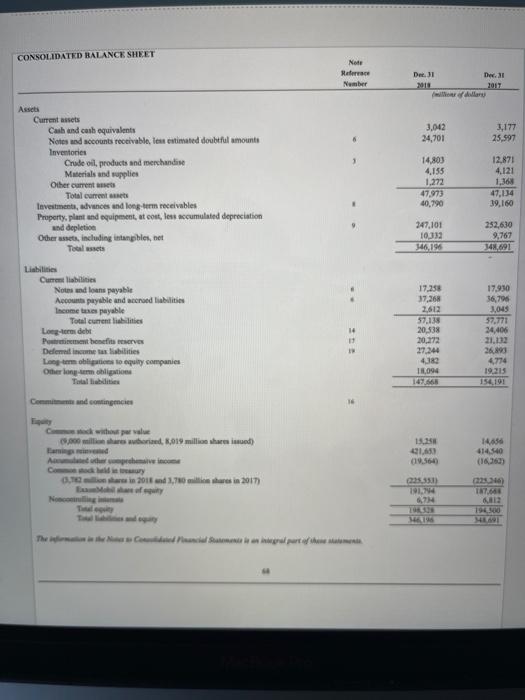

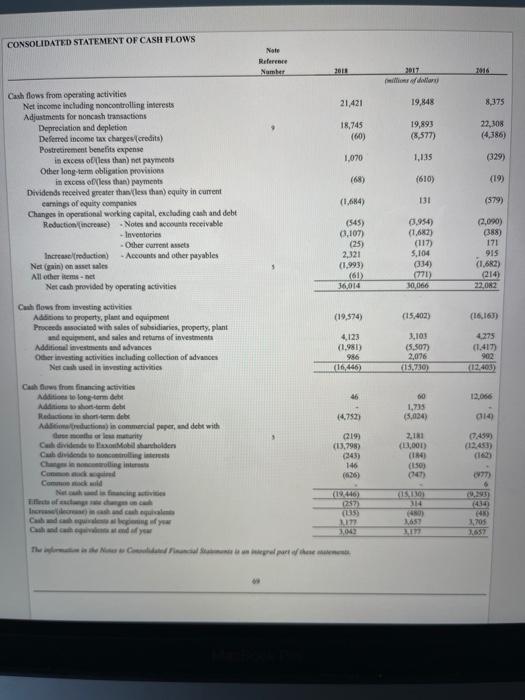

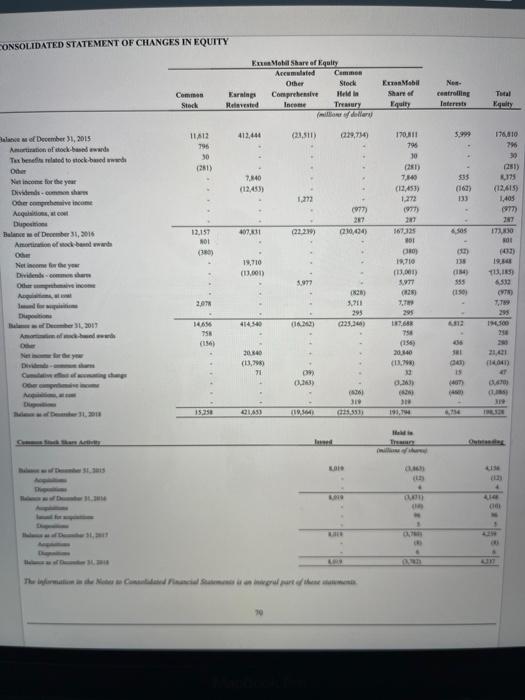

NOTE: For this question, you will need to use ExxonMobil's financial statements that are attached to this assignment. Please download the financial statements if you have not already As of December 31, 2018, is ExxonMobil financed mostly with debt or equity? Which is riskler? Financed more by debt, which is less risky than equity. Financed more by debt, which is more risky than equity Financed more by equity, which is more risky than debt. Financed more by equity, which is less risky than debt. CONSOLIDATED STATEMENT OF INCOME Note Reference Number 2018 17 1016 279,332 7,355 3,525 290,212 237,162 5,380 1,821 244,363 200,628 4.806 2.680 208,114 Revenues and other income Sales and other operating revenue Income from equity affiliates Other income Total revenues and other income Costs and other deduction Crude oil and product purchases Production and manufacturing expenses Selling general and administrative expenses Depreciation and depletion Exploration expenses, including dry holes Non-service pension and portretirement benefit expense Interest expense Other taxes and duties Total costs and other deductions Income before income taxes Income Net income including moncontrolling interests Net Income wibutable to non controlling interests Net income tributable to ExxonMobil 156,172 36,682 11.480 18,745 1,465 1.215 9 766 128,217 32,690 10,649 19,893 1.790 1,745 601 30,104 22569 18,674 (0.174 19,145 13 19,710 104,171 30,448 10443 22,308 1,467 1.815 453 29,020 200, 145 7.969 (406) 8.375 535 7.540 19 32.663 259,259 30,953 9,532 21421 581 20.8.40 Earnings per common share dollars) 488 LNS 13 4.88 463 1.88 Farmings per common share - assuming dilution dollars) The information in the Notes to Consolidated Financial Statement is an integral part of these statements CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME TOIS 3017 Pelletier 21.421 19.848 8,375 (5.077 3,352 (174) 196 280 234 (219) 493 Net income including noncontrolling interests Other comprehensive income (net of income taxes) Foreign exchange ratation adjustment Adjustment for foreign exchange translation (inlos included in met income Potretirement benefits reserves adjustment (excluding amortization) Amortization and settlement of portretirement benefits reserves adjustment included in ne periodic benefit costs Total other compechenave income Comprehensive income including noncontrolling interests Compechensive income attributable to noncontrolling interests Comprehensive income attributable to ExonMobil 931 0.670 17.751 174 17.577 1,165 6,532 26.JNO 693 25,687 1,086 1,405 9,780 666 9,112 The information in the Notes to Corolidated Financial Statement is an integral part of these te 67 CONSOLIDATED BALANCE SHEET Note Referace Number De 1 Der. Alan 3,042 24,701 1,177 25,597 Assets Current assets Cash and cash equivalents Notes and accounts receivable, les estimated doubtful mounts Inventories Crude oil products and merchandise Materials and supplies Other current Total current Investments, advances and long-term receivables Property, plant and equipment, tout, les accumulated depreciation and depletion Other assets, including intangibles, net Total 14,803 4.155 1,272 47.973 40,790 12,871 4.121 1,368 47,134 39,160 247,101 10.32 346.196 252,630 9,767 347,691 Liabilities Current liabilities Now and loans payable Accounts payable and credibilities Income tax payable Total current les Long-term debet Pohon vs Delencome tax bilities Long term into equity companies Other long-ligt 14 11 17.250 37.26 2612 57.138 20,838 20.872 27.244 4389 1094 17.930 36,795 2,045 57.771 24406 21.132 26.95 4774 19.213 154191 Command contingencies Cock with per miliar word, .019 million share inued) 1535 401.650 19.5640 14 414.540 prathira in 2011 and 1,70 shares in 2017) 1914 22 187.663 CONSOLIDATED STATEMENT OF CASH FLOWS Nate Reference Number 2011 2017 million 21,421 19,848 8,375 18,745 (60) 19,893 (8,577) 22,308 (4,386) 1,070 1,135 (329) 1610) (19) Cash flows from operating activities Net income including noncontrolling interests Adjustments for noncash transactions Depreciation and depletion Deferred income tax charges (credits) Postretirement bereits expense in exceso less than) net payments Other long-term obligation provisions in excess of less than) payments Dividends received greater than less than) equity in current camnings of equity companies Changes in operational working capital, excluding cash and debt Reduction (increase Notes and accounts receivable - Inventories - Other Current AS Increase reduction) Accounts and other payables Negain) on sale All other items! Net cath provided by operating activities (1,684) 131 (579) (545) 03.107) (25) 2,321 (1.993) (61) 36.014 03.9540) (1,687) (117) 5,104 (334) 2,090) (388) 171 915 (1,6R2) (214) 22,082 (771) 30,066 (19,574) (15,402) (16,163) Cash flows from investing activities Addition to property, plant and equipment Proceeds associated with sales of subsidiaries, property, plant and equipment, and sales and returns of investments Additional investment advances Other investing activities including collection of advances Nescasses investing activities 4,123 (1.981) 986 (16,446) 3.103 (5.507) 2,076 15.730 4275 (1.417) 902 (12.403) 46 12.056 00 1,735 (5,024) (4.752 14 Cashfws from financing activities Addition to long-term det Adito soterm det Recher.com debe Adduction is commercial paper, and debt with Grecotelow many Calderon Mobil hardholder Ching Calling in Com Come wild 2.11 (11,001) (7459) (1245) 2219 (13.798) (343) 146 (626) (150) 06) 6 2013 (1946) (1510 (15) 11 (480) 16 egy otally 2,705 2,657 pre CONSOLIDATED STATEMENT OF CHANGES IN EQUITY Exis Mobil Share of Equity Accumulated Comes Other Stock Earning Comprehensive Held Revested Inese Tretry Erman Mata Share of Equity Commen Stock Now controlling Interests Thal 412.446 (21.511) 229,754) 5,999 176,810 746 11A12 795 30 (281) 5:35 7.140 (12,455) 170.11 795 10 (201) 7.140 (12,453) 1.272 1977) 27 167325 116 1.212 Balance of December 31, 2015 Artion of stock band wurde Tex belated to stock bude Other income for your Dividends.com thaive income Acquisitions, at Duposti Balance of December 31, 2016 Amortion of wackben www Oce Netice for your Divided here Oh A. 133 175 (12.415) 1,400 W77) 27 ITUKO (077 267 210,04 407.11 12.157 NOI 02.2) sos 19,710 (3.000) ) 19, 710 13.00) 23 (11) 555 (10) 19. 13,5 6510 (WT 3977 2:07 (20) 1711 295 025.34 (12) 7.TE 295 Dup Iber 31, 2017 295 1.500 414340 12 HUS 758 (14) 240 (13,79 71 (156) 20140 (13. 21,41 140 09 00 15 (407) 319 3 191.1 15.25 Q133 119.50 KO . 4 D